Foreigners purchased more U.S. stocks in February. On the 19th that month, the S&P 500 peaked, before unraveling in March. How foreigners behaved in March therefore will be a tell. Should they turn defensive, this will have come at a time when several other metrics are turning into headwinds.

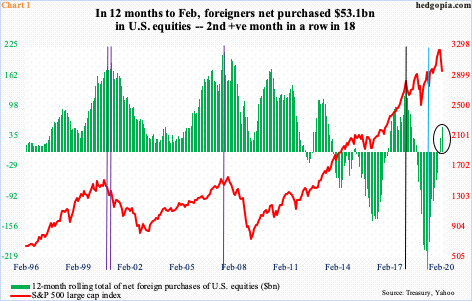

Foreigners continued to show love for U.S. stocks in February. This was the fourth month in a row – and seven out of nine – that net purchases were positive. As a result, the 12-month total came in at $53.1 billion (Chart 1).

Importantly, February was a month in which major U.S. stock indices peaked, with the S&P 500 large cap index reaching an intraday high of 3393.52 on the 19th before retreating. By the end of the month, the index dropped 15.8 percent.

From this perspective, the $11.5 billion foreigners spent in acquiring U.S. stocks in February is interesting. But more important will be March data, as stocks genuinely rolled over in that month before bottoming in the fourth week (Chart 2).

By the 23rd, the S&P 500 intraday was down 25.8 percent in March. It will be interesting to watch if foreigners used that as an opportunity to load up. From that low through the end of the month, the index then rallied 17.8 percent – and 30.1 percent through this Tuesday’s high.

Historically, foreigners’ activity tends to move in tandem with stocks. This occurred during major peaks in stocks in both 2000 and 2007 (violet vertical lines in Chart 1). There was a little bit of divergence beginning January 2018 when foreigners began cutting their exposure (black vertical line). The S&P 500 did retreat back then, but subsequently went on to post newer highs. Foreigners, on the other hand, kept playing defense, until April last year when the 12-month total reached minus $214.6 billion – a record (blue vertical line). Since then, they have been on the right side of trade. How they behaved in March therefore will be telling. Should they turn defensive, this will have come at a time when FINRA margin debt is under pressure, corporate buybacks are set to substantially weaken and money-market assets continue to swell. The only thing is that this data comes with a lag. February’s data was just published. So, it will be another month before March numbers come out.

Thanks for reading!