Foreigners seem to be heavily wagering that the US is headed for a recession. They have been selling US stocks and buying treasury notes/bonds with aggression.

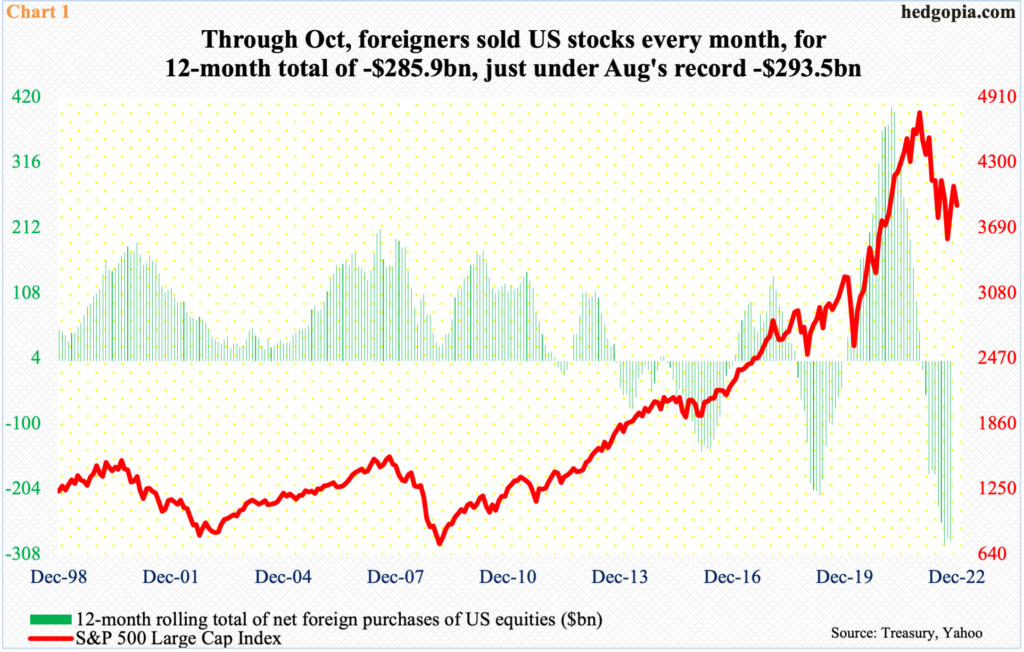

On a net basis in October, foreigners sold $24.4 billion in US stocks. Since 2022 began, they have been selling every month, for a 12-month total of minus $285.9 billion in October, which is just a tad lower than August’s record minus $293.5 billion (Chart 1).

It is too soon to say if August will end up being the peak selling. This data series comes with a little lag, as October’s was reported on Thursday, so it is always possible November will change this. But in any case, foreigners’ purchases – or a lack thereof – are worth paying attention to. If past is prelude, the green histograms and the red line in the chart march together – give and take.

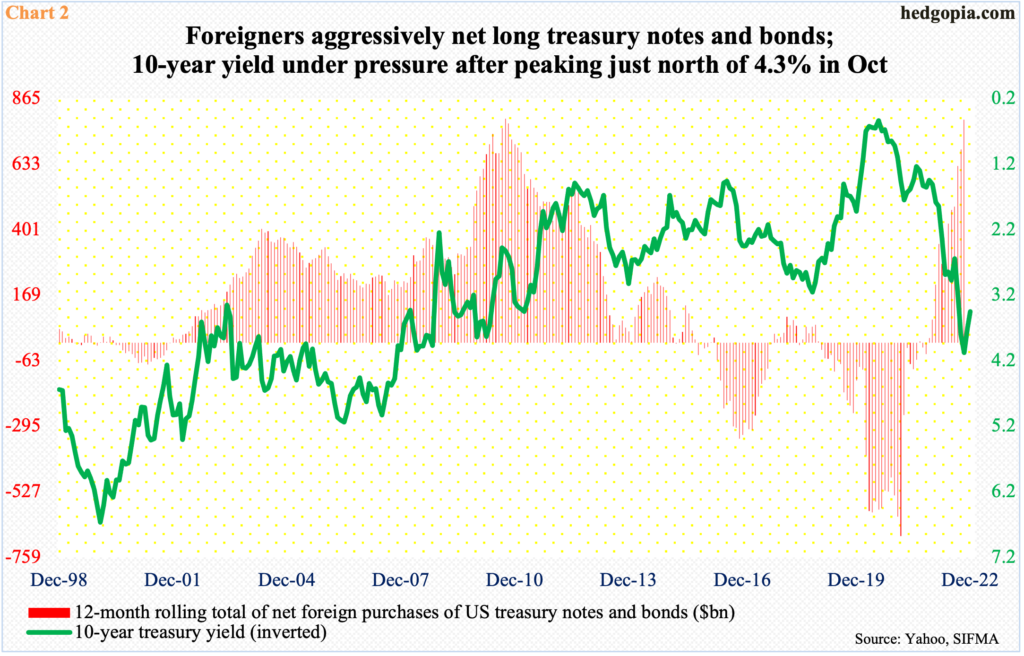

Concurrently, they have also been actively buying up treasury notes and bonds. In October, they purchased $61.9 billion worth, for a 12-month total of $790.1 billion – the second highest total after the record total of $793.3 billion posted in September 2010 (Chart 2).

In fixed income, yields are inversely related to the price. For these foreigners to make money, rates have to be coming under pressure, which is beginning to happen.

The 10-year, which is inverted in the chart, yielded 0.40 percent in March 2020. Rates then gradually persisted high. Since early August this year in particular, the 10-year went up in pretty much a straight line, as the Fed began to aggressively raise rates on the short end. By October 21st, the 10-year ticked 4.33 percent intraday before heading lower.

Longer-term, the 10-year has a long way to go on the downside on the monthly.

Foreigners seem to be paying close attention to Jerome Powell, Federal Reserve chair.

This Wednesday, the FOMC raised the fed funds rate by 50 basis points, which was a step-down from four consecutive 75-basis-point hikes. The benchmark rates currently stand at a target range of 425 basis points to 450 basis points. The dot plot projected rates would peak next year at 5.1 percent. Futures traders, on the other hand, continue to forecast a terminal rate of south of five percent in the early months of 2023 and for the Fed to begin cutting in November.

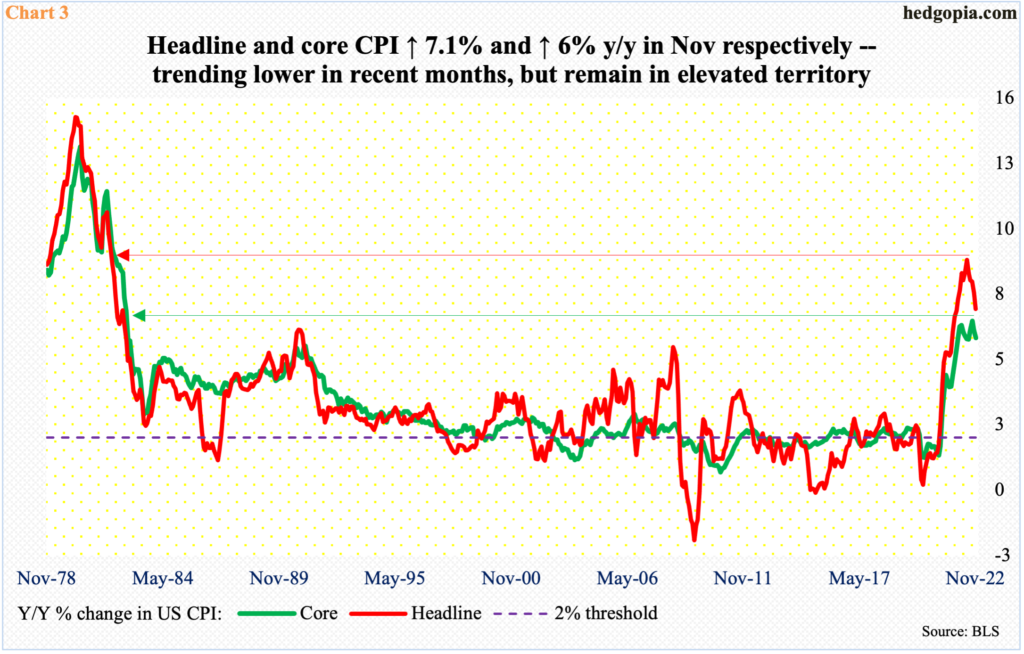

In the post-meeting presser this week, Powell was crystal clear there will be no rate cuts next year. “Historical experience cautions strongly against prematurely loosening policy. I wouldn’t see us considering rate cuts until the committee is confident that inflation is moving down to two percent in a sustainable way.”

That is a long way from here.

On Tuesday, headline and core CPI in the 12 months to November came in at 7.1 percent and six percent, with the former peaking at 9.1 percent in June and the latter at 6.6 percent in September – the highest since November 1981 and August 1982 respectively (Chart 3).

Either way we look at it, inflation remains elevated. Foreigners seem to be betting – probably rightly – that more restrictive rate hikes decrease the likelihood of a soft landing, and have positioned themselves accordingly.

Thanks for reading!