QQQ (PowerShares QQQ Nasdaq ETF) finds itself at an interesting juncture.

The ETF (153.50) peaked at 156.69 seven sessions ago, before coming under heavy selling pressure in two separate sessions (Chart 1). The bulls nonetheless are putting their foot down, defending the daily lower Bollinger band in the last several sessions.

In one scenario, it rallies a point or so before once again witnessing selling pressure. The 10- and 20-day moving averages respectively lie at 154.73 and 154.34.

In the other scenario, QQQ rallies past this resistance and at least goes toward testing the daily upper Bollinger band (156.69), exactly matching the all-time high.

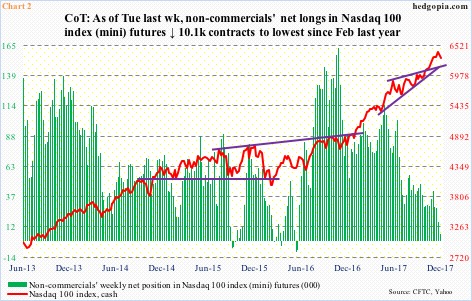

Scenario two is especially possible if non-commercials begin to add to net longs in Nasdaq 100 index (mini) futures. We will find out tomorrow if they are maintaining the status quo or are shifting.

As of last Tuesday, they had been actively cutting back. Net longs stood at 5,611 contracts, down from 42,009 only four weeks ago and the lowest since February last year. Incidentally, going back several years, they have not stayed net short for too long (Chart 2).

So if these traders raise long exposure in an attempt to take advantage of favorable seasonality, we may be looking at different dynamics than just a week ago.

This puts options initiated in expectation of potential downside pressure on Nasdaq 100/QQQ in a bind. Particularly so if they only go out a couple of weeks, which was the case with a hypothetical bear call spread discussed early this week.

December QQQ 153.50 calls were sold for $1.67 and 155.50 calls of the same expiration purchased for $0.82, for a net credit of $0.85. Closure of the spread will cost $0.90, for a net loss of $0.05 – which is looking like a prudent thing to do.

QQQ December 2017 (expires 22nd):

- Sell 155.50 call for $0.86

- Buy 153.50 call for $1.76

It is worth pointing out that QQQ continues to remain vulnerable medium- to long-term, but is a toss-up near term.

The ETF is heavily dominated by large-cap tech. The top five – Apple (AAPL), Alphabet (GOOG, GOOGL), Microsoft (MSFT), Amazon (AMZN), and Facebook (FB) – have been assigned 43 percent weighting. On the daily chart, they are showing some life.

With this in mind, the best remedy when one is not sure – or when the original thesis changes – is to move on.

Thanks for reading!