If not for the intraday reversal, the S&P 500 Tuesday came very close to ending the ongoing bear market. Regardless how things shake out near term, at least until February, margin debt stood elevated – relatively speaking. In the prior two bear markets, it was more than cut in half.

Close but no cigar!

Tuesday, the S&P 500 large cap index came darn close to beginning a new bull market. The prior bull, which began in March 2009, ended on February 19th. At 131.4 months, this was the longest bull going back nine decades.

On March 23rd, the index closed at 2237.40, down 33.9 percent on a closing basis from February’s record high. A 20 percent rise from that low puts the index at 2685. Tuesday, the S&P 500 opened strong, rose as high as 2756.89, but began to deflate shortly after noon. As a matter of fact, the rug was genuinely pulled out in the last 10 minutes as it lost 42 handles, to close at 2659.41.

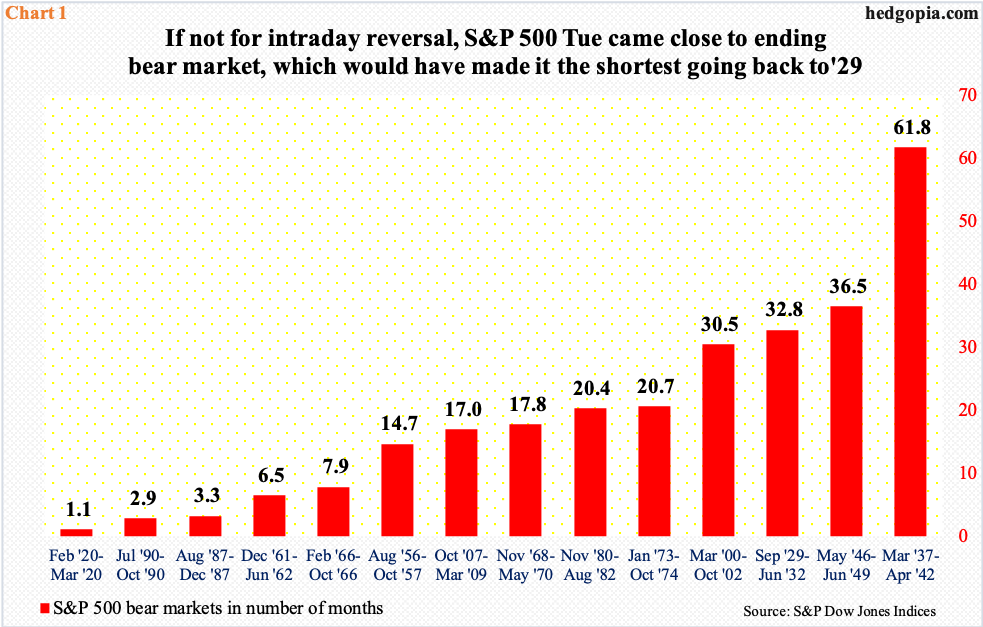

A bull market is defined as a 20 percent rise from the prior low. From last month’s closing low, the S&P 500 is up 18.9 percent and remains within striking distance of 2685. Should that occur, at 1.1 months it will be the shortest bear market going back to 1929 (Chart 1). A great opportunity was blown Tuesday, but bulls can take solace in the fact that unless March’s closing low is undercut, this is still doable – timing notwithstanding.

Right here and now, they do face a few roadblocks.

If indeed the S&P 500 in the sessions ahead reaches the 20 percent threshold and continues higher, there is massive resistance at 2800-2850 (Chart 2). At this level, risk-reward odds favor shorts more than longs. In fact, even before that level is reached, longs could be tempted to lock in profit. In merely 12 sessions through Tuesday’s high, the S&P 500 jumped 25.8 percent – intraday, not on a closing basis. Tuesday’s intraday reversal took place at an important juncture.

A 38.2-percent Fibonacci retracement of the February 19th-March 23rd decline lies at 2651. Several times in the past couple of weeks, this level drew sellers. The outcome would have been different Tuesday, but bulls were unable to hang on to the gains.

As selling got intense last month, the S&P 500 sliced through a rising trend line from February 2016. The underside of this broken support offered resistance in the last couple of weeks. This week, the index had an opportunity but failed to take it out Tuesday, although it closed out the session right on it.

Tuesday, the daily RSI closed at 49.7. On March 23rd, it tagged 30, so has come a long way. In a bear market, sellers begin to show up around 50-60. If so, this metric should begin to run out of steam right around here. This is near term.

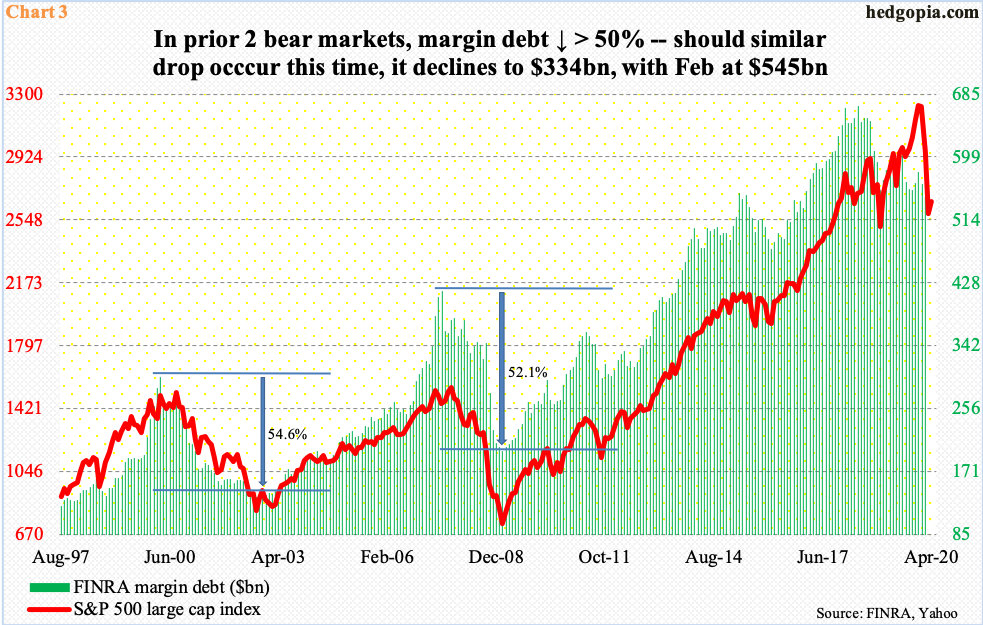

Also worth watching from a medium-term perspective is how margin debt behaves. FINRA margin debt peaked as far back as May 2018, when it posted $668.9 billion – a new record. The S&P 500, however, continued to post new highs. This divergence ended in February with the index playing catch-up.

In February, margin debt dropped $16.7 billion month-over-month to $545.1 billion. It will be interesting to find out how March behaved. The S&P 500 tumbled 12.5 percent in that month and was down as much as 25.8 percent at one time. Selling likely got exacerbated due to margin calls. We will find out when March numbers are out.

At present, we know this much. Even though margin debt peaked nearly two years ago, it has had stellar growth during the last cycle that just ended. In February 2009, it bottomed at $199.7 billion, before growing 235.1 percent through the May 2018 high. (The S&P 500 bottomed in March 2009 and surged 409.3 percent intraday and 395.5 percent on a closing basis.)

Here is the thing. In the prior two bear markets, margin debt went on to contract more than 50 percent – 52.1 percent between July 2007 and February 2009 and 54.6 percent between March 2000 and September 2002. Mark Twain is credited to have said ‘history does not repeat itself but it often rhymes.’ Simplistically, a 50 percent contraction will have shrunk margin debt to $334.5 billion. Once again, we are yet to find out how March shook out, but when it is all said and done, from where it ended February, margin debt has a long way to go on the downside.

Thanks for reading!