Small-cap earnings are coming in much weaker than expected when these companies began reporting the fourth quarter – or even when the December quarter began. Small-business optimism remains subdued. Yet, the sell-side expects blockbuster earnings this year. The Russell 2000 does not buy into this optimism.

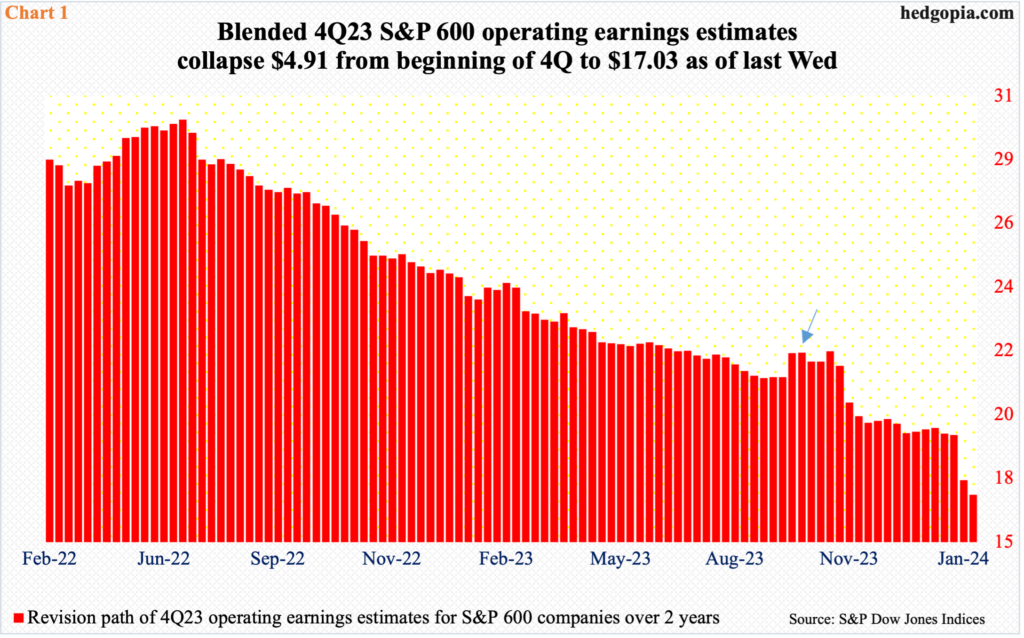

Fourth-quarter small-cap earnings are falling short of already-lowered expectations. At the end of the September quarter – that is, at the beginning of the December quarter – the sell-side expected $21.94 in operating earnings for S&P 600 companies (arrow in Chart 1). Last Wednesday, blended estimates for the quarter were $17.03, down $0.50 from a week ago.

The pattern of downward revision is not just a recent phenomenon. Going back a couple of years, 4Q estimates were as high as $29.98 as of June 14, 2022. By the end of last December – just before these companies started reporting – the sell-side had lowered the bar to $19.21, and even that is proving tough to jump over.

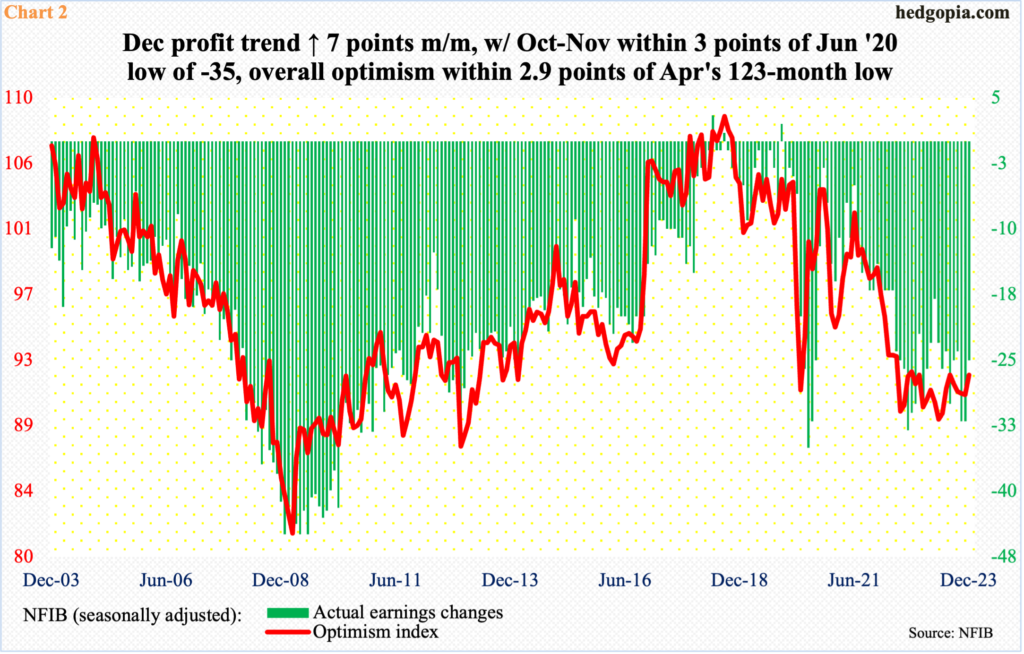

This, in fact, jibes with how NFIB (National Federation of Independent Business) members view things currently. In December, the ‘actual earnings changes’ sub-index, which shows these businesses’ profit trend, came in at minus 25, which is an improvement from a reading of minus 32 in both November and October, but has remained suppressed for a while now. The November-October print was just a point from the August 2023 low of 33 and three points from the June 2020 low of 35 (Chart 2).

Concurrently, overall small-business optimism in December edged up 1.3 points month-over-month to 91.9, not too far away from last April’s 89, which is the lowest since January 2013. The last time the optimism index hit 100 was August 2021. Looking at both the red line and the green bars in the chart, these businesses do not exude confidence.

Yet, the sell-side continues to wax optimistic.

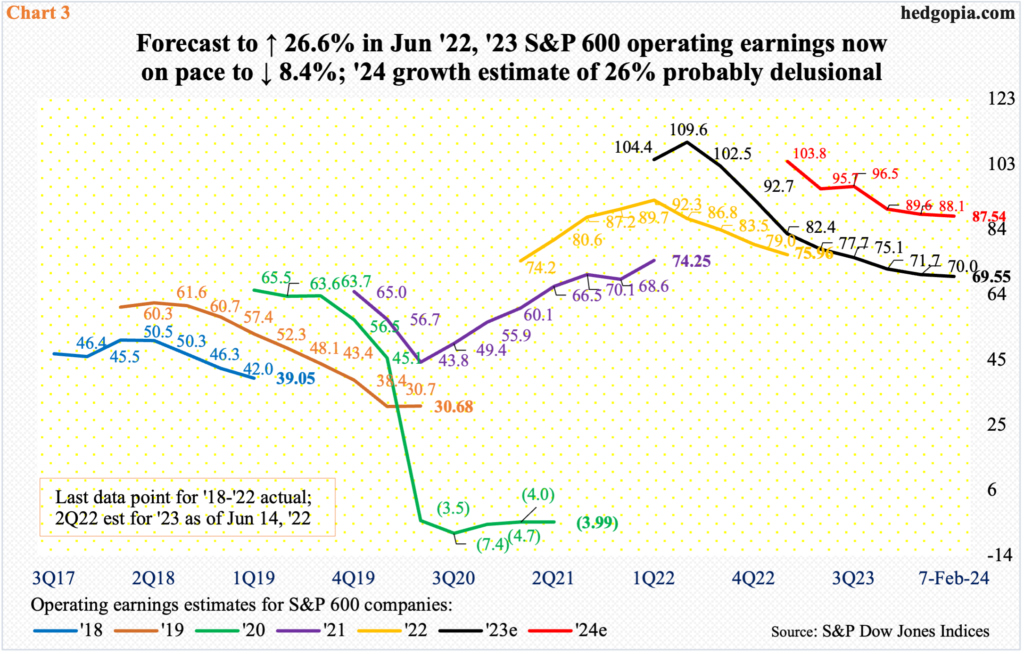

In 2023, with 4Q earnings still being reported, these analysts expect $69.55, which will be down 8.4 percent from the $75.96 posted in 2022. The irony is that back in June 2022, earnings last year were expected to surge 26.6 percent from 2022 to $111.23. We are obviously nowhere near that.

The sell-side is notorious for starting out optimistic and then bring out the scissors as the year progresses. This was once again evident when they expected 2024 to ring up $105.68 last March, which as of last Wednesday has now dropped to $87.54, which would have grown 25.9 percent from last year’s. If small businesses thought this was probable, their sentiment would not be as subdued as is the case now.

Viewed differently, this would also be reflected in stocks.

The Russell 2000 continues to trade substantially below its record highs of November 2021. This is unlike how other indices such as the S&P 500 and the Nasdaq 100 are behaving, with both having rallied to fresh highs.

On December 13th last year – the day the Federal Reserve made that now-famous dovish pivot – the Russell 2000 did break out of a range between 1700 and 1900, which had been in place since January 2022, but building on that is proving difficult.

Using a measured-move price target, technicians would expect the small cap index to reach 2100 in due course. On December 27th, it did tag 2072, before retreating. After that, mid-January, the bulls defended a breakout retest. Last Monday, too, the index touched 1921, and bids showed up, ending the week up 2.4 percent to 2010.

The index is back at testing 2000, which has resisted rally attempts going back to August 2022. The bulls have an opportunity here, to at least test the December 27th high – or 2100. Technicals favor this. If things evolve this way, odds favor the rally then loses steam once the measured-move target is achieved. Small-business optimism is just not robust enough to expect a sustained rally.

Thanks for reading!