Following up on Tuesday’s blog, here is some additional food of thought on XLY, the SPDR consumer discretionary ETF.

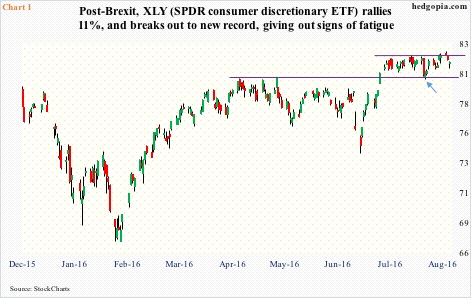

Three sessions ago, it arguably broke out of a five-week congestion; the ETF rose to a new intra-day high of $82.38, closing at $82.16 (Chart 1). This unfolded right on the daily upper Bollinger band, with conditions grossly overbought on nearly all timeframes.

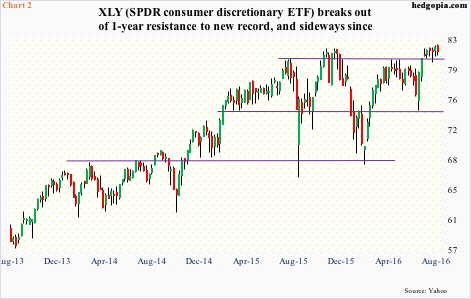

Monday’s meek breakout earlier followed a break out of resistance going back to July last year (Chart 2). Momentum was intact, but beginning to fade. The price action in the past couple of sessions may have tilted the balance in favor of the bears … for now.

On Wednesday, XLY ($81.5) sliced through both its 10- and 20-day moving averages intra-day but managed to claw its way back to close down only 0.23 percent – literally on those two averages.

Near-term, the path of least resistance is breakout retest around $80.10-ish. In fact, after it broke out on July 8th, it was retested on August 3rd – successfully.

It is not even worth guessing as to what might come out of the imminent retest.

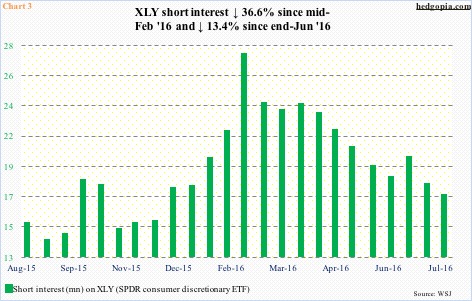

In the past, XLY benefited greatly from high levels of short interest. That tailwind is nearly gone. End-July short interest dropped 4.5 percent period-over-period to 17.3 million – an eight-month low (Chart 3).

Through the Monday high, the ETF rallied just under 23 percent from February 2016 lows, and 11 percent since post-Brexit lows. Short squeeze helped. Short interest on XLY fell a whopping 37 percent since mid-February this year and 13 percent since the end of June.

With the recent drop in XLY, if anything, shorts may even get aggressive. We will find out.

One way to play this scenario is through options.

August 26th weekly 82 calls fetch $0.34. A naked call, if assigned, ensures going short at $82.34, near the afore-mentioned Monday high. Going a safer route, let us say by using a credit call spread does not earn much premium for the risk taken. In the same expiration, 83 calls bring $0.11. Going short 82 and long 83 earns $0.23, but puts $0.77 at risk.

An alternative is to go short the underlying straight, which, given the circumstances the ETF is in currently, is probably the best route. As stated earlier, XLY remains overbought on nearly all timeframes, and some signs of fatigue are showing up. Near-term, at least a breakout retest seems to be in the cards.

Thanks for reading!