On Friday, March’s employment numbers will be reported. Job growth has been decelerating for months now. Amidst this comes February’s JOLTS report, which points to more softening in the jobs picture in the months ahead.

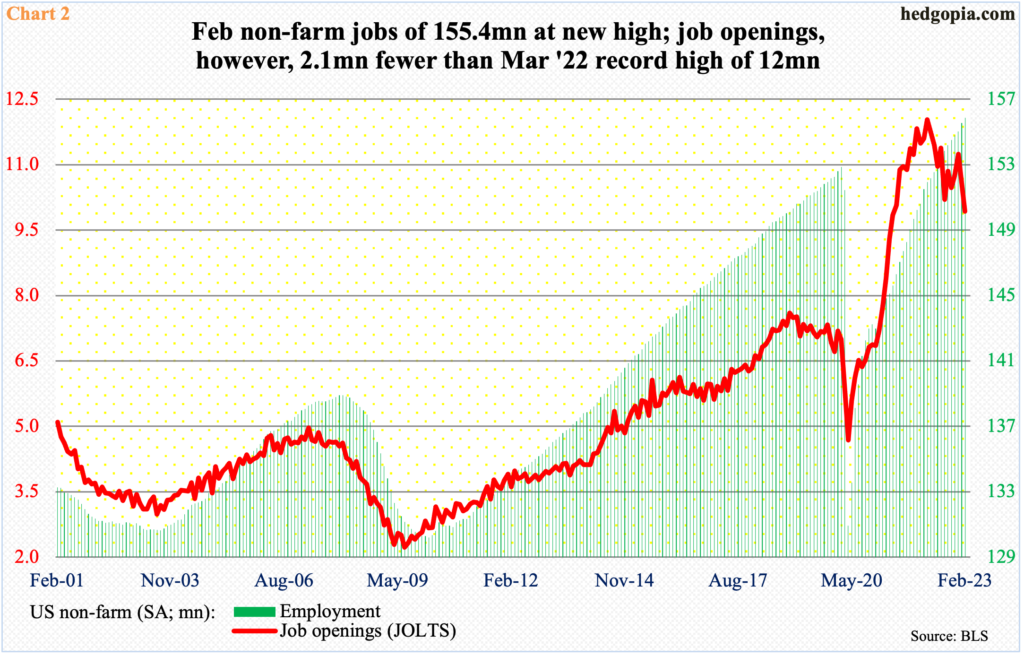

In February, the US economy added 311,000 non-farm jobs to 155.4 million, which is a fresh high. With just two months in, 2023 has added an average of 408,000 in a month. This compares to a monthly average of 399,000 in 2022 and 606,000 before that in 2021.

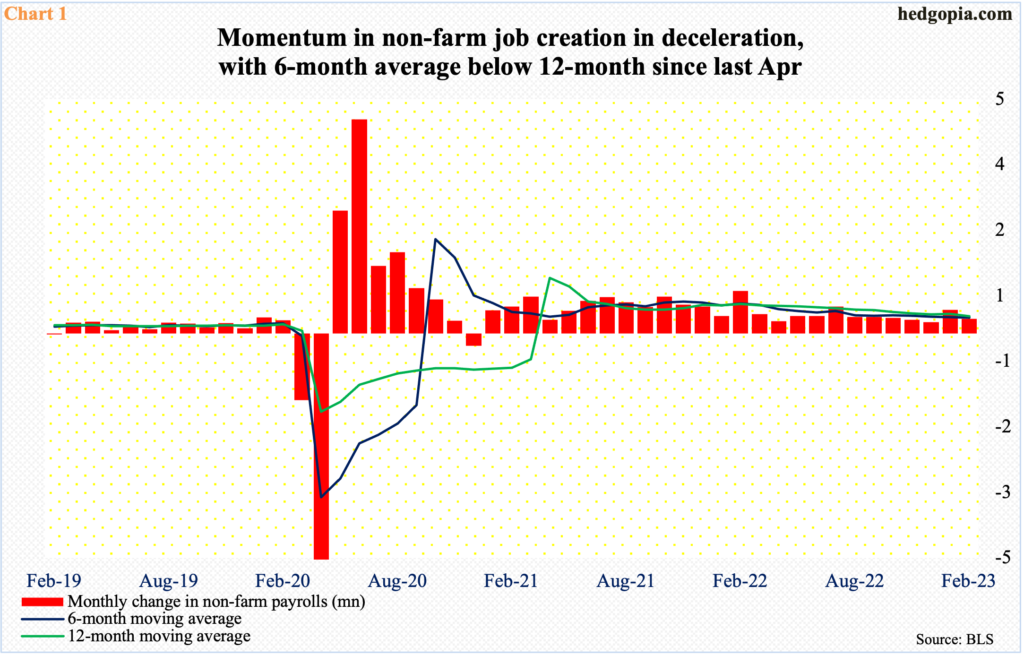

Job growth has decelerated for months now. The six-month moving average of monthly change in non-farm payroll has been under the 12-month since last April (Chart 1).

The signal coming out of the JOLTs (Job Openings and Labor Turnover Survey) report suggests more weakness ahead.

Historically, non-farm job openings have tended to lead employment (Chart 2). In February, openings dropped 632,000 month-over-month to 9.9 million – a 21-month low. The series peaked at 12 million in March last year and has since fallen by a cumulative 2.1 million. If past is prelude, it is only a matter of time before the green bars in Chart 2 will follow the red line lower.

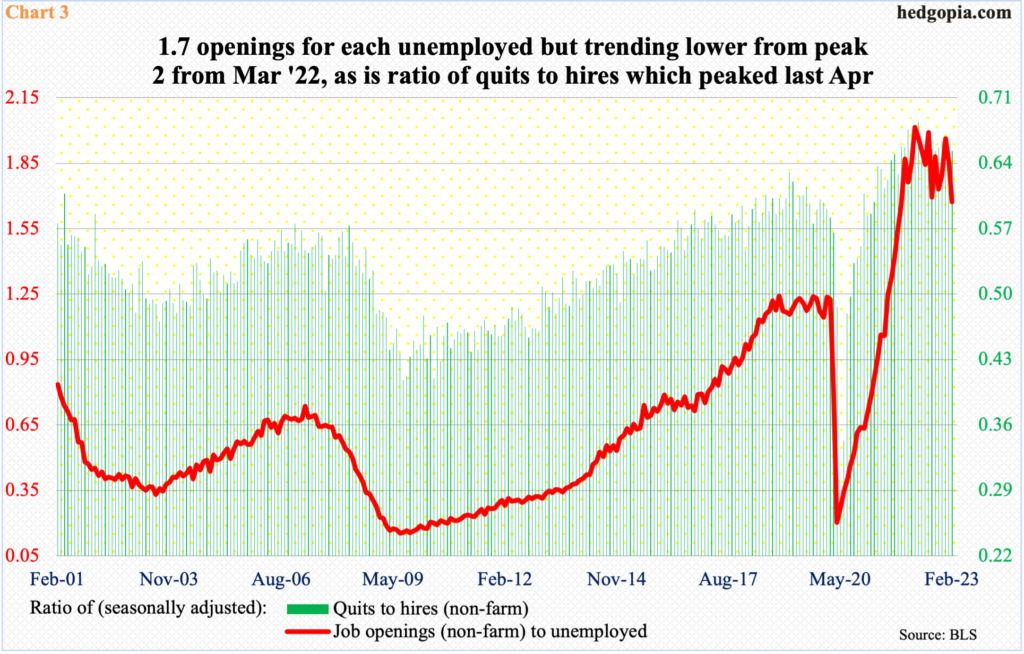

Chart 3 presents a couple more ways to measure the underlying strength in jobs – or a lack thereof. Once again, the trend points to a softening outlook.

One of the signs of a healthy job market is employees’ willingness or ability to quit, which reflects conviction on their part that they would have no problem finding another. In February, there were four million quits, up 146,000 m/m but down 477,000 from the November 2021 all-time high of 4.5 million. The ratio of quits to hires in February came in at 0.65, down from record 0.68 last April.

Similarly, the ratio of job openings to unemployed was 1.67 in February. This is a healthy number. That said, in March last year there were two openings for each unemployed. A rising ratio reflects underlying strength, and vice versa. Once again, the trend points to deceleration.

In summary, the job market is showing early signs of a crack. The Federal Reserve’s one-year campaign of interest-rate hikes is beginning to have an impact.

Thanks for reading!