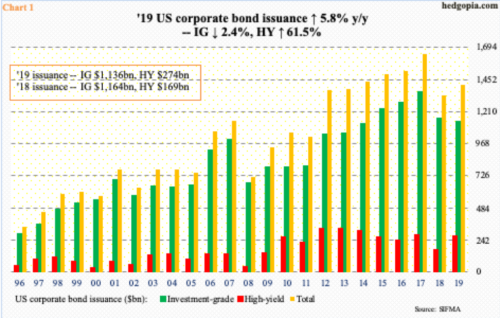

US corporations issued 5.8 percent more bond last year than they did in 2018. The $1.41 trillion in issuance is still lower than the 2017 record high of $1.64 trillion. It is possible corporations are pulling in horns because they already hold way too much in outstanding debt.

US corporate bond issuance grew 5.8 percent in 2019 to $1.41 trillion. In 2018, issuance dropped 18.8 percent. Investment-grade, however, fell 2.4 percent last year to $1.14 trillion – its second straight yearly decline. High-yield jumped 61.5 percent to $273.5 billion, but that came after dropping 40.1 percent in 2018.

Despite the big jump last year, high-yield issuance remains well below the record set in 2013 of $332 billion; in fact, issuance exceeded $300 billion each in 2012-2014. Investment-grade set its record in 2017 when the category issued $1.36 trillion worth. It was also in 2017 a record was set in total issuance – $1.64 trillion (Chart 1).

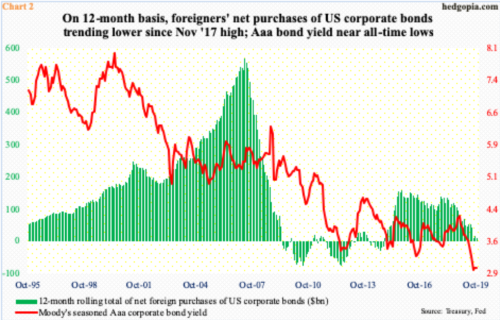

Demand probably is not an issue. In August last year, Moody’s Aaa corporate bond yield fell to 2.81 percent – a record low – before rising slightly. It is just north of three percent currently. Rates remain near historic lows.

Concurrently, foreign purchases of US corporate bonds have trended lower for a while now but remain positive. In the 12 months to October, they purchased $8.5 billion worth. This is down from $137.3 billion in November 2017, so the trend is down (Chart 2). November’s numbers will be out next Thursday.

It is possible corporations are taking it easy considering how much they have issued already post-Great Recession. In the decade through last year, bond issuance totaled $13.7 trillion, each year with a trillion-plus (Chart 2).

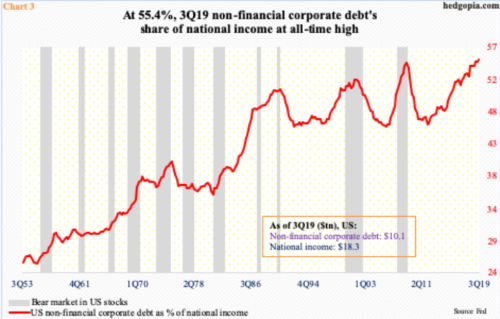

Accordingly, non-financial corporate debt outstanding in 3Q19 reached $10.1 trillion – a record high. And it is beginning to look egregious. As a percent of national income, this represented 55.4 percent (Chart 3). The metric is in uncharted territory and was lower in the prior two bear markets – 2000-2002 and 2007-2009. Unwinding – whenever that is – is bound to be painful.

Thanks for reading!