After June’s CPI Thursday, markets are heavily betting a September rate cut is all but certain. For equity bulls, who have rallied the indices massively on the back of ‘a rate cut is coming,’ this could very well mark a ‘by the rumor, sell the news’ phenomenon.

In the eyes of futures traders, September is a lock. The FOMC meets on 17-18 that month; a 25-basis-point is now favored with 85 percent probability. These odds spiked after June’s consumer price index – out Thursday – behaved better than expected, sustaining the prevailing disinflation trend.

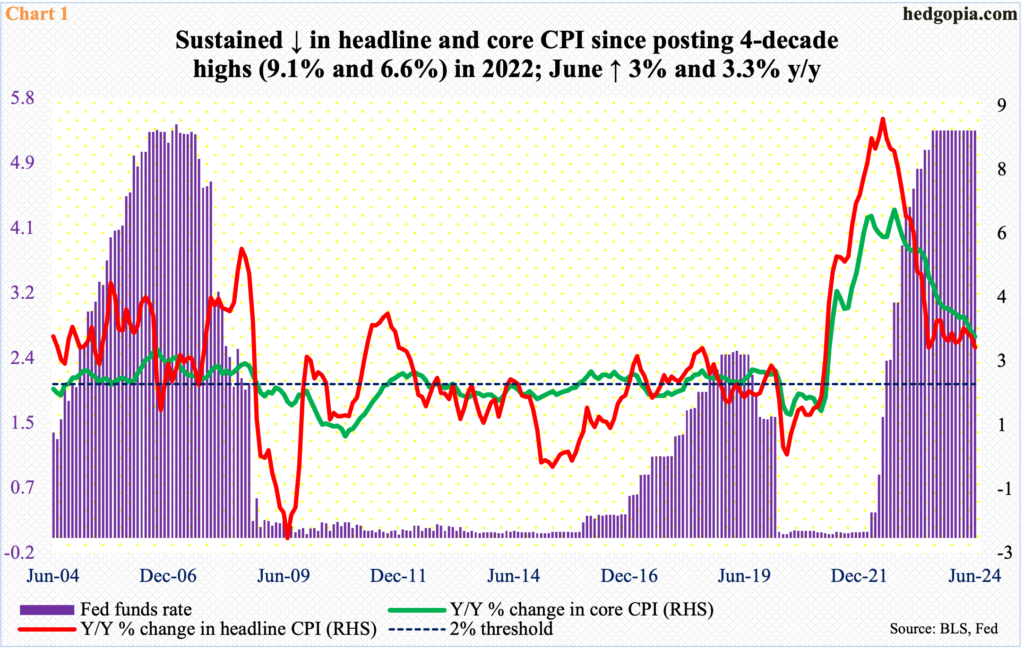

From May, headline and core CPI in June fell one-tenth of a percent and rose by the same amount respectively. This was the first month-over-month drop in 23 months. From a year ago, they respectively rose three percent and 3.3 percent, with the core in particular the lowest since April 2021 (Chart 1).

As soon as the report hit the wires Thursday, calls for a September cut got louder.

Therein lies a potential problem for equity bulls.

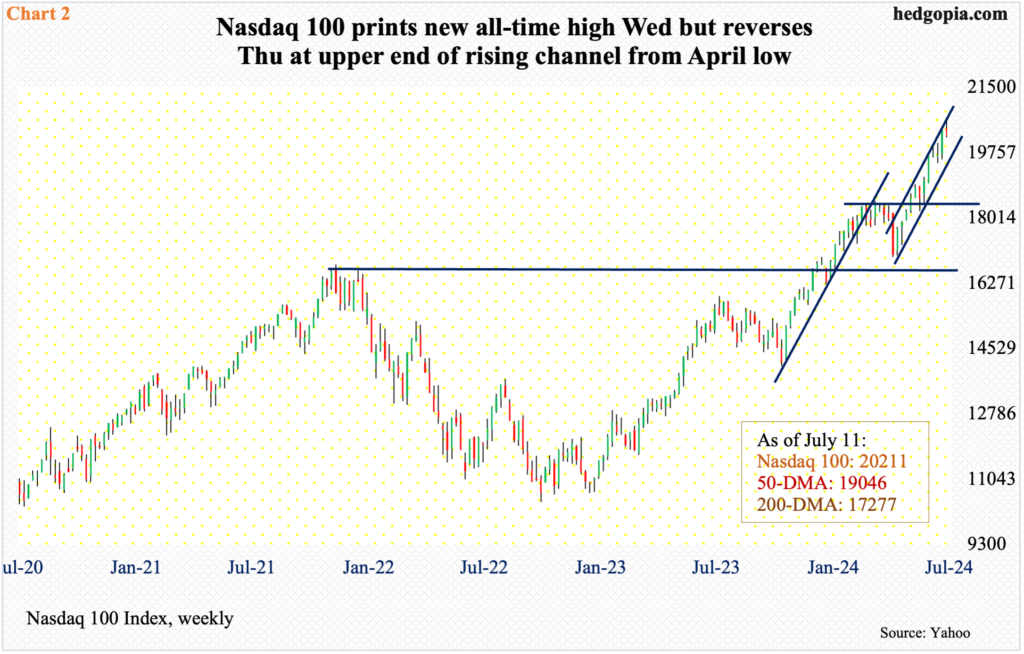

Stocks – notably large-caps – have had a phenomenal ride since last October’s bottom. Tech has been a clear leader, with the Nasdaq 100 up 47.2 percent through Wednesday’s new all-time high of 20691. The S&P 500 (5585), through Thursday’s new all-time high of 5642 is up 37.5 percent from the October low.

One primary narrative behind this run is the expected easing in the monetary policy. The Federal Reserve has left the fed funds rate unchanged at a range of 525 basis points to 550 basis points since last July. They began to tighten in March 2022 when the benchmark rates were languishing between zero and 25 basis points.

Consumer inflation that at one time was rising at four-decade highs is cooperating. In 2022, headline and core CPI were rising at an annual rate of 9.1 percent (June) and 6.6 percent (September). They have now slowed down to a three handle. This gives the Fed an opening to at least begin to lower rates. The September meeting is now in play. Once a cut occurs, ‘the Fed will be lowering rates’ narrative will have been played out, possibly beginning a ‘buy the rumor, sell the news’ phenomenon.

It is possible at least some bulls are already anticipating this. With one session to go this week, the Nasdaq 100 (20211) is down 0.9 percent, although the index was up as much as 1.5 percent at Wednesday’s high; as things stand, the week is likely to end in a shooting star.

In fact, even before this week’s action, the Nasdaq 100 was showing signs of indecision/distribution. Last week was strong, up 3.6 percent, but before that it went sideways for a couple of weeks with the weekly forming a gravestone doji and then a spinning top (Chart 2).

Unless tech bulls come out in force and rally today’s session strongly, a weekly shooting star this week will be yet another candle favoring the sellers in the sessions/weeks ahead. Incidentally, the Nasdaq 100 is rallying all along a rising channel from April’s low; sellers appeared this week at the upper end.

Thanks for reading!