- Shorts added to already-elevated positions on time to take advantage of latest decline in equities

- Indices in gross oversold conditions, giving bulls opportunity to try to squeeze shorts

- If shorts resist these pressures well, that signals rockier time ahead for stocks

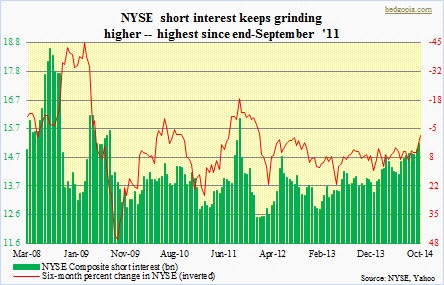

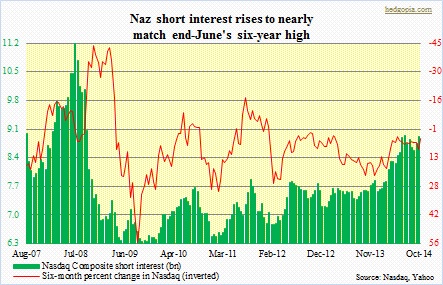

Shorts timed the decline in U.S. equities the past two weeks very well. From the middle of September to the end, short interest on the NYSE Composite rose 1.4 percent and 1.9 percent on the Nasdaq Composite. To be clear, it is not like shorts have suddenly been active. As shown in the adjacent chart and below, they have been raising bearish bets for a while now. That has particularly been the case on the NYSE, where short interest is at a three-year high. On the Nasdaq, mid-June this year it was at a six-year high, before retreating. The index went on to rally nearly seven percent in the next two and a half months, which probably resulted in some kind of squeeze. On the 19th (September), the index tested the September 3rd high and failed. Soon followed the drop (in stocks) of the past two weeks. It is probable shorts added to their positions in the wake of that technical failure. Whatever the case, their bets have paid off. But the bigger question is, Where to from here? The short-interest theory tells us that a large short interest presages a rise in the price. It is also called a cushion theory, as a squeeze potentially can act as a cushion.

Shorts timed the decline in U.S. equities the past two weeks very well. From the middle of September to the end, short interest on the NYSE Composite rose 1.4 percent and 1.9 percent on the Nasdaq Composite. To be clear, it is not like shorts have suddenly been active. As shown in the adjacent chart and below, they have been raising bearish bets for a while now. That has particularly been the case on the NYSE, where short interest is at a three-year high. On the Nasdaq, mid-June this year it was at a six-year high, before retreating. The index went on to rally nearly seven percent in the next two and a half months, which probably resulted in some kind of squeeze. On the 19th (September), the index tested the September 3rd high and failed. Soon followed the drop (in stocks) of the past two weeks. It is probable shorts added to their positions in the wake of that technical failure. Whatever the case, their bets have paid off. But the bigger question is, Where to from here? The short-interest theory tells us that a large short interest presages a rise in the price. It is also called a cushion theory, as a squeeze potentially can act as a cushion.

But how large is large? That red line (inverted) in the charts tends to hook down as short interest drops. Which means prices rise as short interest drops. Most of the time anyway. Now if we look to the left of the charts, we notice that short interest stood at a comparable level early 2008. Back then, plenty of cogent arguments were probably made suggesting short interest was too high and that it was setting up as the mother-of-all-squeeze opportunities. But it kept rising. In the end, shorts had the last laugh. That is not to suggest that shorts always get it right. They do not. In the present circumstances, there is one thing, though. There is persistence in the rise in short interest. And that shows conviction on the part of shorts. Are things then comparable to what eventually led to the July 2008 peak in short interest? No. Not even close. But can we get there? Of course. Central-bank money printing has not solved anything, come to think about it. Yes back in 2008 the Fed literally dragged the financial system from the brink of systemic failure. But persistent spoon-feeding since has helped distort the pricing mechanism – both interest rates and currency. The disease afflicting debt-heavy developed nations has been treated but not cured. If this is what is driving these shorts, they are probably right in their thesis.

But how large is large? That red line (inverted) in the charts tends to hook down as short interest drops. Which means prices rise as short interest drops. Most of the time anyway. Now if we look to the left of the charts, we notice that short interest stood at a comparable level early 2008. Back then, plenty of cogent arguments were probably made suggesting short interest was too high and that it was setting up as the mother-of-all-squeeze opportunities. But it kept rising. In the end, shorts had the last laugh. That is not to suggest that shorts always get it right. They do not. In the present circumstances, there is one thing, though. There is persistence in the rise in short interest. And that shows conviction on the part of shorts. Are things then comparable to what eventually led to the July 2008 peak in short interest? No. Not even close. But can we get there? Of course. Central-bank money printing has not solved anything, come to think about it. Yes back in 2008 the Fed literally dragged the financial system from the brink of systemic failure. But persistent spoon-feeding since has helped distort the pricing mechanism – both interest rates and currency. The disease afflicting debt-heavy developed nations has been treated but not cured. If this is what is driving these shorts, they are probably right in their thesis.

But it can also be a long wait.

As things stand now, they are essentially fighting central banks –not so much company fundamentals. How much lower equities have to drop before the Fed is forced into another iteration of QE? Which means every now and then bulls will have opportunities to try to push these shorts against the wall. We may be in the midst of one right now. Technically, things are way oversold, and several indicators are screaming for at least a near-term respite in selling. Even a modicum of stability can result in a decent rally. If shorts can withstand these pressures and bulls are not able to cash in on these opportunities, then we know we are in for a rockier ride in stocks.