From the euro’s perspective, March 10th was an interesting session.

Mario Draghi, ECB president, pulled out his big bazooka that day. All interest rates were cut. The existing QE was expanded from €60-billion/month in purchases to €80 billion. And the surprise of all! The bank would now buy corporate debt! All meant to, among others, driving the euro down.

Initially on Thursday (March 10th), post-ECB decision, the euro fell hard, equities rallied. But investor mood soured in no time. By close, the DAX was down 2.3 percent; from intra-day high to low, it collapsed five percent. The euro, down 1.6 percent, shed 3.7 percent from the session high. Come Friday (March 11th), equities recovered, but the euro held its ground, only down 0.3 percent.

The currency’s reaction was comparable to how the Japanese yen reacted to the Bank of Japan’s adoption on January 29th of negative interest rate policy. The yen fell 1.9 percent in that session, before reversing the next day and beginning a 13-percent rally through April 7th intra-day high.

Relatively speaking, the euro’s rally has been subdued. From the intra-day low on March 10th through Monday’s intra-day high of 114.475, the currency rallied 5.8 percent. With this, it has reached an important price point.

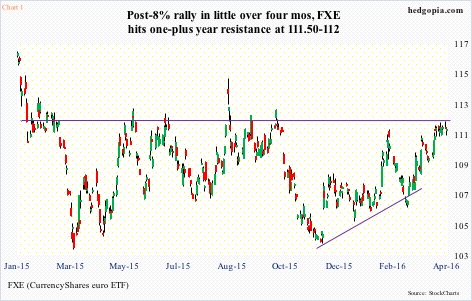

Resistance at 114-114.50 goes back a year. On FXE, the CurrencyShares euro ETF, the corresponding resistance lies at 111.50-112 (Chart 1).

Will it hold or give way?

First off, off the December 2nd intra-day low through the Monday high, FXE rallied eight-plus percent. Technicals are now overbought. Daily indicators have stayed overbought for three weeks, while weeklies have just gotten there.

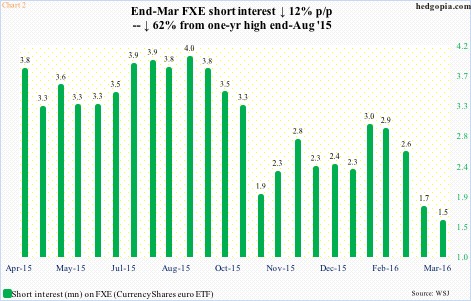

Shorts lent a big hand in all this.

At the end of February, short interest on FXE was 2.56 million. By the middle of March, it had dropped 32 percent, to 1.73 million. (Reminder: the euro reversed on March 10th, squeezing the shorts.) By the end of March, short interest dropped another 12 percent, to 1.53 million (Chart 2).

FXE has pretty much gone sideways since March 31st.

To be clear, short interest on FXE had been declining since the end of August last year, when it reached four million. The March 10th euro reversal only added fuel to the fire.

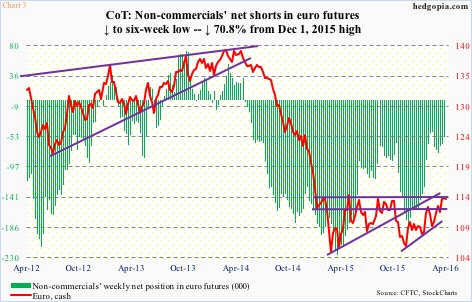

Non-commercials’ are the same way. These traders started to reduce net shorts in euro futures from early December last year. In the week ended December 1, 2015, they held 182,845 contracts. By Tuesday last week, they were only holding 53,487 (Chart 3). The February 23rd low of 46,857 was the lowest since June 2014.

Shorts have been taken to the cleaners, and the euro/FXE is right at resistance, with momentum indicators as overbought as they are.

Odds favor they pull back here – if nothing else just to unwind overbought conditions.

On FXE (111.28), the 50- and 200-day moving averages lie at 109.16 and 108.31, respectively.

One way to play potential near-term weakness is through weekly options, but premiums are tiny. April 15th 111.50 calls only bring $0.30. Might as well go short the underlying.

Thanks for reading!