- Bulls desperately need to retake 200-dma on S&P 500

- Potential unwinding of oversold technical conditions can act as tailwind

- Failure to build on Wednesday’s hammer reversal pattern will mean rockier times down the line

Last week, we discussed the significance of the 200-day moving average, and that, rightly or wrongly, this average is viewed as a line in the sand between a bull and bear market. Things are not always this simple in investing. But it is what it is. If enough people believe in this, in the end it becomes a self-fulfilling prophecy. On October 10th (Friday), the S&P 500 Large Cap Index closed the session literally sitting on that average. Come Monday morning, it opens a little lower, tries intra-day to retake the average, fails and then closes down big. By Wednesday (intra-day), the index was down 85 points from that Friday close. Like that. It was fast. And it was furious.

Now the task at hand for the bullish camp is to retake that average. It was lost on Monday (13th), and if by Friday (17th) the index was back above it, no damage done. It would signal the prior trend was still intact. That obviously has not happened. Hence the discussion here, and elsewhere, of possibility of a trend change. The index now has its first weekly close below that average since 2012. If the bull market is still alive and well, bulls should have no problem in mustering enough strength to reclaim that average. And that needs to happen fast. By the way, if and when that gets done, for bull-market confirmation stocks need to take out September highs. But that is later. First job at hand is to retake the 200.

Should the index continue to stay under the average this week, this will be viewed by technicians as a negative development.

In the wake of James Bullard’s dovish comments on Thursday all the major U.S. indices had a strong Friday. Nevertheless, particularly on the S&P 500 (1887) and Nasdaq Composite (4258) the advance was repelled, you guessed it, at their respective 200-day moving averages. This is the risk stocks face now. They have suffered technical damage, and levels that in the past invited bids will now be sources of offers. As a matter of fact, this already took place early this month. After the October 2nd hammer candle, the S&P 500, and other indices, quickly reversed its decline but the following advance was stopped two sessions later at a technically predictable level. In the end, it only turned out to be a quick trading opportunity. The subsequent drop was quick and ugly. This phenomenon could repeat itself if the current rally attempt gets rejected at technically important levels. Subsequent selling likely comes from two sources: (1) those who bought stocks in the past three sessions, and (2) those who are yet to bail out thinking the decline so far is nothing more than a plain-vanilla drop.

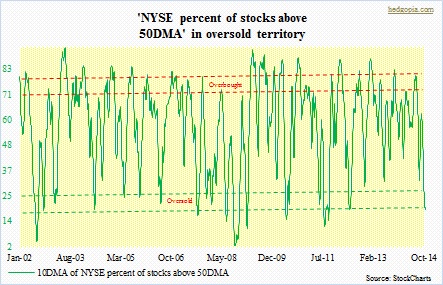

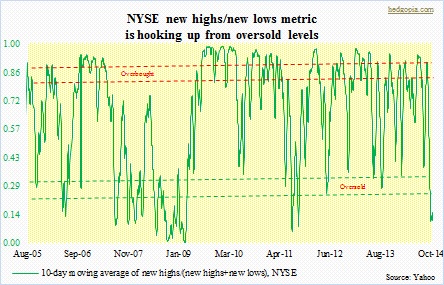

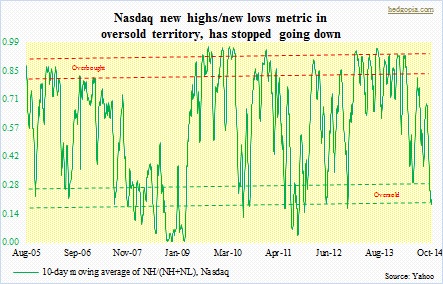

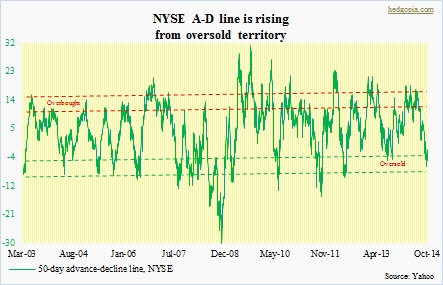

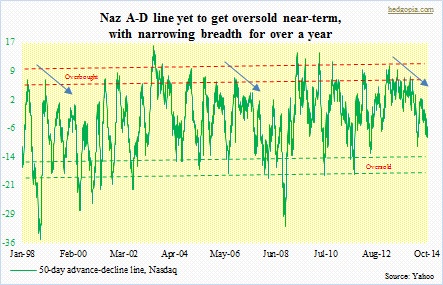

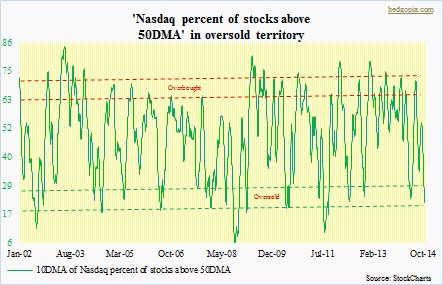

It is nearly universally believed that the drop in stocks is a buying opportunity. The typical thinking goes something like this. Stocks have seasonality tailwind behind them. The U.S. economy is set to accelerate. And that the nearly 10-percent drop in the S&P 500 (from intra-day peak to trough) makes it a bargain. No one is puking just yet. For now, bulls do have the support of oversold conditions as potential tailwind. Last Wednesday’s hammer candle can be a very bullish reversal pattern, if supported by follow through action. Several technical indicators this blog follows are grossly oversold (some of which are presented here). Options are now sending a similar message. The first two charts above show the new highs/new lows metric on both the NYSE and Nasdaq. Both, and others, are oversold enough for unwinding to potentially begin. On the NYSE in particular, it is beginning to hook up. One thing, though. As can be seen in all these charts, in the past there have been times they have gotten even more oversold. And these have been times of stress. If the current rally attempt gets rejected followed by undercutting of lows of last week then these will be indications that markets are betting things will get rockier before they get better. Under these circumstances these oversold conditions have further to go on the downside. Maybe. Maybe not. We will simply let the markets guide us.