- Exports’ share in U.S. GDP not as high as industrialized peers but increasingly important

- Fed’s rate-hike-this-year message significant tailwind for greenback’s relentless rally

- Fed officials not enamored of buck surge; how long before they start jawboning?

There is a wide body of economists/observers/investors who argue that exports’ role in the U.S. economy is not a make-or-break as it is in several other developed countries.

It is true that U.S. reliance on exports is not as high as in several other industrialized countries. Germany’s, for instance, is in the mid-40s, Canada’s and Switzerland’s low-30s.

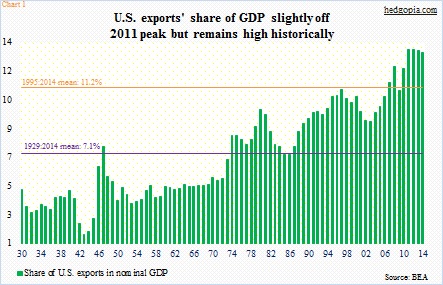

Last year, exports accounted for 13.4 percent of U.S. nominal GDP, off slightly from a record 13.6 percent in 2011.

Over the years, however, its role has increasingly grown, way above average (Chart 1).

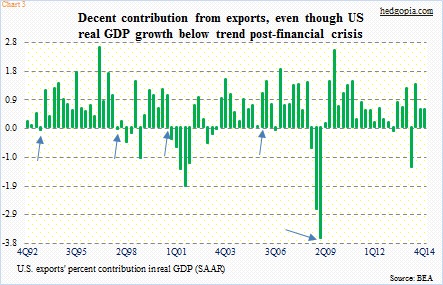

Particularly post-financial crisis, the U.S. economy continues to struggle to really get going. The past five years, real GDP has only averaged 2.2 percent. Exports’ contribution to this growth is as follows: 1.33 percent in 2010 (to real GDP growth of 2.5 percent), 0.87 percent in 2011 (1.6 percent), 0.44 percent in 2012 (2.3 percent), 0.41 percent in 2013 (2.2 percent), and 0.43 percent in 2014 (2.4 percent).

Exports have increasingly taken on increasing importance.

Is it any wonder then that Fed officials are beginning to sound alarm over the dollar’s persistent strength?

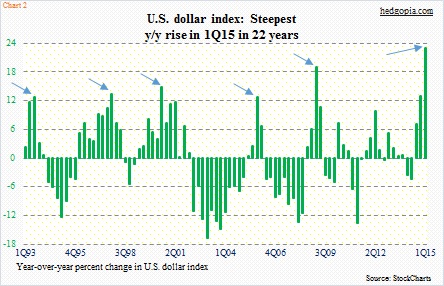

Chart 2 shows the nearly parabolic ascent of the U.S. dollar index the past nine months. In 1Q15, it was up 23 percent year-over-year. Going back to at least 1993, the index has never had as steep a quarterly surge. Two things are notable in the chart.

One, each time the index spiked (blue arrows), y/y growth decelerated in the subsequent quarter, but did not go negative. Momentum does not seem to do a 360 right away. The index ended 2Q14 at 79.81, so it is possible this pattern continues in the current quarter. Two, in the quarter the dollar spiked, four out of five times, exports’ contribution to GDP growth took a hit either in the same or subsequent quarter (arrows in Chart 3). The bars in Chart 3 have gotten smaller the past three quarters, but the real impact of the 4Q spike (in the dollar) will probably be felt in 1Q15.

In a speech on Monday, Bill Dudley, president of the New York Fed, said this: “…the significant rise in the value of the dollar is likely to lead to weaker U.S. trade performance…Another significant shock is the nearly 15 percent appreciation of the exchange value of the dollar since mid-2014…My staff’s analysis concludes that an appreciation of this magnitude would, all else equal, reduce real GDP growth by about 0.6 percentage point over this year.”

Whoa! In all of 2014, the economy grew 2.4 percent. You lop off 0.6 percent, and all we have left is 1.6 percent!

There you have it.

It seems Fed officials increasingly are not happy with the dollar’s rise. Over the last few months, we have been hearing comments to that effect, including Chair Janet Yellen who has said the dollar is on policymakers’ minds.

But what can they do about it?

They have just begun to voice their opinion on the matter. They have not even begun to seriously jawbone the currency markets. What else could they be doing? Interest rate is the best tool, but with not much room for it go any lower. QE is another they could resort to. But at this point, that seems far-fetched.

They still have the following at their disposal.

The dollar began to rise in the middle of last year; the pace quickened as the FOMC made it clear rates would be heading higher soon. The allure of favorable interest-rate differential was too hard to ignore. Gobs of money have moved into dollars trying to front run the Fed.

This dynamic will only change if and when the Fed begins to backpedal on its ‘rate hike this year’ message. In said speech, Mr. Dudley did say the path of interest-rate hikes are likely to be shallow. Particularly post-jobs report last Friday, rate-hike expectations have been pushed back to the latter months of the year.

But this has not even put a dent in the bullish dollar thesis, not in any significant way.

Yes, the dollar index did peak in the middle of March, before quickly losing four-plus percent, but buyers have showed up on support; yesterday, the index rallied 1.2 percent.

It is currency markets versus the Fed. The former likely continues to test the latter’s will until the latter at least resorts to jawboning.