- AAPL set to join Dow brings out ‘this is top’ talk

- Historically, tough to argue Dow inclusion ensures top

- If AAPL peaks, it will be for other business-related reasons

AAPL (127.14) is slated to replace T in the Dow Jones Industrial Average, effective March 19th.

With that has begun a debate as to what that might mean for the stock. Initially, several index funds as well as the ETF (DIA) that track the average will create demand for shares. But this is one-time.

There is no shortage of people that are now saying this will end up being the top for AAPL as stock. Global Equities Research last week urged AAPL management to refuse to join the average. Their argument being “companies in Dow have historically symbolized companies which are boring, have zero innovation, complacent and are inching closer to irrelevance by the day,” and that AAPL represents none of that. Hence it does not belong there.

People often bring up examples of MSFT and CSCO that saw their share prices come under pressure for years after being included in the average. Fair argument, but to be fair, these two companies, along with HD and INTC, were inducted in November 1999. Just a few months before the bubble burst on the Nasdaq. Five years after joining the average, they were still down. All four of them.

People often bring up examples of MSFT and CSCO that saw their share prices come under pressure for years after being included in the average. Fair argument, but to be fair, these two companies, along with HD and INTC, were inducted in November 1999. Just a few months before the bubble burst on the Nasdaq. Five years after joining the average, they were still down. All four of them.

Come to think of it. There is some logic to the bearish argument.

The average contains 30 of the largest and most influential companies in the U.S. The keepers of the index choose one only after a company has gotten scale, is well known and on investor radar screen already. These are not hidden gems, as, for instance, AAPL was when it was languishing under a buck in October 2002 (the iPod was already announced one year prior to that low, by the way). So by the time a company makes it to the Dow, it is already at the top of its game, so to speak. After reaching the top of Mt. Everest, where does the climber go next? Down, of course. That is the argument.

But is it really that simple?

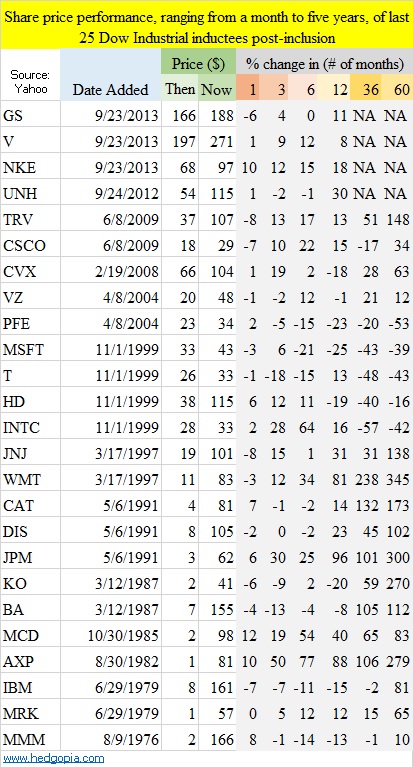

So to find out, I decided to look into all the 30 companies that are currently in the Dow and see how their stocks performed over six different periods – one month, three months, six months, one year, three years, and five years – after inclusion into the index. The accompanying table only includes 25 companies. The missing five are UTX (added on 3/14/1939), DD (11/20/1935), PG (5/26/1932), XOM (10/1/1928), and GE (11/7/1907). They are not on the table since I could not find the stock price going that far back.

So staying with the 25, the table makes it crystal clear that inclusion into the Dow alone does not ensure a top in the stock price. Of the 25, 12 saw their stock drop in the first month (essentially a toss-up), and nine each over three, six and 12 months. Eight out of 21 had a lower share price after three years, and five after five years (GS, V, NKE and UNH were only added in 2012/2013.)

As a matter of fact, the further we go back into time, we see that stocks have risen multifold since being added to the Dow. In a little over three decades, for instance, AXP has gone up from $1 to $81. So as long as they do not get kicked out, they seem to do just fine. MMM has been there since 1976, and GE since 1907. Imagine buying GE back then, or even JPM as recently as 1991. Inclusion in the Dow did not ring a ‘this is the top’ bell for them.

Now we know all too well that companies get kicked out all the time. Most recently, in 2013 GS, V and NKE replaced BAC, HPQ and AA. And back in 2009, CSCO replaced GM. At the time they got excluded, they were facing problems. (Incidentally, IP was kicked out in April 2004 when it was trading in high-$20s. Now the stock is in mid-$50s.)

So from an investor’s perspective, the question is: Is AAPL on its way to becoming HPQ or AXP? If AAPL the stock tops, it will not be because it made it to the Dow, rather because, as bears point out, its fate is way too much reliant on the iPhone, the law of large numbers will begin to dictate, and everybody and their dog are now bullish on AAPL.