Last week, major US equity indices enjoyed mini breakouts. A retest took place Tuesday. Post-breakout, Investors Intelligence bulls jumped 5.1 percentage points this week to 50 percent, but they remain way below the 57.2 percent recorded in the week the S&P 500 peaked late July. Their count needs to improve for the index to test the late-July high, let alone surpass it.

The S&P 500 large cap index (2979.39) peaked intraday at 3027.98 on July 26. By August 5, it had dropped to 2822.12. Horizontal support just north of 2800 goes back to March last year. This is where bulls repeatedly showed up in August. At the same time, rally attempts were getting rejected at 2940s, which approximated the 50-day moving average. This ceiling gave way last Thursday. Three sessions later, on Tuesday, bulls were forced to defend a retest, as there were bids waiting to sop up early-session weakness (Chart 1).

Things evolved similarly on the Nasdaq 100, having peaked on July 26 at 8027.18 and bottomed on August 5 at 7356.27. Throughout August, bulls defended trend-line support from last December, but they were also having difficulty taking care of one-year horizontal resistance just north of 7700. The 50-day lied around there as well. Last Thursday, bulls pushed through this resistance, followed Tuesday by a retest (Chart 2).

With the recent rally, both these indices are within striking distance of late-July record highs – the S&P 500 1.6 percent away and the Nasdaq 100 2.7 percent away. Daily momentum indicators on both indices have entered overbought territory, raising the odds of unwinding near term – unless, of course, bears and/or neutrals aggressively jump on the bullish bandwagon.

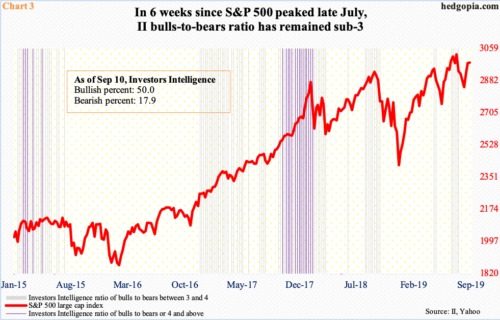

Last week’s breakout did not cause a substantial rise in bullish sentiment, only some. Investors Intelligence bulls this week jumped 5.1 percentage points week-over-week to 50 percent. This is the highest reading since registering 57.2 percent in the week ended July 30, which is when the indices peaked. Throughout August, they, along with several others, remained rangebound, even as bulls stayed put sub-50 for five straight weeks. In the last six weeks, the bulls-to-bears ratio did not even cross three, let alone four (Chart 3).

It is possible bulls are waiting for a successful retest, which they now got. Ordinarily, this should help buoy sentiment. We will find out when next week’s numbers are reported next Tuesday. A lack thereof, once again, raises the odds of unwinding of overbought conditions.

Thanks for reading!