October’s CPI report showed continued disinflation since peaking last year at four-decade highs. Concurrently, Walmart, which commands a wide consumer reach with nearly $600 billion in annual sales, rather ominously commented that the company was more cautious than it was 90 days ago. Futures traders seem increasingly right in their rates outlook for next year.

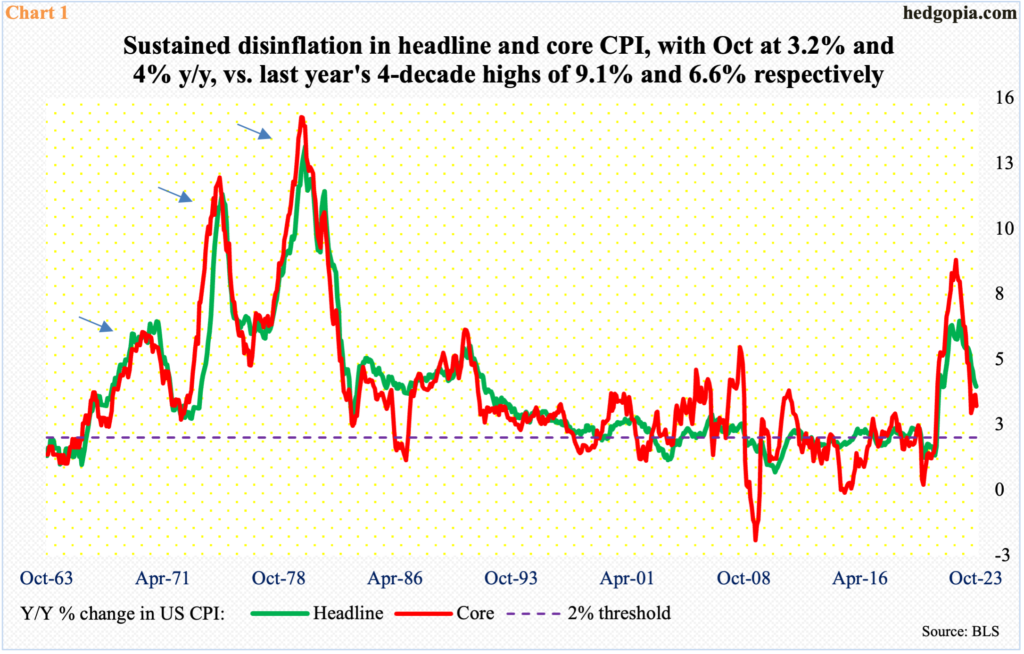

October’s consumer price index (CPI) report confirmed the prevailing disinflation trend. Headline and core CPI increased at an annual rate of 3.2 percent and four percent last month. Last year, they were galloping ahead at 9.1 percent (June) and 6.6 percent (September), in that order.

The Federal Reserve has a two percent goal on core inflation, with its favorite core PCE (personal consumption expenditures) having risen 3.7 percent in the 12 months to September, down from the 5.6 percent peak reached in February last year; October numbers are due out on the 30th this month.

In each of these, last year’s highs were at four-decade highs, so inflation has come down quite a bit. Although not at/near a level the Fed can declare ‘mission accomplished’, it increasingly feels like inflation is unlikely to show the kind of resurgence repeatedly seen in the ’70s (arrows in Chart 1).

Disinflation is taking deeper roots. Next comes meaningful economic deceleration at best or contraction at worst. Signs are there.

Walmart (WMT), which this fiscal year will do nearly $600 billion in sales, is a giant of a company. It reported its October quarter Thursday morning. Numbers were not bad, but the outlook was not comforting. The CFO said the company was now more cautious than it was 90 days ago. Management is not encouraged by the last couple of weeks of October and is rethinking the health of the consumer. Customers are holding out for lower prices.

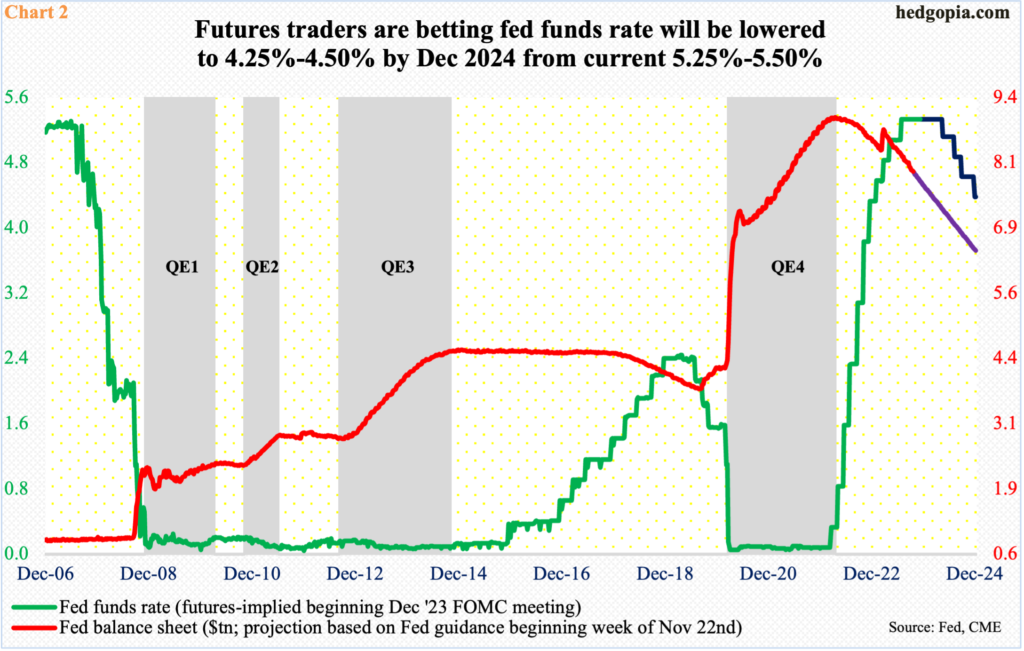

In the futures market, traders immediately adjusted their 2024 rates outlook. Until Wednesday, they were expecting the first cut in the fed funds rate to occur in June. Post-WMT and the latest figures for the weekly unemployment claims, this has now been brought forward to May, with the 25-basis-point cut putting the benchmark rates between 500 basis points and 525 basis points.

The fed funds rate currently stands at a range of 525 basis points to 550 basis points, up from zero to 25 basis points in March last year. The Fed is also reducing its bloated balance sheet. The last hike in the fed funds rate took place in July. It is probable the economy is yet to absorb all of the 16-month tightening, which only means growth deceleration in the months/quarters to come.

Futures traders are now betting the fed funds rate will end 2024 between 425 basis points and 450 basis points, which will represent a full-percentage-point reduction from the current levels. In fact, for months at one time, they were expecting the benchmark rates to end next year south of 400 basis points. All along, the central bank has remained steadfast in saying the fed funds rate will be left elevated for longer, with September’s statement of economic projections showing FOMC members expected two 25-basis-point cuts in 2024.

Given where things are and given the likelihood how things will evolve in the months to come, the Fed is likely to ease more than it currently expects.

Thanks for reading!