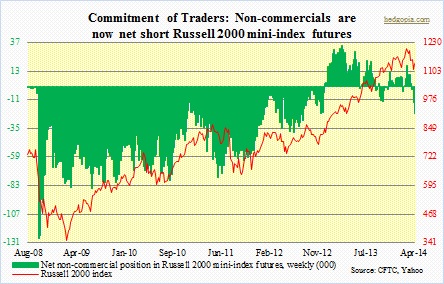

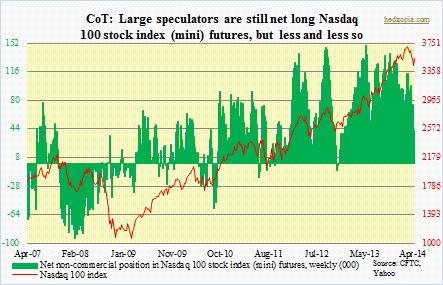

Going by action on the S&P 500, Russell 2000 and Nasdaq 100, non-commercial futures traders have been gradually cutting back on their net longs for a year now, but they are yet to get aggressive in raising their short bets.

Going by action on the S&P 500, Russell 2000 and Nasdaq 100, non-commercial futures traders have been gradually cutting back on their net longs for a year now, but they are yet to get aggressive in raising their short bets.

For the uninitiated, the CFTC keeps a tally on holdings of participants in various futures markets, ranging from stock indexes to currencies to metals to grains to livestock to treasuries to interest rates to the VIX. The report is published each Friday, providing a breakdown of prior Tuesday’s positions.

The report breaks down trader positions in three groups: 1) commercials – producers, merchants, processors, users, and swap dealers; 2) non-commercials – managed money and other reportables, and 3) non-reportables – essentially small speculators.

Commercials are essentially hedgers – going short when the underlying goes up and going long when the underlying goes down. They simply seek protection against unexpected price movements. A couple of examples. A producer of ethanol sees the price of corn drop, hence it is in his interest to lock in that price in the futures market. An exporter in China sees the value of Renminbi dropping, hence it will be to his benefit to go long that currency in the futures market so his exports get more competitive.

The other group, non-commercials – let us call them large speculators – are trend followers. They are generally considered to be the “smart money.” Some observers label commercials “smart money” as this group deals with the stuff day in, day out, hence should have a better feel for it. Nevertheless, they are there to hedge, not follow the trend. Over the years, I have noticed that commercials start following the trend only when trends are very strong, otherwise they limit themselves to hedging.

The non-commercials, from this respect, is an interesting group. This group is essentially made up of hedge funds, commodity trading advisors, and what not. What drives them? Profit. That is it. They are good at identifying trends, and staying with them until the trend is no more.

By the way, commercials comprise the majority of open interest – understandably so as they provide a commodity or instrument to the market. Speculators have no need for the underlying. They will exit before the contract is due.

With this understanding, let us see what we can divine from these charts.

With this understanding, let us see what we can divine from these charts.

First, this caveat. As stated earlier, the Friday publication of the data is already three days old, and a lot can happen in those three days, especially if the markets are fast-moving. Since the data is not real time, it is hard to use it as a market-timing tool. But that does not mean there is no value in it. The data is perfect for gauging broader trends, which then, by default, can provide one an opportunity to look for trend reversals.

Of the three indices covered here, in the recent sell-off, the SPX, NDX and RUT fell a little over 4.4 percent, 8.7 percent, and 9.6 percent, respectively. Money came out fast from the previous risk-on groups – not what you want to see happen from the perspective of the overall health of the market. But that is a topic of discussion for another day.

In the charts, we see that non-commercials have been cutting back on their net longs for a year now, give and take. The NDX is the only one with net longs currently, with the remaining two in net shorts. The group was net long 114k NDX contracts as of February 25th, and started raising net shorts by both cutting longs and raising shorts. This was about two weeks before the index peaked. Now, net longs have dwindled to 34k.

In the charts, we see that non-commercials have been cutting back on their net longs for a year now, give and take. The NDX is the only one with net longs currently, with the remaining two in net shorts. The group was net long 114k NDX contracts as of February 25th, and started raising net shorts by both cutting longs and raising shorts. This was about two weeks before the index peaked. Now, net longs have dwindled to 34k.

Over on the RUT, it is the same story. Net shorts are rising. Non-commercials are also net short the SPX, but less so than two months ago – probably why, performance-wise, the index has fared well vs. the other two.

The good thing, from bulls’ perspective, is that the group has not gotten very aggressive in increasing net shorts. The ‘not-so-good’ is that this could very well be the beginning of a process, lasting weeks and months. It is too soon to call it a reversal, but as the charts show, once a reversal is in – either direction – it lasts a long time. The key thing to watch is how this group will treat the current bounce/rally.