Foreigners comprise an important source of buying in the US sovereign and corporate bond markets. In March and April, they bought some corporate bonds but massively sold off Treasury notes and bonds. The vacuum was filled by the Fed, whose tentacles are spreading ever wider.

The Federal Reserve continues to broaden its horizon.

On March 23rd, it established what is called the Secondary Market Corporate Credit Facility, under which it would buy corporate bonds issued by US companies that were investment grade as of March 22nd. This was later expanded to include junk bonds. Until Monday, it had been buying ETFs such as LQD (iShares iBoxx investment grade corporate bond ETF), HYG (iShares iBoxx high yield corporate bond ETF) and JNK (SPDR Barclays high yield bond ETF). Yesterday, it announced it would begin buying a portfolio of corporate bonds in the secondary market.

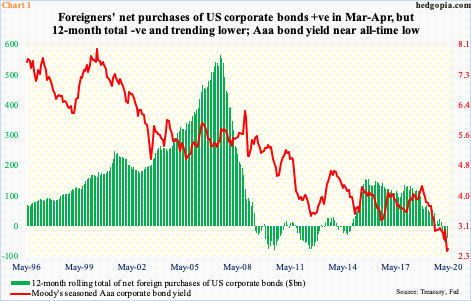

All these three ETFs have rallied massively since their March bottom. Even though the original announcement was made in March, it was only a month ago that the Fed actually began buying ETFs holding corporate bonds. For nimble traders, this offered an opportunity to front-run the Fed. The ETFs above have attracted billions in inflows. Ditto with foreigners, who purchased $3.2 billion worth of corporate bonds in March and another $10.9 billion worth in April. This preceded three consecutive months of net selling totaling $70.8 billion.

That said, foreigners are yet to turn into net buyers. In the 12 months to April, they sold $37.3 billion worth, down from minus $53.2 billion in March (Chart 1). The lack of foreign participation has not mattered much as the Fed has essentially backstopped this market. On Abril 14th, Moody’s Aaa corporate bond yield dropped to an all-time low of 2.23 percent. Last Friday, it closed at 2.42 percent. The US economy is in a recession.

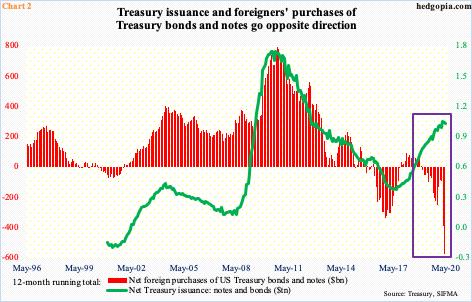

Foreigners, however, are aggressively getting out of the sovereign.

In the 12 months to April, they sold $573.5 billion in Treasury notes and bonds – a record. Selling picked up in March and April, as they sold $475.6 billion worth in those two months alone.

On a 12-month basis, the red bars in Chart 2 entered the minus column in January last year. This was a time when Treasury notes and bonds were being issued at an accelerating pace. From a low of $335.1 billion on a 12-month basis in July 2017, Treasury issuance reached $1.01 trillion this March, with May at $992.9 billion. Given the persistently increasing federal deficit, issuance in all probability is headed higher. Historically, foreign buying kept pace with Treasury issuance. This time around, they have diverged (box).

In any other time, the lack of a buyer of this size would have mattered, but not this time. On March 9th, the 10-year Treasury yield intraday posted an all-time low of 0.4 percent. Monday, rates closed at 0.7 percent. It has been under one percent since March 23rd. Once again, the Fed is the savior.

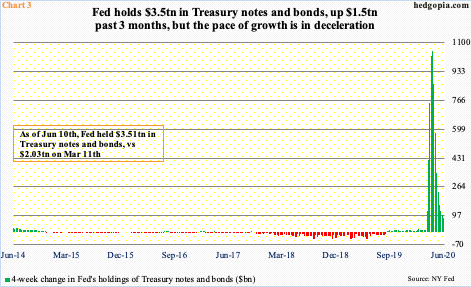

Its balance sheet has grown to $7.17 trillion, up $2.9 trillion the past three months. Holdings of Treasury notes and bonds have gone up by $1.48 trillion during the period to $3.51 trillion. Two months ago, the central bank was accumulating these assets at a four-week pace of $1.05 trillion, which softened to $84.2 billion last week (Chart 3).

Logically, this cannot continue. The Fed will have to find a way to accelerate the pace of buying. Otherwise, with foreigners stepping out of the way, there will be a vacuum left in the market, which will then translate to upward pressure on the long end of the yield curve. This is not something a heavily levered economy will take kindly to.

Thanks for reading!