The other day, Goldman Sachs took a sharp knife to its earnings estimates for S&P 500 companies.

It cut 2015 estimates from previous $122 to $114. In 2014, these companies earned $113 in operating earnings. If Goldman is right, we are talking growth of less than one percent this year – 0.9 percent, to be exact. That is some serious deceleration. Earnings grew 5.3 percent in 2014 and 10.8 percent before that.

As a matter of fact, Goldman’s new 2015 forecast is not that far away from the consensus.

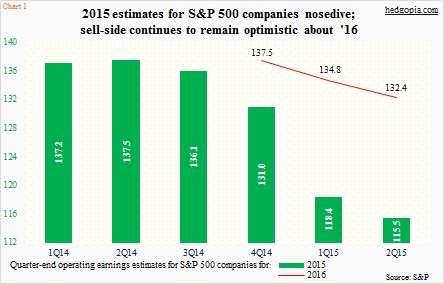

The sell-side currently forecasts $115.47 for this year. But the trend has decidedly been to the downside. One year ago, they were expecting $137.52! Estimates particularly took a nosedive this year (Chart 1).

Equally noticeable in the Goldman call is what it expects next year. Estimates dropped to $126 from prior $131. Once again, the consensus is higher – $132.36.

And once again, 2016 consensus estimates have started out very high, as was the case with 2015 estimates a year ago. As early as February 12th this year, next year’s estimates were $137.46. In a little over four months, they have gone down by $5-plus.

What are the odds that the consensus will be right next year and Goldman wrong – meaning earnings will hit $137, not $126? Not very high.

The only scenario in which $137 is hit is if the U.S. economy suddenly achieves the elusive escape velocity. Here is the problem with this scenario.

We have had zero interest-rate policy for six and a half years now, and real GDP has only managed to grow at a quarterly average of 2.2 percent (at a seasonally adjusted annual rate). Going back all the way to 1947, the growth rate has averaged 3.3 percent. One of the major headwinds the economy faces is the amount of leverage in the system, which has increased – not decreased – since the financial crisis.

This is not going to change next year. So a more pertinent question may be, might the new Goldman forecast be optimistic still? The broker is basing its estimates on forecast of 2.8-percent real GDP growth next year. This is pretty close to the consensus 2.7 percent growth. Here is the rub. Pretty much throughout the current expansion, expectations have tended to be optimistic at the beginning, only to gradually ratchet down numbers.

Early last year, the Congressional Budget Office was forecasting 3.4-percent real GDP growth in both 2015 and 2016. In January, it brought that down to 2.9 percent each. Right here and now, consensus real GDP forecast stands at 2.1 percent this year.

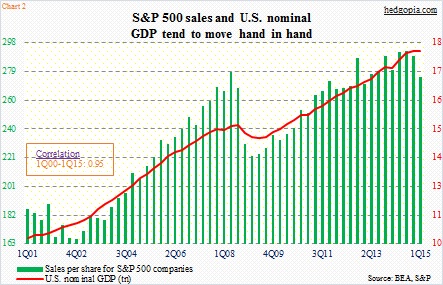

This is important. The correlation between U.S. GDP and S&P 500 sales is too tight. Chart 2 plots U.S. nominal GDP against sales per share for S&P 500 companies. Going back to 2001, R is 0.95 between the two – near perfection. GDP is sub-par, as is companies’ top-line growth.

Corporate margins and profits are more than holding up, though. In recent quarters, momentum has shifted down. The BEA’s corporate profits (adjusted for inventory and capital consumption) peaked in 3Q14 at $2.17 trillion, slowing down to $2.03 trillion in 1Q15.

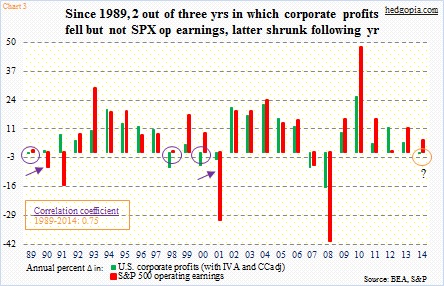

Going back to 1989, there have been three years in which the BEA’s measure of corporate profits fell but not operating earnings of S&P 500 companies – 1989, 1998 and 2000 (violet circles in Chart 3). In two of the three, operating earnings of S&P 500 companies fell the following year – 1990 and 2001 (arrows). In 2014, the government’s measure of corporate profits fell 0.8 percent, even as operating earnings of S&P 500 companies rose 5.3 percent. So the question is, what will 2015 bring?

As stated earlier, Goldman’s new 2015 forecast of $114 is less than a dollar away from what was earned last year. If estimated earnings come up a dollar short, we are looking at a down year, which is what Chart 3 might be suggesting.

The bigger question revolves around 2016 estimates. Goldman’s new forecast sees earnings to expand 10.5 percent next year. If the broker is right, the consensus, which forecasts growth of nearly 15 percent, has a lot of catching up to do – on the downside. Going by the recent trend in downward earnings revision, there is room to even doubt $126.

Thanks for reading!