After hiking 10 consecutive times totaling 500 basis points, the Jerome Powell-led Fed hinted at a pause on Wednesday. Markets are now pricing in three 25-basis-point cuts by year-end. Powell – focused on inflation – promptly dashed hopes for rate cuts. Odds favor he will be proven right unless the ongoing regional banking crisis morphs into something much more serious.

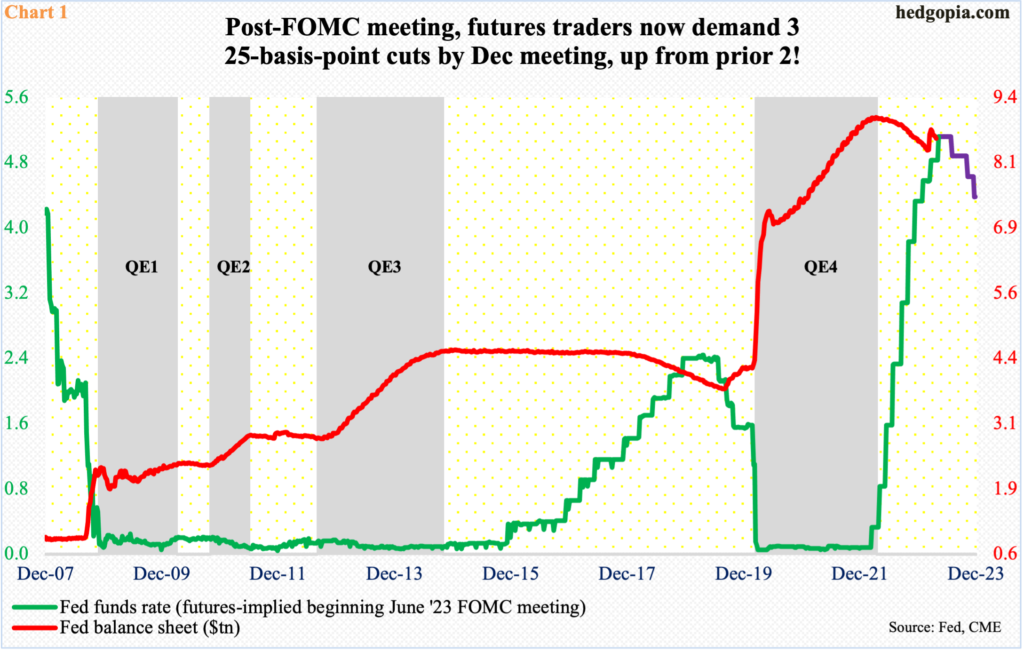

The FOMC delivered its 10th hike of the current tightening cycle, raising the fed funds rate by 25 basis points to a target range of 500 basis points to 525 basis points – the highest since August 2007. In March last year, the benchmark rates were languishing between zero and 25 basis points. The 500-basis-point hike came about in less than 14 months.

In the post-meeting press conference Wednesday, Federal Reserve Chair Jerome Powell was non-committal as to if this was the last hike. But the post-meeting statement made some changes in forward guidance hinting at one, putting emphasis on data dependency. The Fed will continue to reduce its holdings of treasury securities and mortgage-backed securities.

The tweak in language, in fact, emboldened futures traders to now expect three 25-basis-point cuts by year-end to a range of 425 basis points to 450 basis points (Chart 1). Going into the FOMC meeting, they expected the central bank to begin cutting in either September or November, followed by another 25-basis-point cut in December, ending 2023 at 450 basis points to 475 basis points.

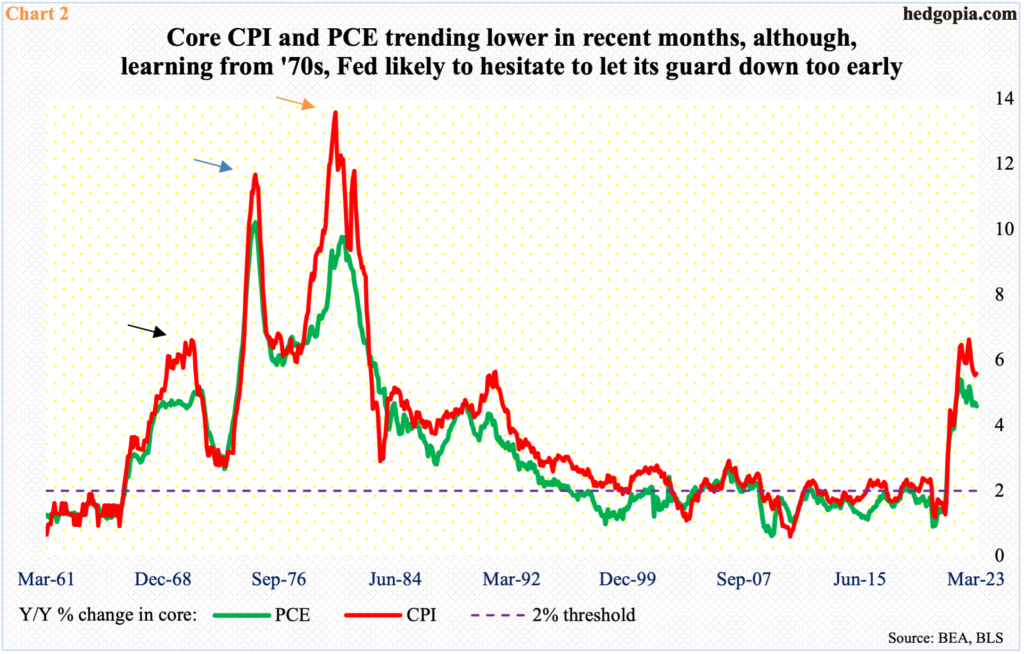

The upcoming CPI (consumer price index) and PCE (personal consumption expenditures) reports for April will be watched closely. They are due out on the 10th and 26th this month, in that order.

The trend is lower, although both metrics remain elevated. On a core basis, the CPI increased 5.6 percent and the PCE 4.6 percent in the 12 months to March. They respectively peaked last year at 6.6 percent in September and 5.4 percent in February.

In the ’70s, there were several instances in which inflation would begin to head lower but only to resurge and eclipse the previous highs (arrows in Chart 2). This is what makes the Fed wary of acquiescing the markets, which are now aggressively demanding rate cuts.

The ongoing regional banking crisis is the newest variable in this equation.

It has been nearly two months since Silicon Valley Bank experienced a deposit run and was seized by the regulators. Over the weekend, First Republic was acquired by JP Morgan (JPM). The market is looking for the next domino to fall.

Turns out PacWest Bancorp (PACW) is weighing strategic options, including a potential sale. Pre-open, Western Alliance Bancorporation (WAL), too, is under decent pressure, among others.

KRE (SPDR S&P Regional Banking ETF) acts like it is anticipating problems ahead. It reached an all-time high of $76.30 in January last year, with a lower high of $67.37 last August and $64.77 this February. Come March, it began to fall apart, slicing through the neckline of a head-and-shoulders pattern (Chart 3).

This was followed by seven weeks of sideways action just above $41, which gave way Tuesday. If the head-and-shoulders pattern completes, bears will be eyeing mid-$30s – at least. In this scenario, the incipient regional banking crisis will have morphed into much more serious, forcing the Fed to rethink about its resolve not to cut this year.

Else, depending on how inflation behaves, a pause can be just that – a pause. This is precisely what the Reserve Bank of Australia did this week, raising its benchmark rates by 25 basis points after taking a pause in the prior meeting. Ditto with Malaysia’s central bank which raised after leaving rates unchanged in two previous meetings.

Thanks for reading!