On Monday, the Russell 2000 busted through 1250s. This has been an important price point going back five years. Despite lofty earnings expectations for both this year and next, this week’s action is a thumbs-up from markets. As long as the price stays above this level, bulls deserve the benefit of the doubt.

Suddenly, small-caps are walking with a spring in their step.

Monday, the Russell 2000 small cap index (1298.08) powerfully broke out of what has otherwise been a strong ceiling for over two weeks. Going back five years, 1250s has proven to be an important price point for both bulls and bears. Bulls lost this support last month – seven weeks ago. They, however, went on to defend 950s-60s later that month. The rally that followed first stopped at 1170s-80s and then 1250s. At 1246 also lies 38.2-percent Fibonacci retracement of the February-March collapse. The breakout thus has potential to be significant.

Following Monday’s breakout, bulls rallied the Russell 2000 to 1316.71 intraday Tuesday, although they were unable to hang on to all the gains, in the end resulting in a long-legged doji (Chart 1). Plus, at 1333 it would have retraced half of the February-March decline. The daily is extended, so it can always pause here. But, as long as the price remains above 1250s, bulls deserve the benefit of the doubt. Markets, as with everything else in life, are not always right, but right here and now they have spoken, and should be respected.

At the same time, a couple of things need consideration.

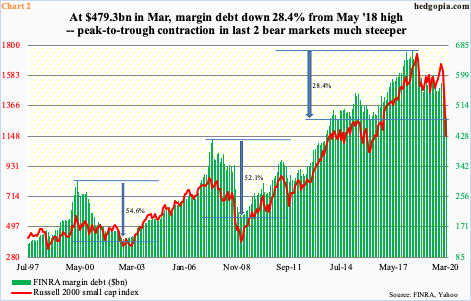

In March, FINRA margin debt tumbled $65.8 billion month-over-month to $479.3 billion. Stocks really took it on the chin that month. The Russell 2000 dropped 21.9 percent and was down as much as 34.6 percent at one time.

In general, margin debt moves hand in hand with stocks. This time around, it is marching more in step with small-caps than large-caps. The Russell 2000 peaked as far back as August 2018, while the S&P 500 did so this February. Margin debt peaked in May 2018 at $668.9 billion.

Here is the thing. In the last two bear markets, from peak to trough, margin debt dropped over 50 percent. This time around, the drop has been to the tune of 28.4 percent. April’s data will not be out for another month, but since all the major indices have done very well this month, it is possible margin debt saw an uptick as well.

If in due course margin debt follows history, it has lower to go still, and stocks in all likelihood will follow.

Then, there is the issue of earnings.

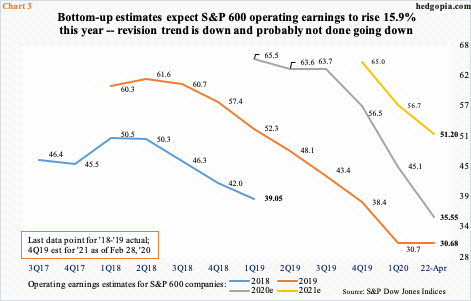

This year, the sell-side expects S&P 600 earnings to grow 15.9 percent to $35.55. Given a hit the economy is taking this year thanks to the coronavirus, it is hard to swallow this optimism. In both large- and mid-caps, bottom-up estimates expect a down year this year, with S&P 500 and 400 companies expected to earn 13.6 percent and 12.4 percent less than they earned last year, in that order. In all probability, even this looks optimistic.

The sell-side does tend to be optimistic as it rolls out its estimates, and gradually lowers them as the year progresses. This is evident in how the revision trend progressed in 2018 and 2019 (Chart 3). As a matter of fact, to date, 2020, as well as 2021, is not immune to this trend. As recently as October last year, these analysts expected $66.86 for this year! It has now been nearly cut in half. They are probably not done lowering their numbers.

In this scenario, either the bulls are writing off 2020 and hoping 2021 comes through – which again looks unrealistically elevated – or reality will sink in sooner than later. If so, the bulls are not out of the woods, hence the significance of 1250s. What happens there will be a tell.

Thanks for reading!