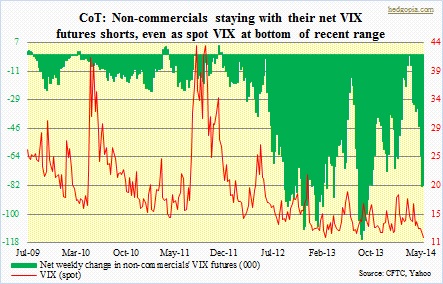

Non-commercial futures traders’ bet in recent weeks on a declining VIX was spot-on. Toward the middle of March, these large speculators were net short a mere 1k contracts. VIX (spot) was around 15 at the time. Technically, there was room for VIX to go south, and the bears pressed hard. Since that 1k low, large speculators have continued to build on net short positions, which peaked at 83k two weeks ago and stayed essentially flat in the latest week. VIX, in the meantime, closed Friday at 11.36, and is near major support. On a long-term chart, in the right circumstances, there is room for VIX to go slightly lower still, but medium-term conditions are now grossly oversold. If ‘long-term’ wins over ‘medium-term’, then we are possibly looking at VIX with a ten handle. At least going by the latest week, however, non-commercials are not betting on that outcome. They are staying with their sizeable net short positions, but did not add any in the latest week, as they have persistently done in recent weeks.

Non-commercial futures traders’ bet in recent weeks on a declining VIX was spot-on. Toward the middle of March, these large speculators were net short a mere 1k contracts. VIX (spot) was around 15 at the time. Technically, there was room for VIX to go south, and the bears pressed hard. Since that 1k low, large speculators have continued to build on net short positions, which peaked at 83k two weeks ago and stayed essentially flat in the latest week. VIX, in the meantime, closed Friday at 11.36, and is near major support. On a long-term chart, in the right circumstances, there is room for VIX to go slightly lower still, but medium-term conditions are now grossly oversold. If ‘long-term’ wins over ‘medium-term’, then we are possibly looking at VIX with a ten handle. At least going by the latest week, however, non-commercials are not betting on that outcome. They are staying with their sizeable net short positions, but did not add any in the latest week, as they have persistently done in recent weeks.

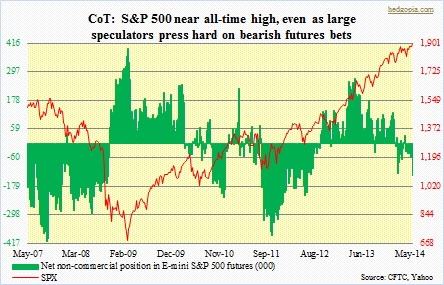

VIX with a ten handle also looks unlikely considering the signals coming out of E-mini S&P futures. In the latest week, non-commercials added nearly 100k contracts to their net short positions, for a total of 134k, vs. 31k net longs at the start of April. These traders caught the drop in the SPX the first couple of weeks (in April), but missed the rally since, as they have persistently stayed net short. The latest reading saw a sharp jump in net shorts, as both longs cut back and shorts added – perhaps indicating the conviction behind the next expected major move in the SPX. The index remains way overbought long-term, is now overbought medium-term and getting overbought near-term. The latest move has persistently come on low volume, but ultimately price is what matters. Having said that, anemic volume is also an indication that there is not much net inflows into stocks. Sure, rotation has taken place, from momentum-driven high-fliers to ‘steady as she goes’ large-caps. The Nasdaq is still 200 points below its early-March highs, even as the SPX just crossed 1900. For VIX to continue to slide toward 10, either someone needs to once again light a fire under momentum names, or new money needs to heavily flow into large-caps. Possible? Yes. Probable? No.

VIX with a ten handle also looks unlikely considering the signals coming out of E-mini S&P futures. In the latest week, non-commercials added nearly 100k contracts to their net short positions, for a total of 134k, vs. 31k net longs at the start of April. These traders caught the drop in the SPX the first couple of weeks (in April), but missed the rally since, as they have persistently stayed net short. The latest reading saw a sharp jump in net shorts, as both longs cut back and shorts added – perhaps indicating the conviction behind the next expected major move in the SPX. The index remains way overbought long-term, is now overbought medium-term and getting overbought near-term. The latest move has persistently come on low volume, but ultimately price is what matters. Having said that, anemic volume is also an indication that there is not much net inflows into stocks. Sure, rotation has taken place, from momentum-driven high-fliers to ‘steady as she goes’ large-caps. The Nasdaq is still 200 points below its early-March highs, even as the SPX just crossed 1900. For VIX to continue to slide toward 10, either someone needs to once again light a fire under momentum names, or new money needs to heavily flow into large-caps. Possible? Yes. Probable? No.