- Facing lower earnings, several oil companies already plan to cut 2015 capex

- U.S. energy sector accounts for whopping one-third of S&P 500 capex

- Given drop in oil price, ‘15 S&P 500 EPS estimates too optimistic

Oil’s sharp drop can reverberate through the economy in many ways. One of which is its impact on capital spending. COP, RDS, and Italy’s Eni several weeks ago said they would cut capex to maintain profitability. Other exploration firms such as RIG, CLR and PXD have talked about modest plans for 2015. These are just a few examples. We will learn more in January/February as companies inform us of their 2015 capex plans. The reason this is so important is the sheer size of the energy sector. Deutsche Bank says the sector is responsible for 32 percent of S&P 500 capex. As these companies rein in spending, repercussions will be felt through other sectors. Tech, for instance, is 11 percent of S&P 500 capex, industrials another nine percent. It is simple. Lower oil = lower profits for energy companies = lower capex = lower business/profits for other sectors = lower S&P profits.

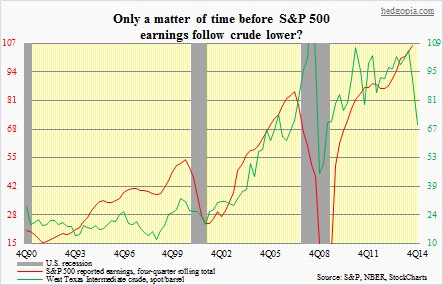

The chart above is self-explanatory. The waterfall dive in the green line should in due course pull the red line down. The current consensus does not reflect that. In the first three quarters this year, reported earnings were $79.60. If 4Q lives up to the current consensus of $30.02, then 2014 is on track for $109.60, up 9.4 percent over 2013. Now get this. Consensus for next year currently stands at $134.90. Yep, up a whopping 23 percent! That is the expectation. As early as 2Q this year, 2015 expectations were as high as $137.52, so they have come down a bit, but far from reflect what is going in the oil pit.