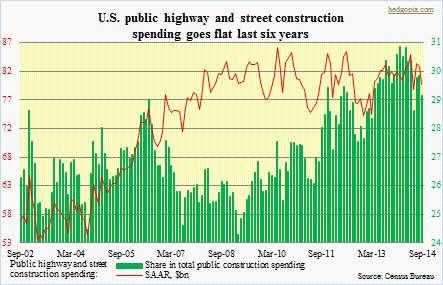

- Public highway and street construction spending flat last six years

- Average age of private fixed structures 26-plus in 2013, highest since 1954

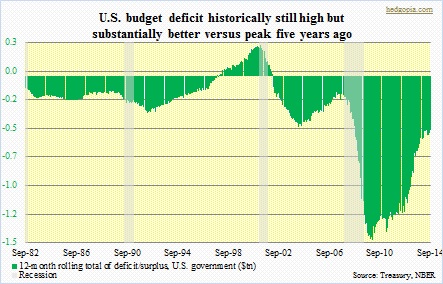

- U.S. ran up $9tn in cumulative deficit in 2008-2013, with emphasis on consumption

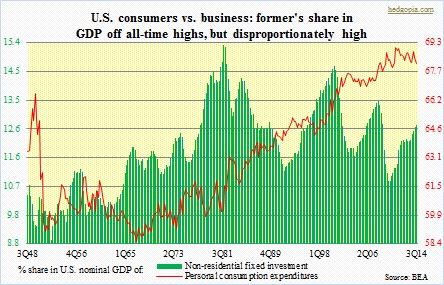

We are aware how in the current recovery U.S. corporations have consistently fallen short of consensus expectations for capital spending. As a matter of fact, as shown below, the share of non-residential fixed investment in nominal GDP peaked way back in 1981/82 even as consumers went into overdrive. In the wake of each of the past two recessions, consumers’ share went up, while corporations’ went the other way. The latter’s share has gone up in recent quarters but continues to remain disproportionately low. But come to think of it. From a business perspective, who can blame them, right? If end-demand is lacking and shows no signs of sustainable pickup, it is prudent not to overinvest. At the same time, it is also not prudent using up cash flows/borrowed dollars in share buyback at increasingly higher prices, but that is another story.

A capX-cautious corporate sector has contributed to a sub-par recovery post-financial crisis. Real GDP growth has only averaged a tad over two percent. One of the repercussions is that the share of government in GDP rose as high as 21.6 percent in 3Q09. For five consecutive years from 2008 to 2012, the budget deficit ran in the trillion-plus range, with 2013 barely under $1tn; in those six years, cumulative deficit was just under $9tn. These are astronomical sums, especially considering that 2010-2013 were recovery years. Be that as it may, as is shown below, there has been a massive improvement in the deficit. For the last 12 months ended September, it came in at under $500bn. The improvement is still relative. The ledger is still in the minus column. Plus, the deficit is still large versus historically. We even enjoyed a surplus for a brief period during the late 1990s. Where things stand now, the concept of surplus is nothing more than a pipe dream. Conditions are just not in place. The federal debt already exceeds nominal GDP. Debt-servicing is not an issue now as rates have been artificially kept low, but the fact that debt burden is already too high negates possibility of more debt-fueled growth.

From the productivity perspective, whether or not all these borrowed dollars are consumed or invested makes all the difference. Corporations are investing less, consuming (share buyback/dividend payout) more. The average age of private fixed structures in 2013 was 26.3 – highest since 1954 (not shown here). The price to pay will probably not be known until the next downturn hits. Things are not any better in government. Infrastructure spending sorely lags. For the last six years, public highway and street construction spending, for instance, has gone absolutely flat; it was $80bn (seasonally adjusted annual rates) in September. This is a period when the nation ran up trillions of dollars in deficit. Myopic, but true.