Although it rose 1.2 percent, the Nasdaq 100 essentially went sideways in March. This also offers tech bulls an opportunity to force another breakout. Catalysts are needed. There is, however, a month to go before the leading tech companies report their calendar first quarter. Amidst this, non-commercials last week went net short Nasdaq (mini) futures.

Last month, the Nasdaq 100 added 1.2 percent. This compares with jumps of 3.1 percent by the S&P 500 large cap index and 3.4 percent by the Russell 2000 small cap index. Apart from this relative underperformance, the tech-heavy index also pretty much went sideways last month.

On March 1st, the index tagged 18333, which was a fresh high at the time. This was surpassed on the 8th when it ticked 18415 intraday but only to reverse lower to close at 18018. This behavior was once again on display on the 21st when 18465 was reached intraday but the session closed at 18320. Amidst this flattish action, the month closed at 18255 last Thursday.

It should not come as a surprise if the Nasdaq 100 is in fatigue. Through last week’s high, it surged 31.3 percent from the low of last October. This is also coming at a time when the bulls were unable to defend a rising trend line from that low (Chart 1).

In the event of downward pressure in the sessions ahead, there is short-term horizontal support at 18000, followed by the 50-day at 17835, which coincides with the daily lower Bollinger band at 17824. Breakout retest takes place at 16700s.

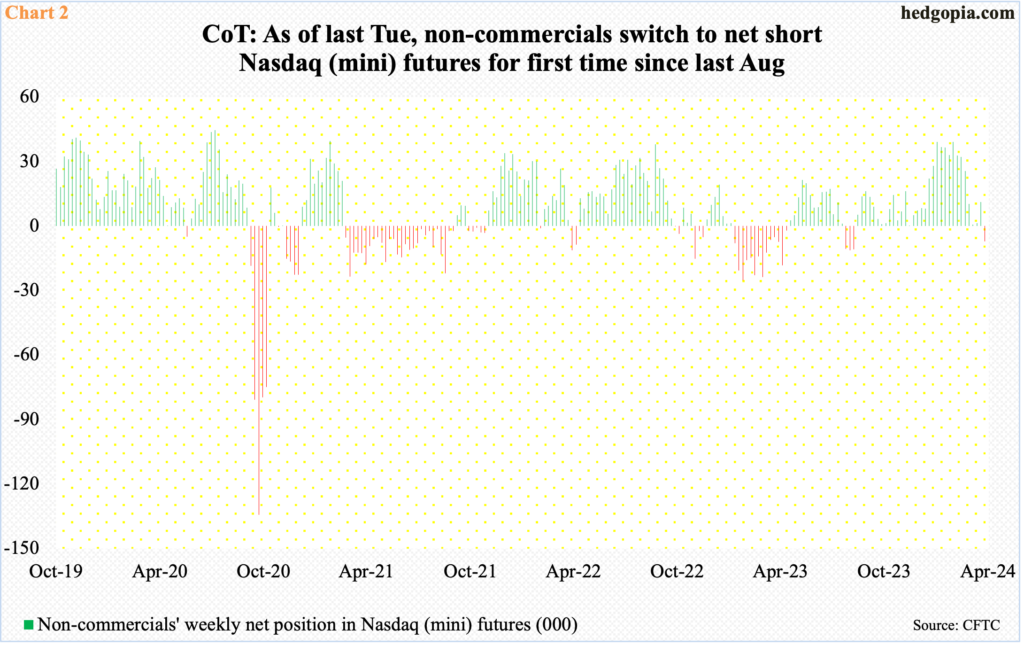

In the futures market, non-commercials are now leaning bearish. Last week (as of Tuesday), they switched to net short Nasdaq (mini) futures. It is only 7,116 contracts, but the important thing is that they have not been net short since last August.

In the week to January 30th, these traders were the most net long in three years, before they began to reduce holdings (Chart 2).

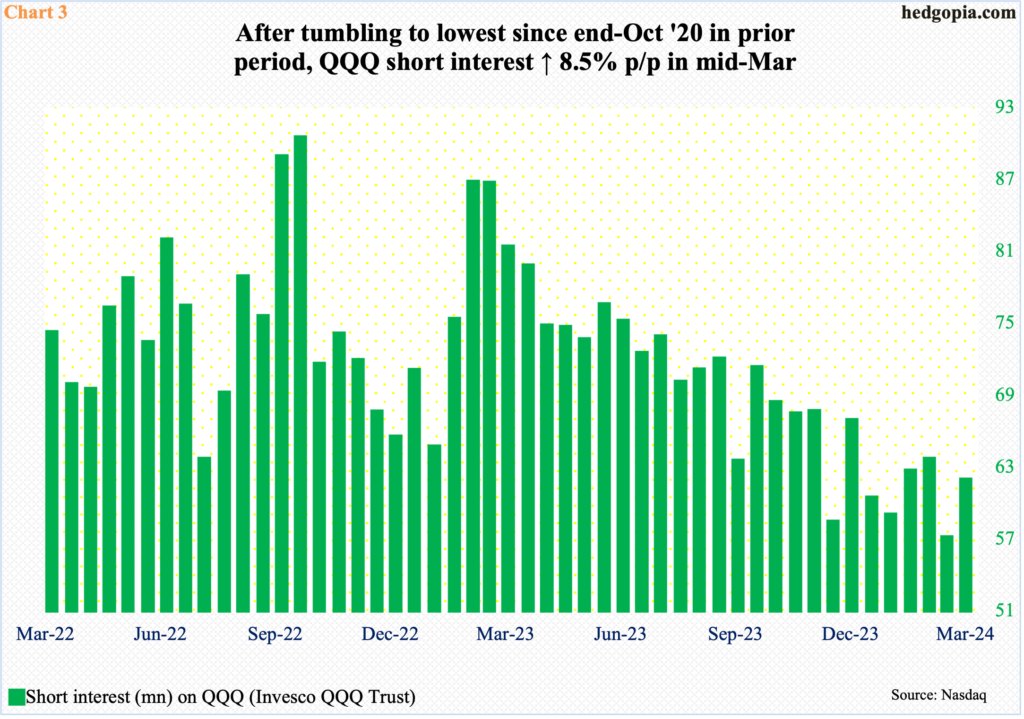

Concurrently, short interest on QQQ (Invesco QQQ Trust) rose 8.5 percent period-over-period mid-March to 61.6 million. Before that, these shorts experienced a massive squeeze, as at the end of February, short interest at 56.8 million was the lowest since October 2021.

At the end of September 2022, short interest had built up to 90.1 million (Chart 3). In October that year, the Nasdaq 100 reached a major bottom (Chart 1), rallying nearly 77 percent since. Shorts contributed massively to this, as they covered. This bullish tailwind is no more.

If anything, shorts could very well use this as an opportunity to gradually build positions.

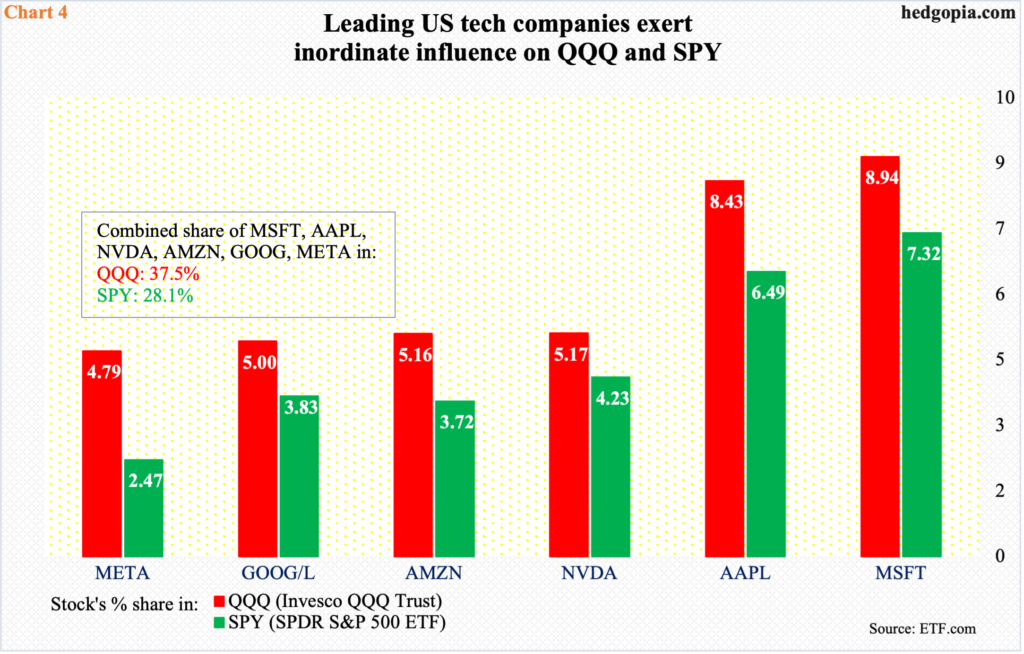

The index remains top-heavy. In QQQ, the combined share of the top six companies – Microsoft (MSFT), Apple (AAPL), Nvidia (NVDA), Amazon (AMZN), google owner Alphabet (GOOG) and Facebook owner Meta (META) – is currently 37.5 percent. In SPY (SPDR S&P 500 ETF), they account for 28.1 percent (Chart 4).

Of the six, Apple (AAPL) in particular acts sick, as it remains 14 percent from its all-time high from last December, and NVDA – after surging seven-fold from its October 2022 bottom – could be in a process of peaking.

From the bulls’ perspective, March’s sideways action in the Nasdaq 100 could act as a blessing in disguise if they can engineer another breakout. For that, catalysts are needed. Except for NVDA, which is on an April quarter, the remaining five do not report their March quarter until late April or early May.

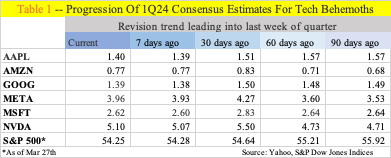

Estimates are reasonable, but a lot can change between now and then. From 30 days ago, sell-side estimates are down for all six companies (Table 1). This has lowered the bar for them to jump over, but there is still a month left.

This can very well create a vacuum in which the Nasdaq 100 cannot help but careen toward the nearest support.

Thanks for reading!