After major financials reported their March quarter last week, blended estimates for S&P 500 companies were revised higher last week. But post-earnings reaction leaves much to be desired. Next week, the top six US companies – all tech – report, and the Nasdaq acts wobbly ahead of this.

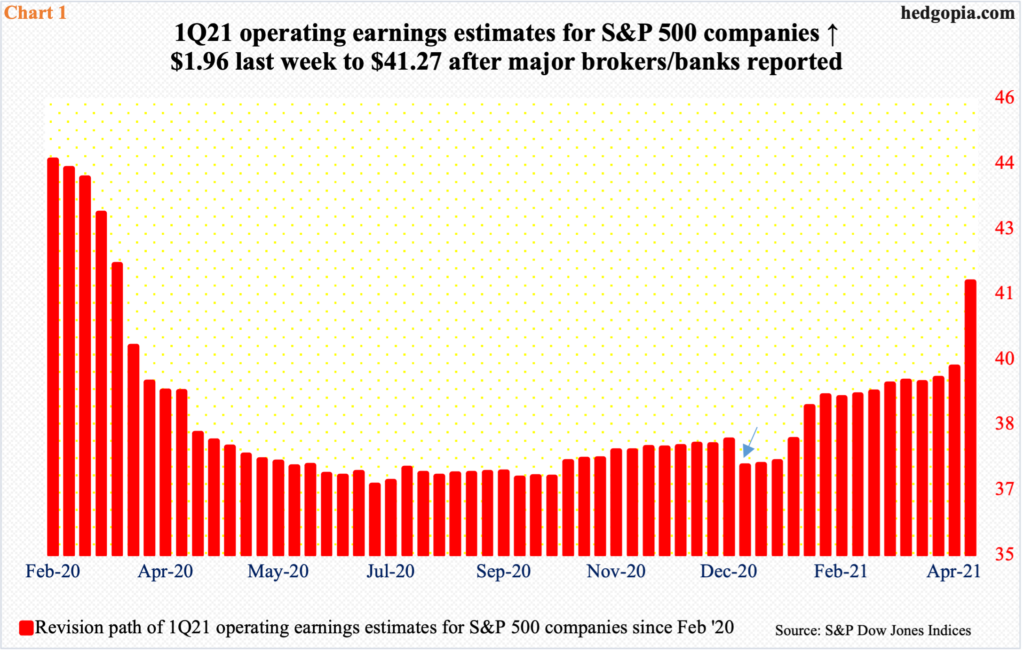

As the 1Q21 earnings season got underway in earnest last week, blended estimates were revised higher. In the week to last Thursday, the sell-side revised their estimates higher by $1.96 week-over-week, to $41.27. Estimates bottomed at $37.04 at the end of last year before trending higher (arrow in Chart 1)

Major banks and brokers reported last week; post-earnings reaction was mixed. For the week, Wells Fargo (WFC) and Goldman Sachs (GS) were up, JP Morgan (JPM), Bank of America (BAC) and Morgan Stanley (MS) were down, and Citigroup (C) was flat. In the first two sessions this week, they are all down.

On Monday, IBM (IBM) reported its March quarter. Results were better than expected – EPS of $1.77 versus $1.63 consensus and revenue of $17.7 billion versus expectations of $17.4 billion. On Tuesday, the stock gapped up to close up 3.8 percent but at the same time left behind a long shadow with the stock ticking $139.77 intraday and closing at $138.16.

The point in all this is that sellers are beginning to come out of the woodwork.

Stocks rallied big into earnings. The S&P 500 tested its 50-day moving average on March 25 and through last Friday’s new all-time high of 4191.31 rallied 8.8 percent (arrow in Chart 2). That is in 16 sessions intraday!

After posting a new record last Friday, the large cap index came under pressure this week, down 1.2 percent, with three more sessions to go. There are subtle but palpable signs of fatigue.

On Tuesday, the index (4134.94) closed right on short-term support of 4130s – and is barely above a rising trend line from March last year. The trend line was breached a couple of times in March, and another looks probable. Should this occur in the sessions ahead, there is short-term support at 4080s, and 3980s after that.

At this juncture, more important perhaps is how things unfold in tech.

Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Google owner Alphabet (GOOG/L), Tesla (TSLA) and Facebook (FB) all report next week. The six account for 45 percent of QQQ (Invesco QQQ Trust)/Nasdaq 100. As they go, so go the equity indices – at least the ones weighted by market cap.

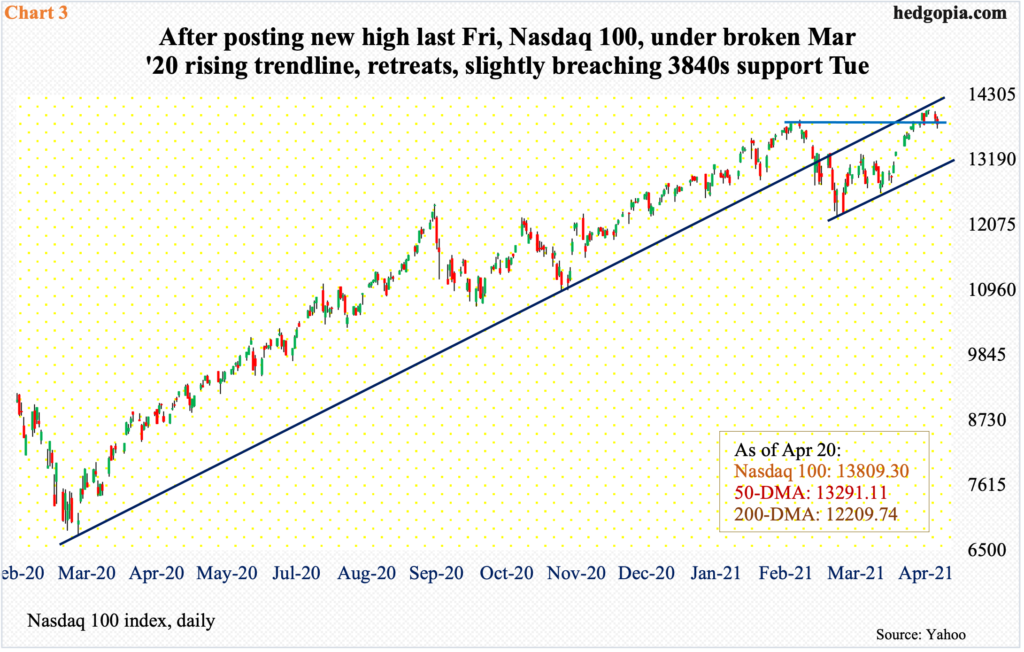

Ahead of this, the Nasdaq 100 posted a new high last Friday. The index otherwise has been a laggard – particularly this year. Like the S&P 500, it too peaked on February 16. However, unlike the S&P 500, which only took a month before a new high was recorded, the Nasdaq 100 took two months to do that.

Even after last Friday’s high, the index still sits under a trend line from March last year, which was broken in the last week of February (Chart 3). And bulls are already struggling to save the new high. Down 1.7 percent so far this week, the Nasdaq 100 (13809.30) closed Tuesday at short-term support at 13840s, or just slightly below that. Odds favor a lower price. A seven-week rising trend line gets tested around 13000.

Thanks for reading!