- In 12 years ended September 2011, gold surged nearly eight times

- Momentum reversed and was never recouped even though QE3 was launched late ‘12

- Sitting on crucial support; lot depends on if U.S. $ takes break from 12-wk, eight-percent-plus rally

Gold – that shiny, lustrous element. Has been a highly sought-after metal from time immemorial. It is used in jewelry, in investments and in industry (one of the least reactive chemical elements). Of all the precious metals, it is the most popular as an investment. As in any other investments, speculation plays as big a role in price discovery as do fundamentals and supply-demand dynamics. The importance of timing cannot be stressed enough. Those who bought gold in July 1999 at $253/ounce have seen their investments nearly quintuple. Those who bought it in September 2011 when the metal peaked intra-day at $1924/ounce are sitting on a loss of nearly 40 percent. In normal circumstances, this kind of a drop would probably pique contrarian investors’ interest in the metal ($1191.1). But has the worst been passed or there is more to come? Listen to gold bugs like Peter Schiff, and we are told gold has the potential to hit $5,000/ounce. Here is the thing. Even if that turns out to be true long-term, if the yellow metal struggles to attract bids in the interim, the path of least resistance may very well be down. Indeed, Ned Davis last week suggested as much, saying if gold follows 1980s pattern it can easily slip below $700/ounce.

Gold – that shiny, lustrous element. Has been a highly sought-after metal from time immemorial. It is used in jewelry, in investments and in industry (one of the least reactive chemical elements). Of all the precious metals, it is the most popular as an investment. As in any other investments, speculation plays as big a role in price discovery as do fundamentals and supply-demand dynamics. The importance of timing cannot be stressed enough. Those who bought gold in July 1999 at $253/ounce have seen their investments nearly quintuple. Those who bought it in September 2011 when the metal peaked intra-day at $1924/ounce are sitting on a loss of nearly 40 percent. In normal circumstances, this kind of a drop would probably pique contrarian investors’ interest in the metal ($1191.1). But has the worst been passed or there is more to come? Listen to gold bugs like Peter Schiff, and we are told gold has the potential to hit $5,000/ounce. Here is the thing. Even if that turns out to be true long-term, if the yellow metal struggles to attract bids in the interim, the path of least resistance may very well be down. Indeed, Ned Davis last week suggested as much, saying if gold follows 1980s pattern it can easily slip below $700/ounce.

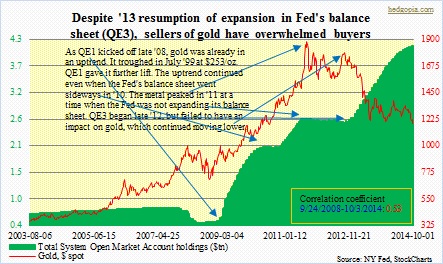

Can it get there? No clue. We do know this. Since its peak in September 2011, gold’s price action runs counter to what a textbook would typically tell us. At a time when central-bank balance sheets in most of the developed world are in expansion mode, the metal is supposed to grow its investor base. It did exactly that up to a point. When the Fed initiated QE1 late 2008, gold already had a tailwind behind it. QE1 shifted that momentum into higher gear. A pause in 2010 in expansion of Fed assets did not stop that thrust. Post-QE2, the Fed paused again in 2011, and it was as if someone had flipped the switch. Gold suddenly ran into a headwind. The metal peaked in September 2011 (intra-day high of $1924). Late 2012, the Fed initiated QE3, but gold never got going! That is not supposed to happen. The strange thing is, everyone and his dog (count this blogger out) believed back then that it was just a matter of time before the U.S. economy launched into an escape velocity and that higher inflation was just round the corner. Indeed, the month gold peaked, U.S. CPI grew 3.9 percent annually. Yet, gold headed lower.

Can it get there? No clue. We do know this. Since its peak in September 2011, gold’s price action runs counter to what a textbook would typically tell us. At a time when central-bank balance sheets in most of the developed world are in expansion mode, the metal is supposed to grow its investor base. It did exactly that up to a point. When the Fed initiated QE1 late 2008, gold already had a tailwind behind it. QE1 shifted that momentum into higher gear. A pause in 2010 in expansion of Fed assets did not stop that thrust. Post-QE2, the Fed paused again in 2011, and it was as if someone had flipped the switch. Gold suddenly ran into a headwind. The metal peaked in September 2011 (intra-day high of $1924). Late 2012, the Fed initiated QE3, but gold never got going! That is not supposed to happen. The strange thing is, everyone and his dog (count this blogger out) believed back then that it was just a matter of time before the U.S. economy launched into an escape velocity and that higher inflation was just round the corner. Indeed, the month gold peaked, U.S. CPI grew 3.9 percent annually. Yet, gold headed lower.

That was a big tell. In hindsight, at least from the inflation perspective, gold was spot-on. This past August, annual consumer inflation came in at 1.7 percent. (Inflation is elsewhere – in equities, bonds, real estate, arts/collectibles, and what not.) And markets are betting that inflation would continue to act benign in the next several years. The dynamics between inflation and deflation – perceived, of course – are not in gold’s favor. And we can just tune out escape-velocity proponents. Not happening. Then there is the U.S. dollar. Gold has many drivers, one of which of course is the greenback (refer to chart on top; r is 0.65 – not perfect but fairly strong positive relationship). The dollar made a higher low in April of 2011, preceding the September gold peak. The currency has been up for 12 straight weeks. It is tremendously overbought, but does have momentum. Immediately ahead, it is hard to visualize what could knock it off its perch, even though the trade is so overcrowded. In all likelihood, it is not gaining because the economy is going gangbusters. The bond market simply does not buy that thesis. It is probably strong because capital is coming back home (unwinding of carry trade). And because both the euro and the yen are selling off.

That was a big tell. In hindsight, at least from the inflation perspective, gold was spot-on. This past August, annual consumer inflation came in at 1.7 percent. (Inflation is elsewhere – in equities, bonds, real estate, arts/collectibles, and what not.) And markets are betting that inflation would continue to act benign in the next several years. The dynamics between inflation and deflation – perceived, of course – are not in gold’s favor. And we can just tune out escape-velocity proponents. Not happening. Then there is the U.S. dollar. Gold has many drivers, one of which of course is the greenback (refer to chart on top; r is 0.65 – not perfect but fairly strong positive relationship). The dollar made a higher low in April of 2011, preceding the September gold peak. The currency has been up for 12 straight weeks. It is tremendously overbought, but does have momentum. Immediately ahead, it is hard to visualize what could knock it off its perch, even though the trade is so overcrowded. In all likelihood, it is not gaining because the economy is going gangbusters. The bond market simply does not buy that thesis. It is probably strong because capital is coming back home (unwinding of carry trade). And because both the euro and the yen are selling off.

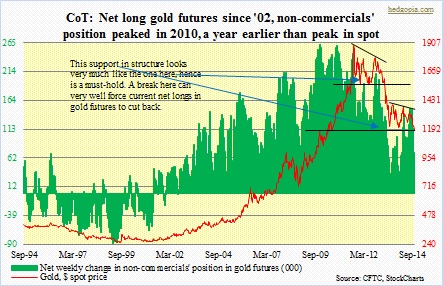

Gold bugs must be hoping that the momentum in the dollar breaks, or at least takes a breather. They have a reason. The metal is sitting on a five-year support. Large speculators have been net long gold futures since 2002, and have been cutting back the last 12 weeks. If spot gold ends up breaking that support, these speculators will come under pressure to further reduce their net longs. Gold would not want to see that.