Foreigners purchased US stocks in November and December, but the 12-month total continued lower. The series comes with a lag, so it is hard to tell if they bought January’s low, particularly because the Investors Intelligence bulls-to-bear ratio this week hit the lowest since April 2020.

Foreigners, who had otherwise been reducing exposure, showed some love for US stocks in November and December, purchasing $7.2 billion and $30.5 billion worth respectively.

In the 12 months to December, their purchases were $46.7 billion. The 12-month trend is on a downward spiral, having peaked at record $405.5 billion last March and dropping each month after that (Chart 1).

This data series comes with a little lag, as December’s numbers were released Tuesday. This obviously does not capture what occurred in January, for stocks took a hit last month. From its record intraday high posted on the 4th through the low on the 24th, the S&P 500 corrected 12.4 percent, although by the time the month was over the large cap index had rallied substantially off that low.

We will have to wait one more month before we find out if foreigners bought more last month. taking advantage of the selloff.

What we do know is that the red line and the green histograms in Chart 1 diverged for most of last year.

January’s selloff also caused equity bulls to pull in their horns.

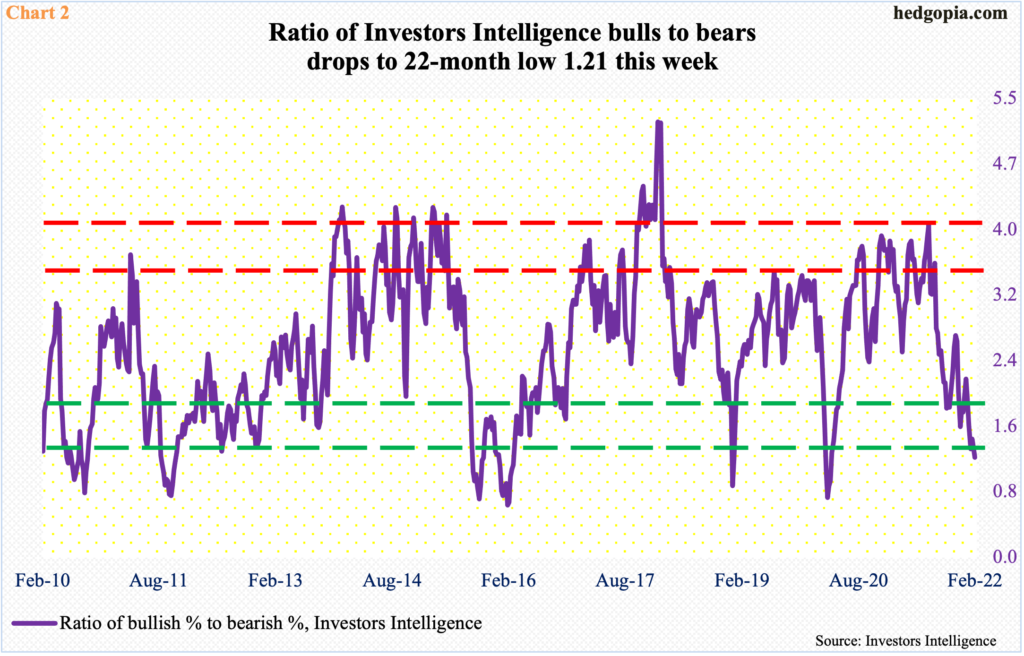

In the week to January 4, Investors Intelligence bulls were 50.6 percent. The S&P 500 peaked in that very session at 4819. By the 24th, the large cap index was down to 4223; by the week to January 25, bulls’ count had shrunk to 34.9 percent, with bears at 26.7 percent. The index (4475) is more than 250 points from that low, but sentiment continues to weaken. This week, bulls were 33.7 percent and bears 27.9 percent. The resulting ratio of 1.21 is the lowest since April 2020.

Back then, after remaining in the negative territory for 15 consecutive months, foreigners’ 12-month total turned positive in December with a minuscule $504 million. They continued to buy, even in February and March that year when US stocks were taken to the woodshed. Their conviction paid off as the S&P 500 took out the February 2020 record high in August. By March 2021, purchases made a new high, before the green histograms in Chart 1 headed lower.

In March 2020, the bulls-to-bears ratio dropped as low as 0.72. Hindsight is always 20/20, but we now know major equity indices were in the process of making major lows back then. The ratio has not gotten that low yet but is low – and oversold – enough to potentially trigger some buying (Chart 2).

Once again, it will be interesting to find out if foreigners thought last month’s low was worth buying. As Chart 2 shows, once foreigners reverse course, they tend to stay with it for a while.

Thanks for reading!