Foreigners continue to wax enthusiastic about US equities. For their optimism, they have been rewarded handsomely. Although the Treasury publishes the related data with a lag, foreigners’ behavior is worth a close watch, as prior major peaks have coincided with them pulling back their horns.

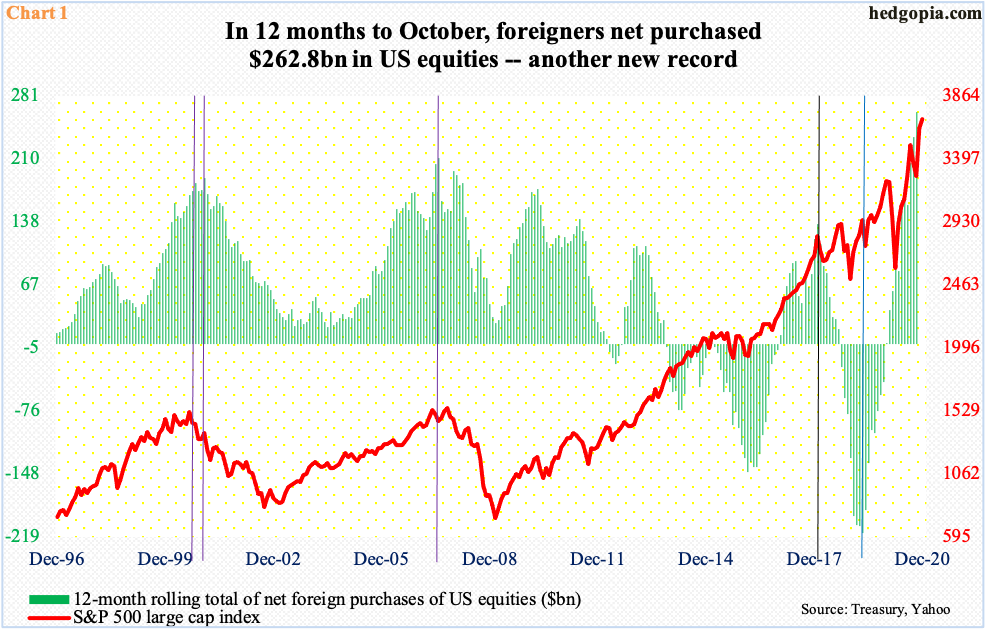

Historically, foreign buying of US stocks – or a lack thereof – went hand in hand with the S&P 500. In both 2000 and 2007, the two turned down together (violet vertical lines in Chart 1).

In January 2018, the 12-month rolling total of foreign purchases retreated from $135.6 billion (black vertical line); the large cap index pulled back in February and March before the uptrend reasserted itself, but foreigners kept selling. Come December that year, the S&P 500 experienced a deeper sell-off, but it was not until the following April (2019) that the green bars bottomed – at record selling of $214.6 billion (blue vertical line).

Most recently, foreigners maintained their optimism even during the mini collapse in US stocks during February and March this year. This was rather used as an opportunity to add. After bottoming in March, the S&P 500 went on to post new highs.

Again, in September and October, the index came under pressure, down a cumulative 6.6 percent. And again, foreigners were buying in those months. In October, they bought $24.1 billion worth, and $38.2 billion worth before that in September.

Overall, in the 12 months to October, $262.8 billion worth was purchased – a new record. Once again, they have been rewarded. The S&P 500 shot up 10.8 percent in November and is up another two percent mid-way through December.

Regardless which is cause and which is effect, given how the two variables move together, foreigners’ behavior is worth a close watch. The thing is, this data is published with a decent lag. October’s numbers only came out on Tuesday afternoon. Simplistically, based on how November – and December-to-date – have performed, foreigners in all probability are still in it. That said, historically, they also tend to be late-cycle, which once again raises the significance of when they turn.

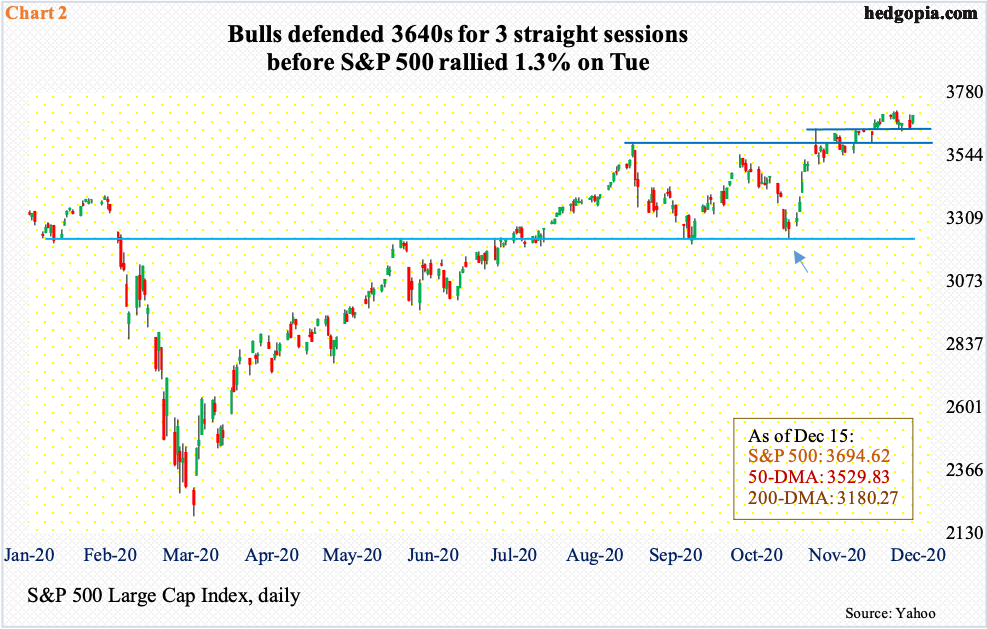

Turn they will, it is just a matter of time. Right here and now, amidst subtle signs of fatigue here and there, bulls are clinging on to the prevailing upward momentum. Intraday, from October 30 when the S&P 500 bottomed at 3233.94 (arrow in Chart 2) through a new record high of 3712.39 last Wednesday, it rallied just under 15 percent.

In this regard, 3580s and 3640s are proving to be important, with the former the prior high from September 2 and the latter another high from November 9 when Pfizer announced its positive vaccine news. After sustaining a little bit of a sell-off for four sessions since the fresh high five sessions ago, bulls defended 3640s for three sessions in a row before the index rallied 1.3 percent on Tuesday, within a striking distance of last Wednesday’s high.

As things stand, 3640s is the one to watch, and 3580s after that.

Thanks for reading!