Leading up to the 4Q22 earnings reporting season, the sell-side continues to wax enthusiastic about this year’s earnings prospects. The enthusiasm looks improbable considering the meaningful rise in interest rates last year is all set to filter through to the economy this year. Corporations will be looking to reduce buybacks to cut cost.

The 4Q22 earnings season will begin soon. Major US banks will kick it off on Friday next week. As of December 29, S&P 500 companies were expected to ring up $53.54 in operating earnings, down from $56.73 earned in the corresponding quarter last year. Sell-side estimates for 4Q22 peaked mid-June last year at $60.74.

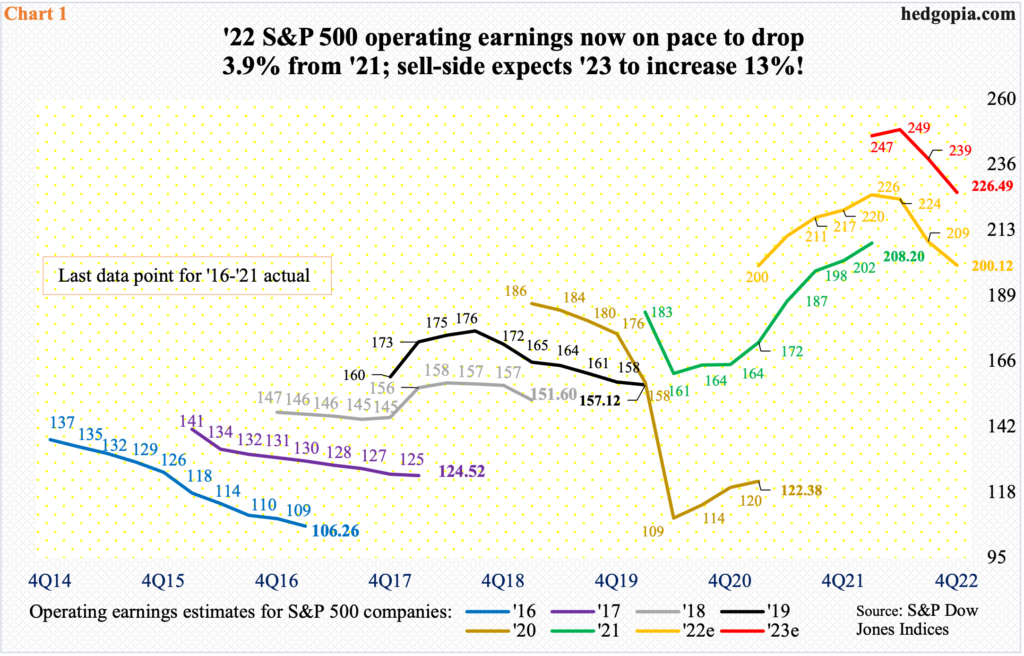

The revision trend is also down for 2022 as a whole and this year. With one quarter to go, these companies are currently expected to earn $200.12 in 2022; at the peak in late April last year, the consensus was $227.51. As things stand, 2022 is on pace to drop 3.9 percent from 2021’s $208.20. The sell-side – amusingly – expects this to reverse this year and grow 13.2 percent to $226.49 (Chart 1).

This year’s estimates are at serious risk, although they have been revised lower from the peak $250.12 recorded in late April last year.

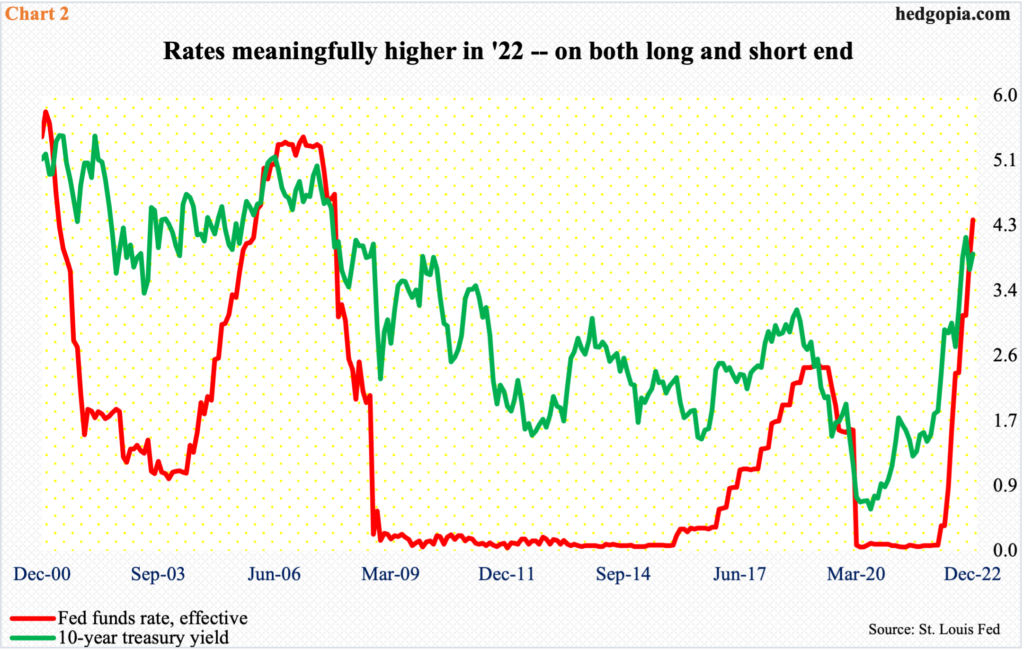

As the Federal Reserve tries to bring elevated inflation under control, monetary conditions have tightened.

Until last March, the fed funds rate was left languishing between zero and 25 basis points. Now, the benchmark rates are in a range of 425 basis points to 450 basis points and are still headed higher, with the December 14 FOMC dot plot projecting a peak this year at 5.1 percent. On the long end, the 10-year treasury yield rallied from 1.7 percent last March to 4.3 percent in October, with last week closing at 3.9 percent (Chart 2).

Rate-sensitive sectors such as housing have taken a hit, but the US economy in all probability is yet to feel the full brunt of all this tightening. Recession risks are very high; as a matter of fact, contraction in economic activity looks probable.

Corporate earnings will not remain unscathed. Rates have been heading higher for a while now, giving corporate boards enough time to adjust. This probably explains the sharp move lower in the red line in Chart 1. The problem can get compounded considering the leverage in corporate balance sheets.

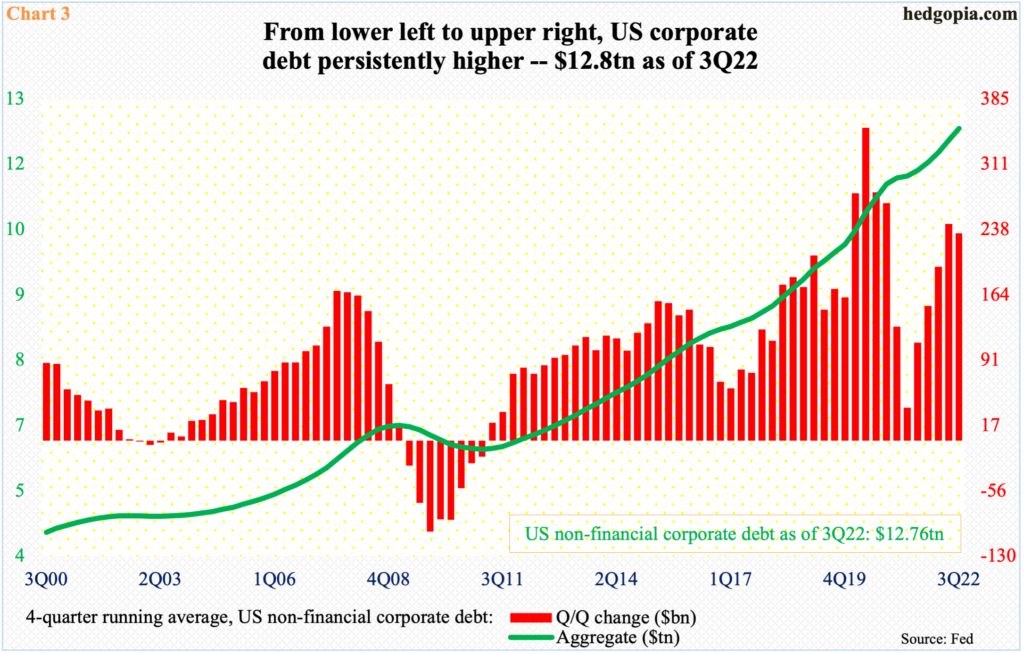

As of 3Q22, non-financial corporate debt stood at $12.8 trillion – a new record. Corporations took full advantage of the low rates that lasted for years. The fed funds rate was zero-bound for seven long years from late 2008 to late 2015 and then again for two years from March 2020 to March 2022 (Chart 2).

At the end of 2008, corporations held $6.6 trillion in debt, which grew to $10.3 trillion by the end of 2019. The uptrend in debt accumulation has continued despite the rising rates last year. Moody’s AAA corporate bonds yielded 2.7 percent at the end of 2021; by last October, this had risen to 5.4 percent, ending 2022 at 4.7 percent.

In the first three quarters of last year alone, corporations took on $755 billion in additional debt. Chart 3 uses a four-quarter average and last year’s spike, which took place amidst higher rates, is clearly visible. The problem begins when the time comes to refinance all this debt that accumulated at ultra-low rates. Billions that will come due will need to be either paid off or refinanced at higher rates.

This will come at a time when earnings are set to take a hit as the economy meaningfully slows down/contracts. Managements will be forced to look for ways to cut cost. One place they can do so is share buybacks.

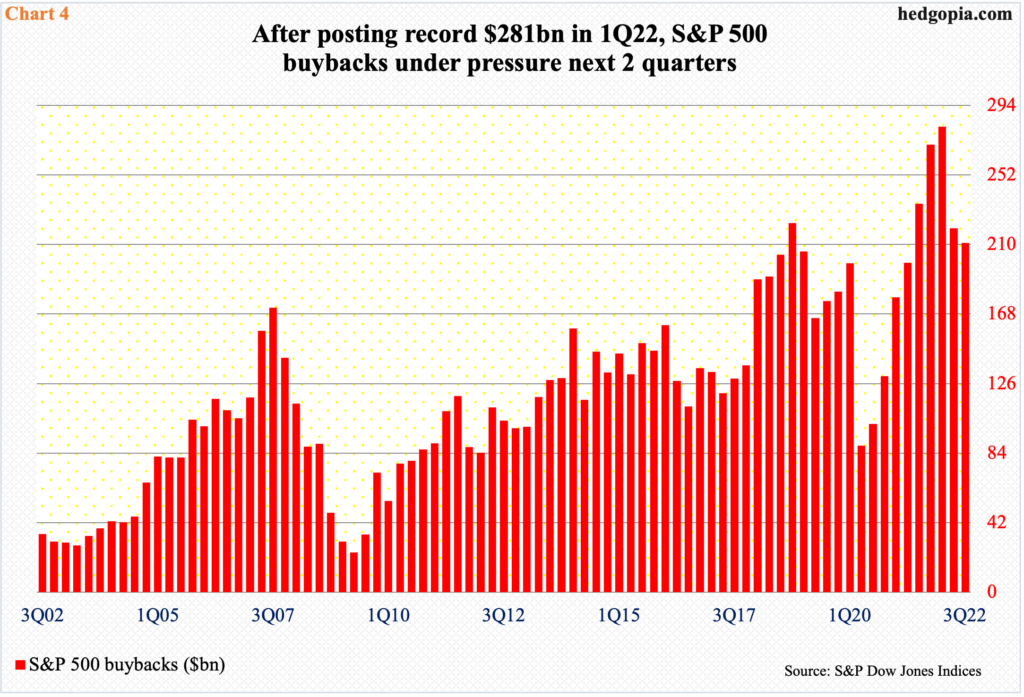

Buybacks by S&P 500 companies have been very strong. In the four quarters through 3Q22, these companies spent $981.6 billion in purchasing their own shares. This was just under $1 trillion spent in 2Q22, which set a record.

Quarter-wise, a record $281 billion was spent in 1Q22, followed by $219.6 billion and $210.8 billion in 2Q and 3Q, in that order (Chart 4). In post-Covid 2Q20, buybacks went sub-$100 billion at $88.7 billion.

Increasingly, buybacks have been taking a bigger slice of earnings. In 3Q22, the four-quarter total of buybacks accounted for 57.2 percent of $1.73 trillion in operating earnings.

Companies also spend a decent chunk in dividends. In 3Q22, $140.3 billion was spent for the purpose, down slightly from the record $140.6 billion spent in the prior quarter. In the four quarters to 3Q22, $552.4 billion went toward dividends – a record.

As big a sum as dividends comprise, managements will try not to tinker with this as best as they can. Post-Covid, dividend payment by S&P 500 companies dropped to $115.5 billion in 3Q20 from $127 billion in 1Q20, before regaining the upward momentum.

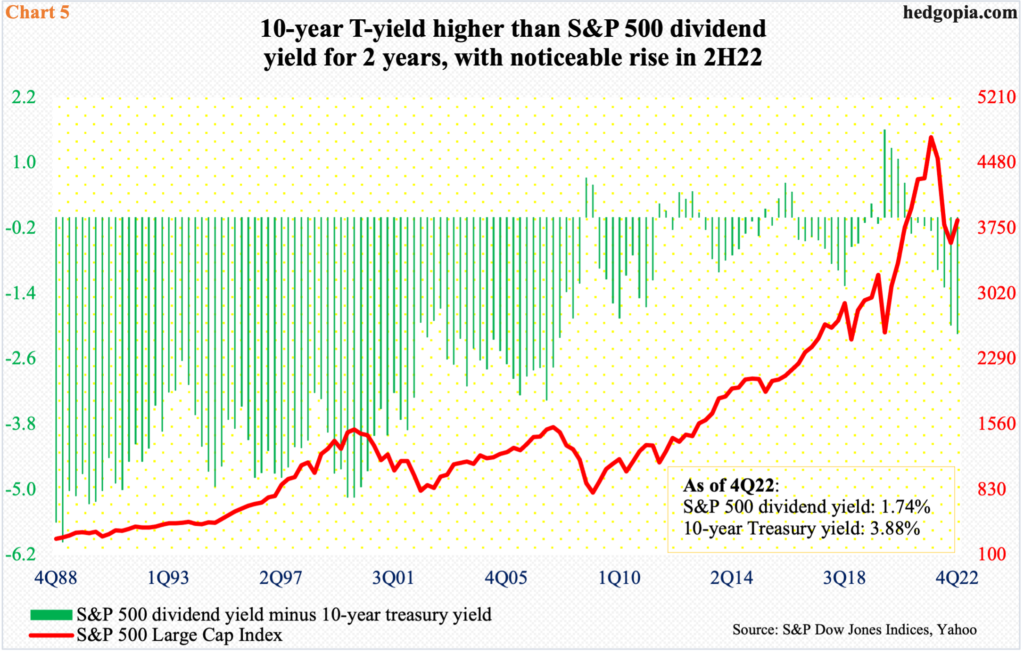

The irony is, even at this level of payout, the dividend yield remains sub-two percent. In an environment of rising rates, bond yields are more than competitive.

At the end of 2022, the S&P 500 dividend yield was 1.74 percent, even as 10-year treasury notes were yielding 3.88 percent. This was eight quarters in a row in which the spread between the two was in negative territory (Chart 5). Buybacks have been compensating for this to attract investors, but even here managements will probably try to reduce buybacks this year given the earnings dynamics that lie ahead.

Thanks for reading!