- Last six years, U.S. high-yield bond issuance of $1.6tn

- This week, several Fed officials signal imminent rate hike this year

- Junk bonds – popular risk-on vehicle – not likely to take kindly to end of ZIRP

A week ago, HYG, the iShares corporate bond fund, surged 0.9 percent. That was when the FOMC delivered a much more dovish message than expected. If junk bonds can rally on a dovish message from the Fed, it is logical to conclude that they will probably do the opposite when that message does a 360.

Based on what the FOMC told us last week, it is hard to imagine a scenario in which they will move in June, or even later this year. Nonetheless, it does not hurt to look at it as a what-if scenario, and try to figure out what might lie ahead. Just in case.

Just this week, we have so far had four Fed officials doing their best to prepare the markets for a rate hike this year.

Stanley Fischer, Fed vice-chair, spoke before the Economic Club of New York on Monday. Here is a quote from the speech: “An increase in the target federal funds range likely will be warranted before the end of the year.”

In an interview with Bloomberg TV on Monday, Loretta Mester, president of the Cleveland Fed, said: “It would be appropriate to raise interest rates sometime this year.”

James Bullard, president of the St. Louis Fed, said in a CNBC interview Monday that the Fed’s removal of the word ‘patient’ was a good move and a hike could come as early as June.

In remarks prepared for delivery to Australian Business Economists yesterday, John Williams, San Francisco Fed president, said: “I think that by mid-year it will be the time to have a serious discussion about starting to raise rates.” He thinks the Fed should move despite the strengthening dollar.

Hence the question, what could a tighter monetary policy mean to junk bonds in particular?

First, some background.

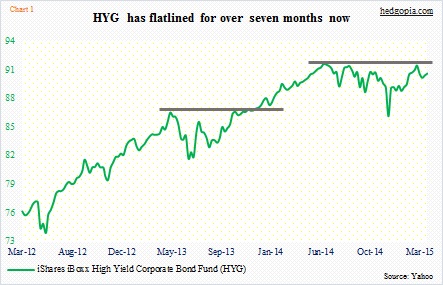

On May 22, 2013, the Fed said it would begin tapering its $85 billion/month purchases of bonds and mortgage-backed securities. Markets panicked. In eight weeks between early May and late June, HYG dropped just under eight percent. Soon the Fed softened its language. HYG responded by getting back on its rally mode, until it peaked in June last year (Chart 1). It has since pretty much gone sideways, in keeping with mixed messages from the Fed and corresponding market reactions.

Junk bonds have had quite a ride. Since November 2008 (the start of QE1) until recently, HYG is up 135 percent.

The rock-bottom interest-rate environment has meant these risky companies can refinance their debt at low rates while at the same time also benefiting from economic expansion.

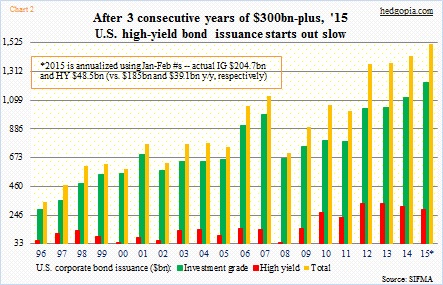

The U.S. junk market has ballooned to $1.3 trillion. In each of the past three years, U.S. high-yield bond issuance exceeded $300 billion (red bars in Chart 2). Since 2009, issuance has totaled $1.6 trillion! In January and February this year, issuance was tracking sub-$300 billion (not surprising given what is transpiring in energy), but remains strong. Total corporate bond issuance is on track for another record year.

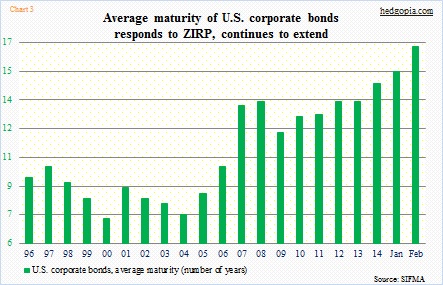

The good thing is, corporations have used ZIRP (zero interest-rate policy) as an opportunity to extend maturities. In February, the average maturity of U.S. corporate bonds stood at 16.8 years (Chart 3). This includes both investment-grade and high-yield.

HYG’s weighted average maturity is six years, similar to that of JNK (SPDR Barclays High Yield Bond ETF).

Over the years, both these ETFs have been a popular risk-on vehicle. HYG has $16 billion in assets, JNK $11 billion. Of late, there have been some outflows from mutual funds buying this debt. But not a whole lot.

Yield spreads between Moody’s Baa corporate bonds and 10-year Treasury notes have inched up since July last year, but nothing major (Chart 4).

If rates really begin to rise this year – not a base case – these ETFs will for sure have their share of pain. Of course, this may not even be an issue should rates continue to linger near zero. But just in case the Fed gets an itchy hand, unexpected things can happen.