Consumer sentiment tumbled in March but remains elevated. The latest collapse in stocks probably played a role. Another important variable worth watching is home prices, which for years have risen faster than inflation and have been a big tailwind from the perspective of wealth effect.

U.S. consumer sentiment tumbled in March. The University of Michigan’s consumer sentiment index dropped 11.9 points month-over-month to 89.1. The drop looks big, but sentiment remains elevated historically.

As a matter of fact, the March reading was only the second sub-90 print since November 2016 – the other being last August with a reading of 89.8. Given the coronavirus-spurred disruptions, sentiment in all probability is set to deteriorate in the months ahead.

Stocks took a nosedive in March. The S&P 500 large cap index collapsed 12.5 percent and at one point was a lot worse before bids showed up on the 23rd (chart here). The March drop in sentiment reflects this. April’s preliminary sentiment data is due out Thursday next week.

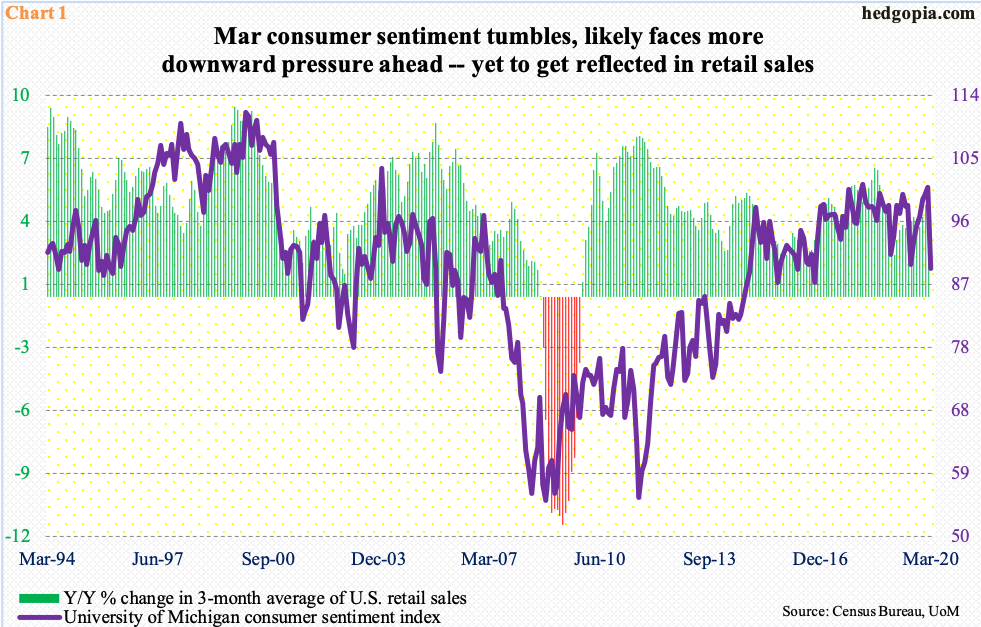

March’s retail sales are not out until April 15th. In the long run, sales tend to obviously follow consumer sentiment (Chart 1). In February, retail sales fell 0.5 percent from January’s record high to a seasonally adjusted annual rate of $528.1 billion. Using a three-month average, however, sales rose 4.9 percent year-over-year – a 17-month high. This is bound to get worse.

There is another variable that is equally important.

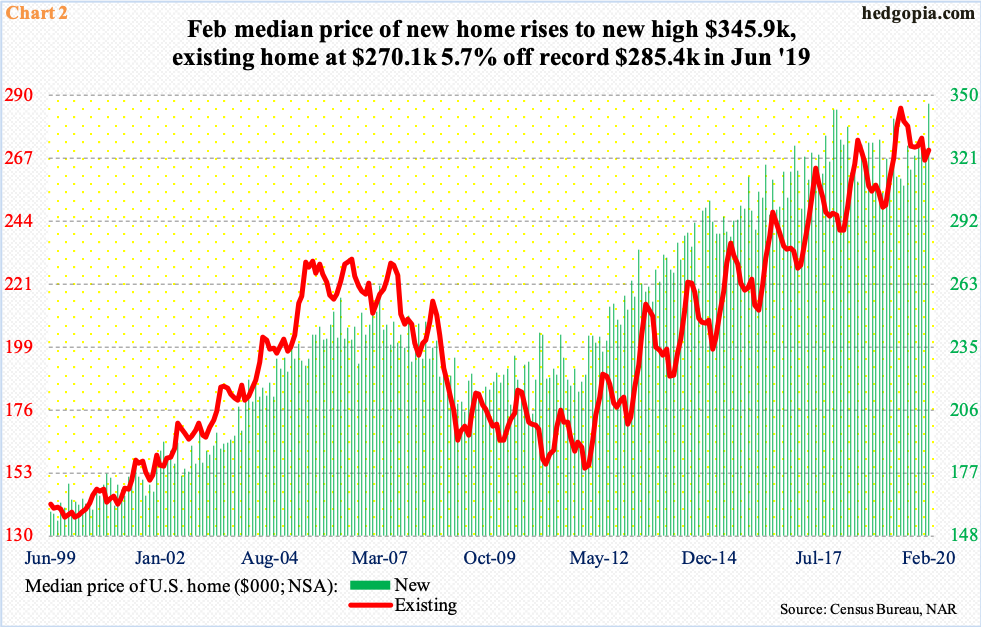

Home prices could not be doing any better. Sales are nowhere near the bubble highs of a decade and a half ago, but prices are at/near all-time highs. Supply is tight, and this has helped. In February, the median price of a new home advanced 6.3 percent m/m to $345,900 – a new record – while the one for an existing home rose 1.5 percent m/m to $$270,100, which is 5.7 percent from record high of $285,400 posted last June (Chart 2).

Besides stocks, from the wealth effect perspective, home prices play a crucial role. How prices fare in the months ahead will have repercussions for the economy.

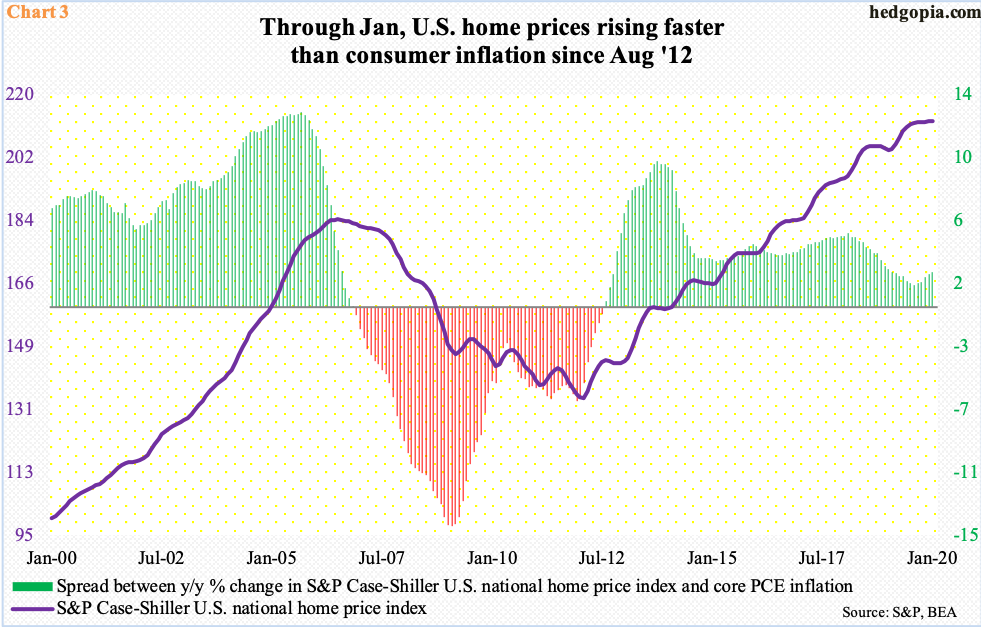

January’s data for the S&P Case-Shiller home price index was published yesterday. Nationally, prices appreciated 3.9 percent y/y in that month. Since last August when the index rose 3.1 percent y/y, prices have been trending higher.

The rate of appreciation is faster than consumer inflation. It has been that way since August 2012. Chart 3 uses core PCE to calculate a spread between the two. Here is the rub. The index seems to be flatlining. It is at a new high so has come a long way. If gravity begins to reassert itself, it does not take long before what has been a tailwind to quickly turn into a headwind – worth watching.

Thanks for reading!