A new high was established in S&P 500 buybacks in 1Q. Unlike most of the time in the past, shares were bought at lower prices as the S&P 500 sold off during the quarter.

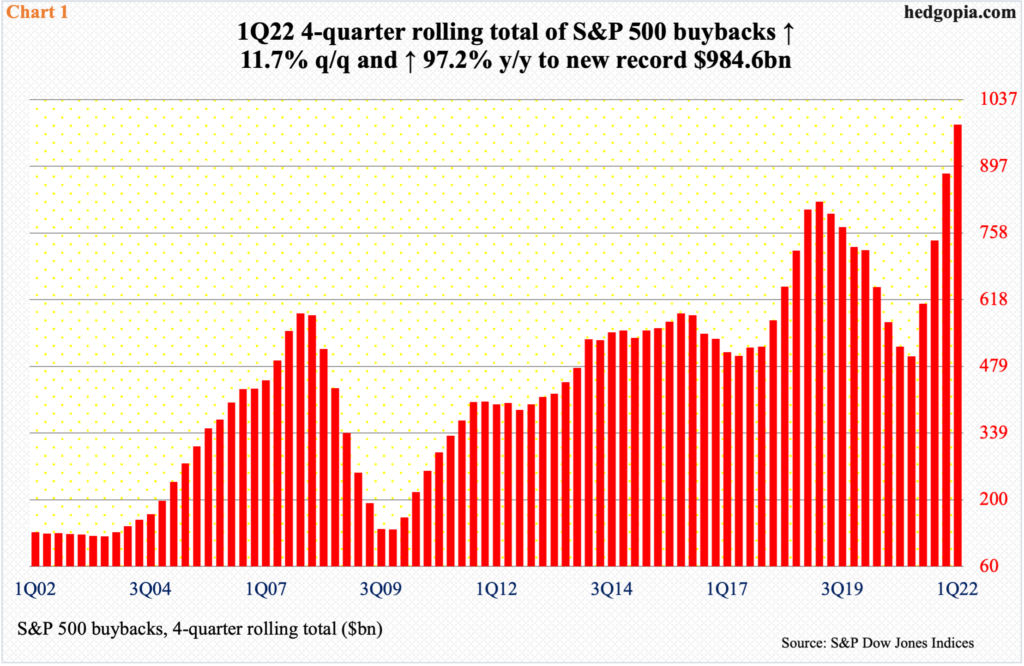

In the four quarters to March, US corporate buybacks set a record, as did dividends. S&P 500 companies splurged $984.6 billion in purchasing their own stock, $281 billion of which – also a record – was spent in 1Q22. They also distributed record $137.6 billion in dividends last quarter, for a four-quarter total of $524.9 trillion – also a record.

Since going sub-$100 billion in 2Q20 at $88.7 billion, thanks to Covid-19, buybacks have risen sequentially every single quarter. On a four-quarter basis, buybacks were $499.2 billion in 1Q21, before nearly doubling through 1Q22 (Chart 1).

In 1Q, the market cap of S&P 500 companies decreased 5.1 percent quarter-over-quarter to $38.3 trillion. Falling stock prices and record buybacks helped 17.6 percent of these companies reduce their share count enough to see a rise in earnings per share by at least four percent; in 1Q21, only 5.8 percent did so.

The buyback momentum likely continued in the current quarter. With six sessions to go before the quarter is out, the S&P 500 is down another 17.1 percent in 2Q. This should nicely help lower the share count.

Last quarter was the first time in eight quarters these companies were buying back when share prices were dropping. For the majority of the time, buybacks happen when prices are rising.

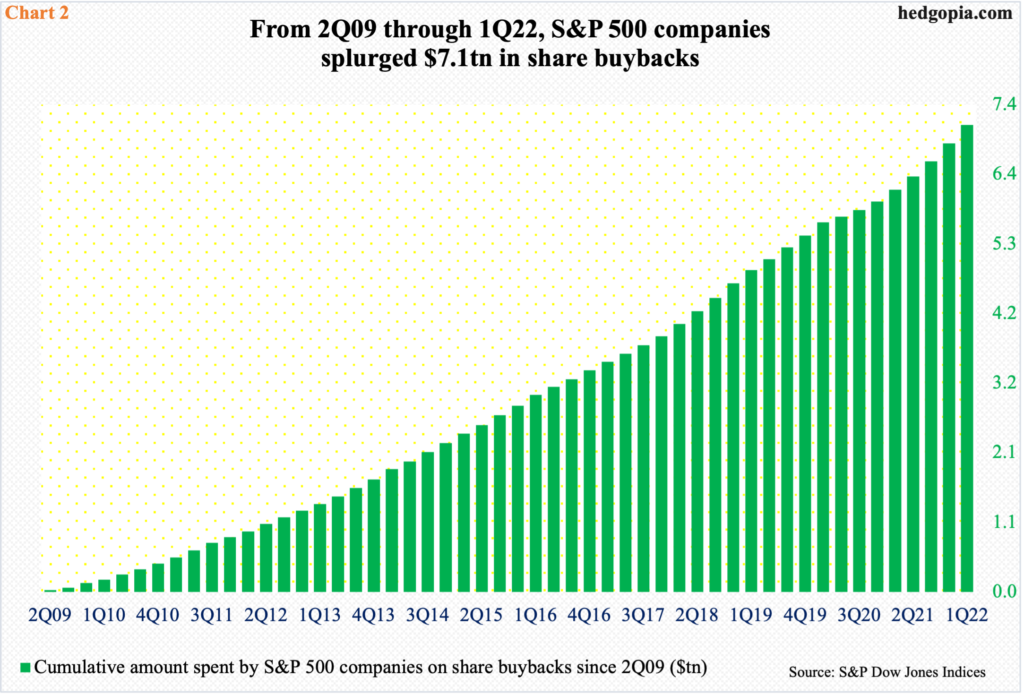

Buybacks began trending higher in 2009. Back then, US recession ended in June and the stock market bottomed in March. In 2Q that year, buybacks by S&P 500 companies languished at $24.2 billion, having earlier peaked at $172 billion in 3Q07. After that low, buybacks gradually rose and picked up momentum in the last several quarters.

From 2Q09 through 1Q22, S&P 500 companies spent a whopping $7.1 trillion in buybacks (Chart 2). It is always arguable if this is the right use of shareholder capital, but it is what it is. If there is any good to the downward pressure the S&P 500 has come under this year, it is that shares are being bought at a lower price.

Thanks for reading!