Foreigners opted not to take advantage of the selloff in US stocks in August. The S&P 500 large cap index dropped 1.8 percent in the month. As a matter of fact, it was down as much as 5.3 percent at one point, before bulls defended support just north of 2800.

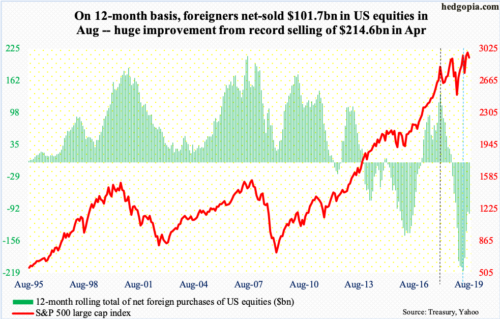

After net purchases totaling $50.6 billion in June and July, foreigners went back to selling $21 billion worth of US stocks in August. This brought the 12-month total of net selling to $101.7 billion, up from $97.7 billion in July.

That said, the pace of selling has subsided significantly since peaking in April. The 12-month total reached minus $214.6 billion in that month – a record (blue vertical dashed line in chart below).

Historically, foreign purchases – or a lack thereof – has coincided with how the S&P 500 performs. In the 12 months to January last year, they were buying $135.6 billion worth (black vertical dashed line). That is when the index suffered a quick, two-week selloff. The S&P 500 then went on to rally to new – and newer – highs, but foreigners kept reducing exposure to US stocks. That was until April this year, raising hopes that a sentiment shift was occurring. Hence the significance of how they behaved in August.

In both June and July, the S&P 500 was up. As explained earlier, foreigners were net buyers in those two months. If sentiment shift was occurring in earnest, one can argue they would have taken advantage of the selloff in August. Particularly when 2800 was successfully tested early that month. Going back to March last year, this price point has proven to be important.

The unwillingness on the part of foreigners to treat the August selloff as a buying opportunity neutralizes their June-July purchases. This data series comes with a lag. September’s data – out in a month – will add further color as to which way the trend is headed.

Thanks for reading!