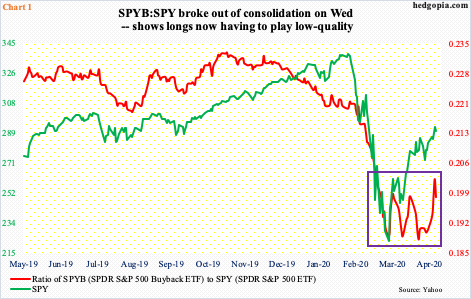

The buyback bonanza that persisted for years is coming to an end this year. It only makes sense that SPYB will lag SPY, but the ratio between the two broke out of one-month consolidation on Wednesday. This shows that, after a month-long massive rally, longs are now desperately reaching for laggards.

Equity shorts have gotten their faces ripped off. The rally from the March lows has probably surprised even the bulls. From its March 23rd low through Wednesday’s intraday high, the S&P 500 large cap index jumped nearly 35 percent. That is in a month!

But there are some indications a relief awaits the shorts.

The red line in Chart 1 is a ratio of the SPDR S&P 500 Buyback ETF (SPYB) to the SPDR S&P 500 ETF (SPY). SPYB tracks the performance of the S&P 500 Buyback Index, which provides exposure to the 100 constituent companies in the S&P 500 with the highest buyback ratio in the last 12-month period.

Along with the S&P 500, the ratio bottomed on the 23rd. Twice after that low, it pulled back after hitting 0.199. This Wednesday, it broke out (box). One session does not make a trend, with Thursday already pulling back, but this is coming at a time when longs are increasingly gravitating toward the laggards. Some might even call them low-quality.

Through Wednesday’s intraday high, XLF (Financial Select Sector SPDR Fund) and IWM (iShares Russell 2000 ETF) this week respectively rallied 8.8 percent and 11.8 percent. One would hope financials and small-caps were leading right from the beginning, but they were not – until this week. There is a similar message coming out of the SPYB-SPY ratio.

Until this week, companies that relied too much on buybacks were not keeping up with the market, which makes sense. In this economic environment, companies simply are not going to spend on buybacks the way they did. Thursday, Apple (AAPL) said it would add $50 billion to its share-buyback program, versus $75 billion last year and $100 billion the year before that.

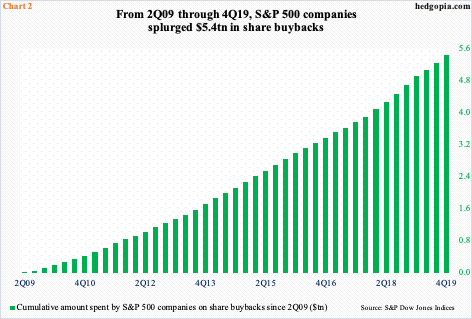

Last year, S&P 500 companies spent $728.7 billion in buying back their own shares. This followed $806.4 billion in 2018, which was a record. Since Great Recession ended, they spent $5.4 trillion in buybacks.

This year, the air will come out of this bubble, which should translate into lesser investor love for these companies, which was evident in the rather sideways action in the ratio since last month’s low. Wednesday’s outperformance, therefore, should not be considered healthy. It smacks more of desperation on the part of longs – as if they are running out of things to buy and buying whatever they could lay their hands on. This does not occur at the beginning of a healthy rally, rather at/toward the end.

Thanks for reading!