The following are futures positions of non-commercials as of January 6th (Tuesday).

Dollar and ten-year notes jump out the most.

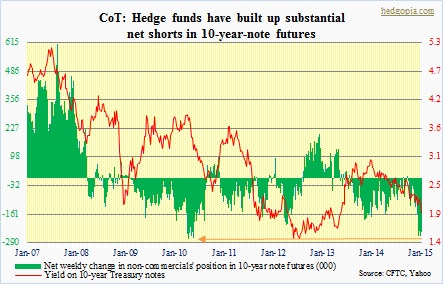

10-year note: Substantial net shorts have been built up. In the prior week, large speculators were most short since mid-May 2010. For reference, they were net short 173.7k contracts at the end of 2013, when 10-year yielded three percent. That was the peak for the 10-year, as was for the net shorts, as these traders got squeezed. Currently they are net short 243.2k, down 18.1k week-over-week.

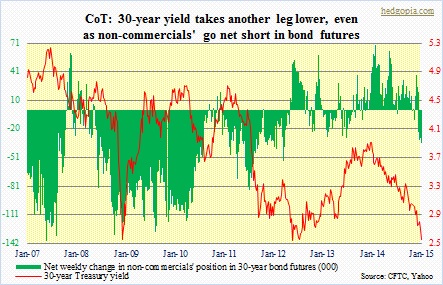

30-year bond: After a long period of net long exposure, they have been net short the past four weeks. Trade has been wrong so far, as yields on 30-year Treasuries have continued lower. Currently net short 35.4k, up 5k w/w.

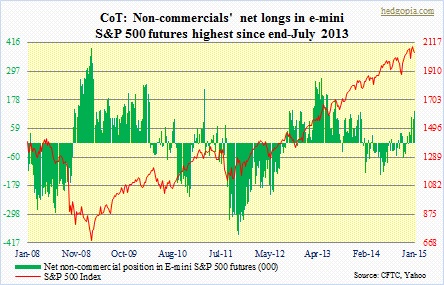

E-mini S&P 500: Net longs are highest since end-July 2013. They were last net short right before Thanksgiving and have been gradually adding to net longs. This partly explains the surge in stocks on Wednesday and Thursday last week. Currently they are net long 170.5k, up 37.7k w/w.

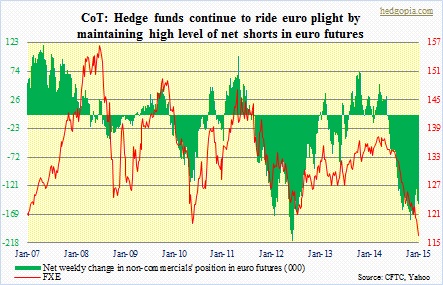

Euro: They have maintained net shorts since the middle of May, as the currency was getting ready to fall off a cliff. They have since consistently raised short exposure, rising to 179k contracts early November. There was a brief drop through the middle of December, before spiking again. Currently net short 161k, up 8.8k w/w.

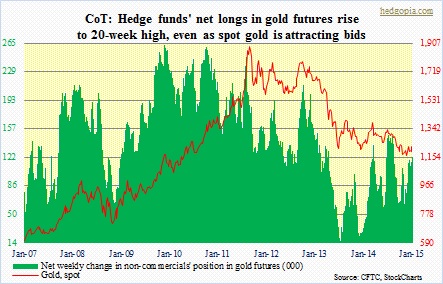

Gold: Net longs rise to 20-week high. Gold is beginning to attract bids, as the 1,180 support was not violated during recent weakness. The metal now finds itself in a rising channel. 200DMA lies at 1,257. Net longs currently 122.2k, up 6.3k w/w.

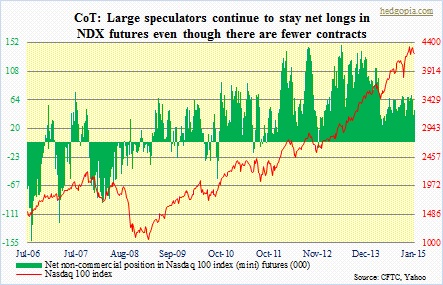

Nasdaq 100 index (mini): Last time they were net short was November 2012. Have consistently maintained net long exposure, even though they started cutting back a month ago. Currently net long 48.4k, up 6.9k w/w.

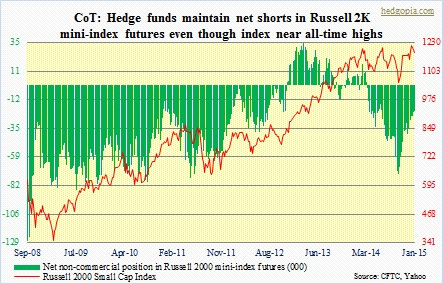

Russell 2000 mini-index: Net shorts are substantially down from 73k in September last year, but still net short 22k, even though RUT hovers near all-time highs. Have been net short since April 1st last year. RUT first peaked early March last year. Currently net short 22k, down 0.5k w/w.

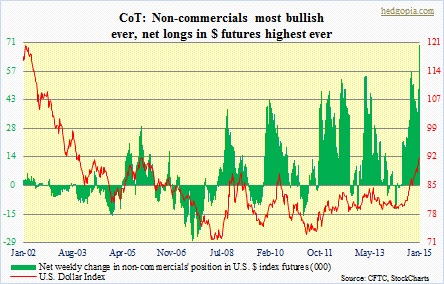

U.S. Dollar Index: Net longs highest ever. As the dollar rips higher, they have been consistently adding since the middle of June. Currently net long 69.8k, up 21k w/w. This is one crowded trade, but the crowd just keeps getting bigger. Until it doesn’t, whenever that is.

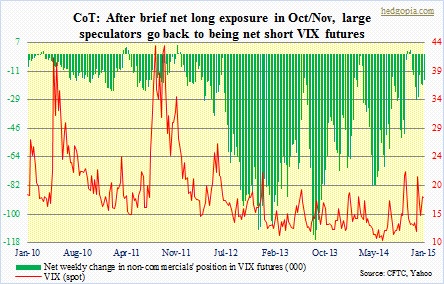

VIX: After a brief net long exposure lasting three weeks ended early November, they have been net short the past nine weeks. Since August 2013, the green bars have been persistently making higher lows, even as the VIX is more or less flattish. Currently net short 16k, down 3.6k w/w.