- Contrary message from U.S. dollar and bonds as to prospects for interest-rate hike by Fed

- Latest Humphrey-Hawkins testimony shows Chair Janet Yellen leaning dovish

- Hedge funds are neck-deep in bullish dollar bets, expecting higher rates

Currency and bond markets are each sending a conflicting message.

Since July last year, the U.S. dollar has been on a rip-roaring rally, up 18 percent, pricing in a tighter interest-rate environment in the U.S.

In contrast, since the dollar started rising until the low four weeks ago, the ten-year yield lost a full percentage point, to 1.65 percent.

Several factors impact the supply-demand dynamics of both. But in the end, it all comes down to the economy. In normal times in particular, a stronger economy should push up interest rates, as well as attract dollar investments.

The buck has been in demand the past seven months. Traders are making bullish bets expecting a stronger U.S. economy and that the Fed would begin to hike toward the middle of the year. Bonds on the other hand are not buying the stronger economy narrative.

U.S. macro data, increasingly coming in weaker than expected, are beginning to side with the bond market. Even the Fed is beginning to sound dovish, versus its message only a couple of months ago. Chair Janet Yellen, testifying before Congress the past couple of days, essentially gave no clues on monetary policy. Nonetheless, her testimony did have a dovish tone to it. Doug Kass perhaps put it better, tweeting “Yellen was neither dovish nor hawkish. She was gibberish.”

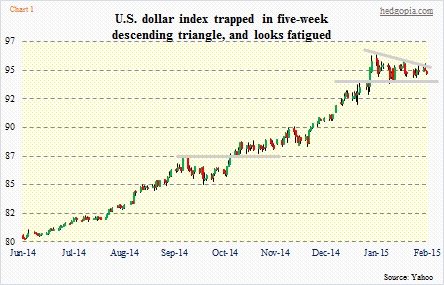

Indeed, if the dollar bulls thought she was hawkish, there was a good technical setup for them to react. The U.S. dollar index has carved out a descending triangle formation (Chart 1). If we recall, the Nasdaq 100 recently broke out of a similar pattern. More often than not, though, this tends to be a bearish formation, as a continuation pattern of the prior trend.

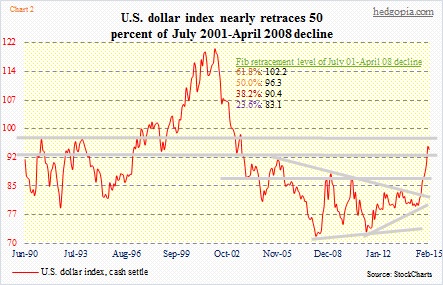

The dollar index has been in a big downtrend from July 2001 to April 2008 (Chart 2), and has now retraced nearly 50 percent of that downdraft. It got to 95.85 intra-day on the 26th of January. (By the way, 50-percent retracement is not really a Fib ratio, but is definitely something technically-minded people closely watch.)

So here is the thing, the dollar is beginning to look vulnerable here. Particularly intermediate- to long-term, technicals are grossly overbought, and have been that way for a while now. The currency is at a point where it desperately needs support from fundamentals – better economic data, and a rise in prospects for higher interest rates.

Over the past several months, tons of money have been betting for exactly that outcome. In the futures market as of Tuesday last week, large speculators were sitting on 66k net longs, down from the all-time high of 73k five weeks ago, but these are still massive positions. As Chart 3 shows, these traders have done an excellent job of riding the currency higher, having reversed to net long from net short in the middle of June. There has been a lot of money made in this thing. And for these traders to continue to stay put, they need a reason. Which means either economic data should start coming in better than expected or the Fed has to move – not a base case on this blog. Especially after the Yellen testimony in which she seems to have pushed back odds of a rate hike toward the latter months of 2015, if at all.

The first area of support on the dollar index (94.22) lies around 93. A breakdown can have implications for commodities in particular.