Foreigners kept selling US stocks in May, but their pace of selling substantially moderated in April and May. Bulls hope this is the beginning of a trend, as foreign buying – or a lack thereof – historically moves hand in hand with US stocks.

May was a rough month for US equities. The S&P 500 large cap index (3004.04) dropped 6.6 percent. Foreigners did not play a significant role in this. They only sold $1.4 billion in US stocks. Before that in April, they sold $964 million worth. This is a substantial improvement from prior months when selling was heavy.

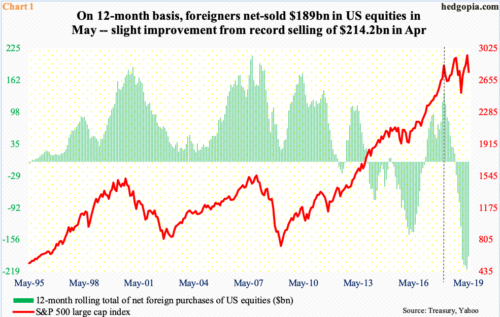

May was the 13th consecutive month – and 15th out of 16 – of selling. In the 12 months to May, net selling totaled $189 billion, which was a slight improvement from April when a record $214.2 billion worth was sold. Bulls hope the relative improvement in April and May is a sign of things to come.

In general, foreigners’ activity tends to move in tandem with the S&P 500. In January last year, they were buying as much as $135.6 billion worth before heading lower (vertical dashed line in Chart 1). That was when the S&P 500 peaked. After a quick double-digit decline, it bottomed the next month, but foreigners kept reducing exposure to US stocks. The index reached another high in September, as they switched from net buying to net selling.

Hence the significance of the improving trend in buying – or less selling – seen in April and May. If past is prologue and the green bars, which are currently in the minus column, keep getting shorter, the S&P 500 likely gets a tailwind. In fact, this may have already happened. This data series is published with a relatively longer lag. May’s numbers were published Tuesday. The S&P 500 already rallied huge in June and July. Between the low of June 3 through the high of July 15, it jumped 10.6 percent intraday.

The index began July with a break out of 2950s-60s and went on to post a new intraday high of 3017.80 this Monday (Chart 2). Conditions are extended – the daily in particular, with the weekly getting there as well. In the sessions/weeks ahead, bulls will be on pins and needles as to if foreigners, who missed the rally since last December, step up near important support – not so much 2950-60s but around 2900 and 2800. The latter also approximates the 200-day moving average.

Thanks for reading!