- Chair Yellen brings up issue of “elevated” P/E and P/S ratios

- In 1996 and 2014, markets ignored Fed chiefs’ valuation warnings

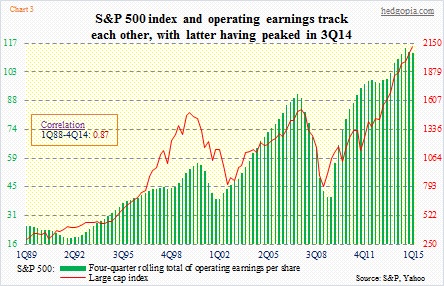

- Tight R between SPX and operating earnings, which probably peaked in 3Q14

One of the nuggets in Federal Reserve Chair Janet Yellen’s Monetary Policy Report to Congress yesterday – also known as the Humphrey-Hawkins testimony – was the following:

…Valuation pressures are notable in some asset markets, although they have eased a little on balance. Leverage at lower-rated nonfinancial firms has become more pronounced…With regard to asset valuations, price-to-earnings and price-to-sales ratios are somewhat elevated, suggesting some valuation pressures. However, estimates of the equity premium remain relatively wide… [emphasis mine]

The S&P 500 large cap index is currently trading at a tad under 18x 2015 operating earnings estimates of $118.32 (reported earnings will be even lower). If we use the actual numbers for the last four quarters, the P/E multiple jumps a full percentage point to just under 19. The multiple – both trailing and forward – was much more expensive during the dotcom bubble era, but is currently well over the long-term average of 15. Using a four-quarter total of sales for S&P 500 companies, the index currently trades at 1.8x, which is higher than during both 2000 and 2007 peaks.

So raising a valuation caution flag seems well-timed.

This is not the first time Chair Yellen has done so.

In a similar setting in July Last year, she said:

Nevertheless, valuation metrics in some sectors do appear substantially stretched—particularly those for smaller firms in the social media and biotechnology industries, despite a notable downturn in equity prices for such firms early in the year. Moreover, implied volatility for the overall S&P 500 index, as calculated from option prices, has declined in recent months to low levels last recorded in the mid-1990s and mid-2000s, reflecting improved market sentiment and, perhaps, the influence of “reach for yield” behavior by some investors. [emphasis mine]

And who can forget the famous December 1996 “irrational exuberance” speech at the American Enterprise Institute in which former Chairman Alan Greenspan said:

Clearly, sustained low inflation implies less uncertainty about the future, and lower risk premiums imply higher prices of stocks and other earning assets. We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade? And how do we factor that assessment into monetary policy? We as central bankers need not be concerned if a collapsing financial asset bubble does not threaten to impair the real economy, its production, jobs, and price stability. [emphasis mine]

Mr. Greenspan’s phrase was interpreted as a warning that the market might be somewhat overvalued. As was Ms. Yellen’s comments about social media and biotech stocks last year.

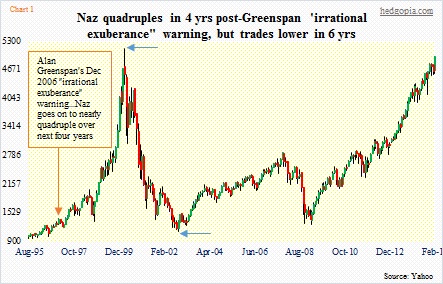

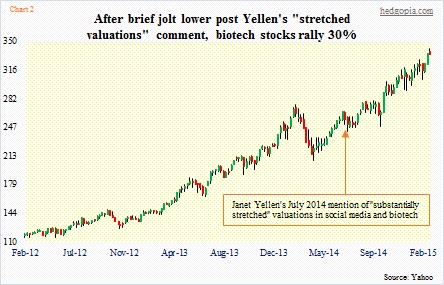

The irony is, in both 1996 and 2014, stocks, after a brief dip, continued on their merry way. Post-December 1996, the Nasdaq in particular nearly quadrupled before the bubble burst in March 2000 (Chart 1). After Ms. Yellen’s “substantially stretched” comments, biotechs (represented by IBB in Chart 2) have not missed a beat – up 30 percent.

With that as a background, what are we to make of Ms. Yellen’s current valuation concerns? Are these warnings going to be early yet again?

Time will tell. Although what might be working for her this time is the following. In fact, her timing may just be perfect this time around.

As Chart 3 shows, the S&P 500 has followed operating earnings higher. In 2000, the index peaked before the four-quarter rolling total of earnings did – by two quarters. In 2007, operating earnings peaked in 2Q07, and the index followed one quarter later. This time around, earnings peaked in 3Q14, and stocks have yet to react.

Earnings expectations for 2015 are just getting cut. Until the end of this past December, 2015 earnings were expected to come in at $131 (they were as high as $138 at the end of June last year). Now they are $118 (were $122 just a couple of weeks ago). While fully aware of the Fed put, if the relationship between the S&P 500 and operating earnings of constituent companies hold, it is only a matter of time before the red line follows the green bars lower.