Homebuilder optimism is catching up with weakening home sales. Starts have responded and inventory is sharply rising – a byproduct of rapidly appreciating prices and a rise in mortgage rates. Buyers need to see relief on both these fronts before sales pick back up.

Home sales are tumbling in the US. In July, sales of new homes plunged 12.6 percent month-over-month to a seasonally adjusted annual rate of 511,000 units, which was the lowest since January 2016. (Existing home sales in July dropped 5.9 percent m/m to 4.81 million units – a 25-month low.)

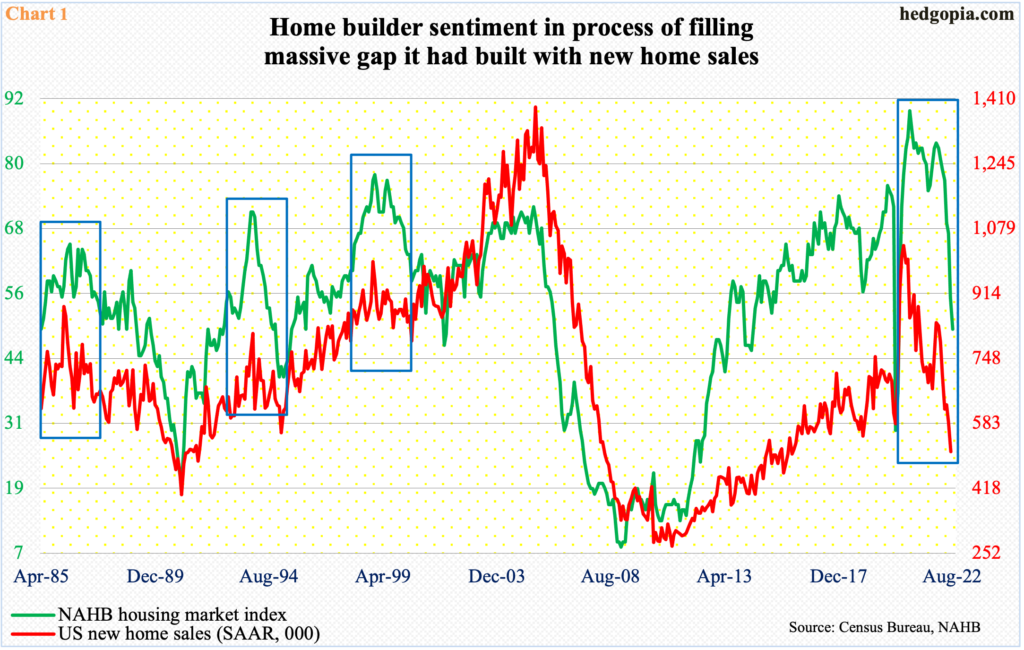

Ahead of this latest collapse in sales, homebuilder optimism was firm, before it too began to crumble. The NAHB housing market index hit an all-time high 90 in November 2020 and was 84 as recently as last December. This month, it fell six m/m to 49, which was the lowest since May 2020.

The gap between builder optimism and sales is rapidly being filled, which typically happens whenever the former sprints and the latter jogs (Chart 1).

The November 2020 peak in builder optimism preceded strong sales, with new homes cresting at 1.04 million in August that year (Chart 1). The resulting optimism led to builders aggressively breaking new ground.

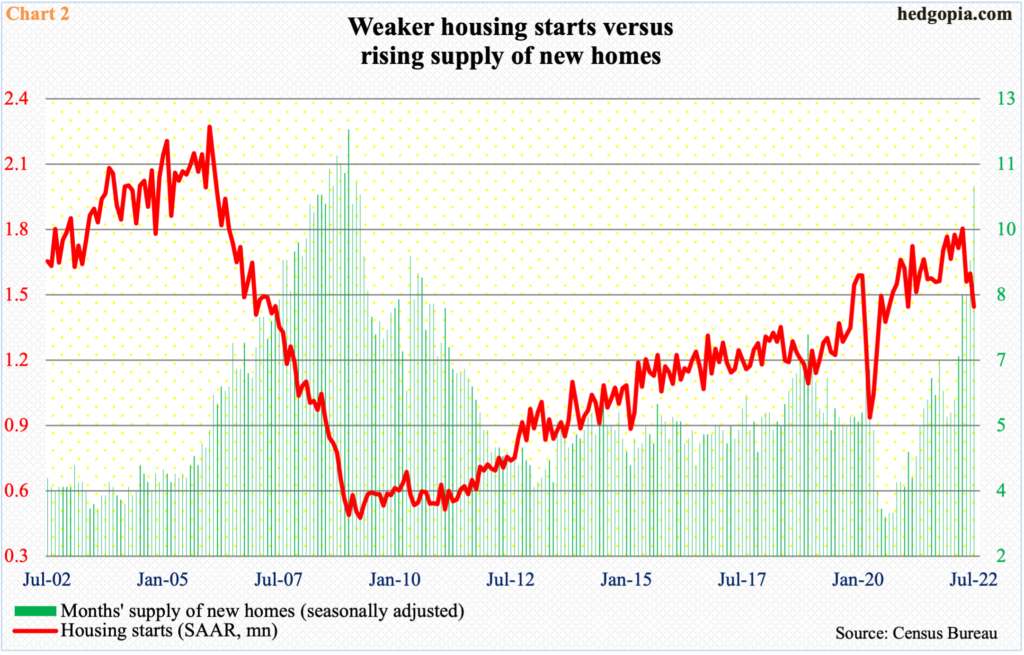

In April, housing starts reached 1.81 million units – the highest reading since May 2006 – but only to then quickly weaken to 1.45 million last month, which was a 23-month low (Chart 2).

The ramp-up in builder optimism and housing starts came just when sales were responding to rising rates and rapidly appreciating prices.

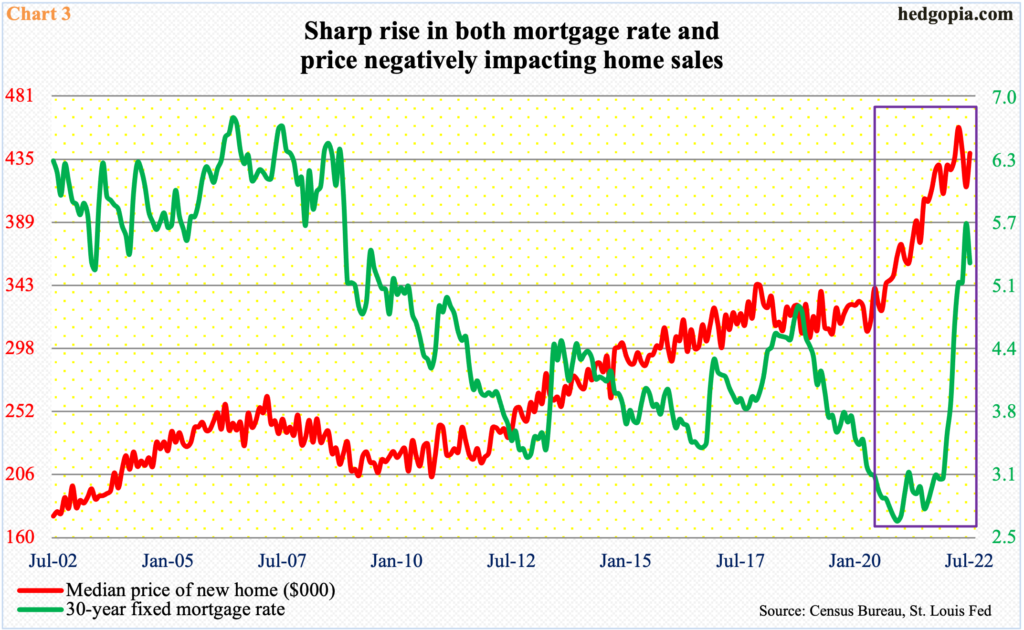

The median price of a new home reached $458,200 in April – a record and up 21.7 percent from a year ago. In July, prices softened a tad to $439,400. Concurrently, the 30-year fixed mortgage rate went from 2.67 percent at the end of December 2020 to 5.7 percent in June this year, ending July at 5.13 percent (Chart 3). The combo is hitting sales hard, and inventory is rising.

In July, months’ supply of new homes hit 10.9. This metric has not been this high since March 2009 (Chart 2). In August 2020, it troughed at 3.3.

The Federal Reserve’s tightening campaign is not helping matters. Odds are that higher rates on the short end will begin to adversely impact the economy, which then begins to get reflected in the long end of the curve, providing relief to mortgage rates. Even in this scenario, the high prices are still a hindrance. For sales to pick up momentum, buyers need improvement in both interest rates and home prices.

Thanks for reading!