Already elevated, US corporate bond issuance has gotten a new lease on life, thanks to the Fed, which acted because credit markets were seizing up. Longer term, this ensures leverage continues higher. When it is all said and done, there is no such thing as a free lunch.

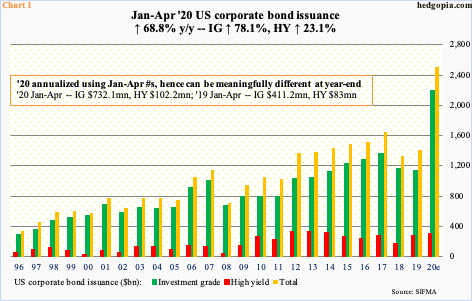

US corporate bond issuance in April was massive. The $834.3-billion total made up of $732.1 billion in investment-grade (IG) and $102.2 billion in high-yield (HY). This was up 68.8 percent over last year, with IG up 78.1 percent and HY up 23.1 percent.

The year is just one-third through, so it is hard to say if this will sustain for the rest of the year. That said, at this pace, issuance will be the highest ever, easily surpassing the prior record year of 2017 (Chart 1). After total issuance of $1.64 trillion in that year, the pace decelerated in 2018 and 2019 – respectively at $1.33 trillion and $1.42 trillion. This year at least has the potential to set a new record.

Early on, issuance was modest. In fact, as markets began to worry about the potential economic impact of the coronavirus, there was liquidity crunch in credit markets. Late February and in March, spreads widened significantly. In March, merely $3.5 billion in high-yield was issued. Then came the Fed.

On March 15th, the central bank ventured into investment-grade corporate bonds. This was expanded on April 9th to include junk bonds. Sentiment did a U-turn. Flows into junk ETFs such as HYG and JNK surged. Lipper data show $21.5 billion moved into high-yield funds in the past six weeks through Wednesday, including $3.5 billion this week.

In the second half of March, top investment-grade issuers included Intel (INTC), Walt Disney (DIS), Coca Cola (KO) and Verizon (VZ). Last Thursday, Boeing (BA) issued $25 billion worth. On April 7th, after the Fed said it would start buying junk, Ford (F), which weeks earlier lost its investment-grade status, sold $8 billion in junk bonds; demand exceeded supply by a wide margin. This Monday, Apple (AAPL) raised $8.5 billion and said it would use the money to fund buybacks and for general corporate purposes. Some others may be issuing new debt in order to refinance maturities, yet others may just be taking advantage of low interest rates – likely a balance sheet management.

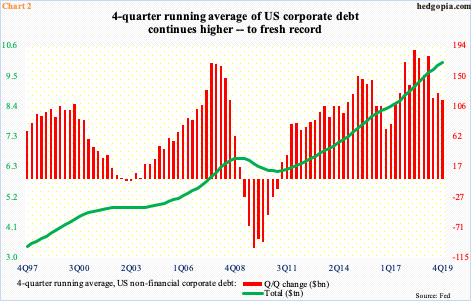

In essence, the Fed has succeeded in essentially lighting a fire under the new issue market. It acted because credit markets risked seizing up. Things are flowing again, which is good. The problem in all this is that the market was already well levered up to begin with.

In 4Q19, US non-financial corporate debt increased by $13 billion to $10.12 trillion – a new record. When Great Recession ended in 2Q09, this stood at $6.45 trillion, so it has gone up by $3.66 trillion. Chart 2 uses a four-quarter running average, and the trend has been persistently up, although sequentially the pace has decelerated some. But it is set to reaccelerate given the issuance trend this year.

In all probability, timing notwithstanding, this is not going to end well. The central bank’s backstopping the market ensures it continues higher – until something like Covid-19 comes along to once again test investors’ patience. Next time around, the Fed itself will be put to test. For all intents and purposes, it is all in. If so, it will be awfully difficult to pull another rabbit out of its monetary hat. Time will tell.

Thanks for reading!