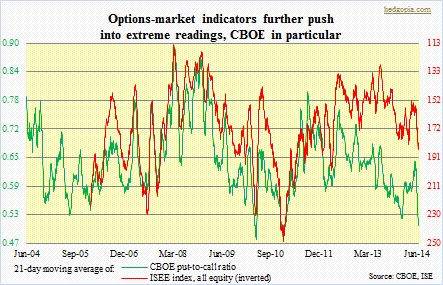

Options provide a reliable way to measure investor/trader sentiment. The accompanying chart uses two sources – the CBOE put-to-call ratio and the ISEE index, all equity. The former is currently flashing yellow/even red, the latter not quite so. In other words, the two are not quite in sync. The question then becomes, is the signal coming out of the CBOE put-to-call ratio genuine or noise? This is what we have at the moment. On both metrics, the 21-day moving average ticked up yesterday (CBOE was .509 on Wednesday) after a persistent decline for over a month (the ISEE index is inverted). It is too soon to say if this is the beginning of a rising trend, but in the past once these averages trough and hook up they have a tendency to maintain the momentum. Of the two, the ISEE index has room to go lower. Over at the CBOE, however, readings are extreme. Going back a decade, this is only the second time the average has gotten this low. Can it go lower? Some historical perspective is in order.

Options provide a reliable way to measure investor/trader sentiment. The accompanying chart uses two sources – the CBOE put-to-call ratio and the ISEE index, all equity. The former is currently flashing yellow/even red, the latter not quite so. In other words, the two are not quite in sync. The question then becomes, is the signal coming out of the CBOE put-to-call ratio genuine or noise? This is what we have at the moment. On both metrics, the 21-day moving average ticked up yesterday (CBOE was .509 on Wednesday) after a persistent decline for over a month (the ISEE index is inverted). It is too soon to say if this is the beginning of a rising trend, but in the past once these averages trough and hook up they have a tendency to maintain the momentum. Of the two, the ISEE index has room to go lower. Over at the CBOE, however, readings are extreme. Going back a decade, this is only the second time the average has gotten this low. Can it go lower? Some historical perspective is in order.

In 2010, by mid-April, the average (CBOE) had declined to levels similar to what we have now. As can be seen in the chart, a reading that low was anything but normal. Nevertheless, it kept going lower. Equities reacted to this by of course pushing still higher. The S&P 500 index from an intra-day low on the 12th of that month to the 26th added 33 points, peaking at 1220. The put-to-call ratio by the 28th had dropped to .478 before bottoming. Since that 26th peak, the S&P 500 index then went on to drop 17 percent in the next two months! No one is suggesting we are headed for a similar decline. Times are different. Issues are different. But one thing that is prevalent now and was back then is the level of investor complacency. The more a rubber band stretches, the more the potential of a violent snapback. The prevailing assumption is that low volatility is here to stay. Markets more often than not find ways to spring a surprise on us.

It is always possible that the ISEE ratio continues to come under pressure, even as the CBOE ratio approaches the 2010 lows. But the latter reading in particular is already so extreme that risk-reward from here on does not favor long calls/short puts, rather long puts/short calls.