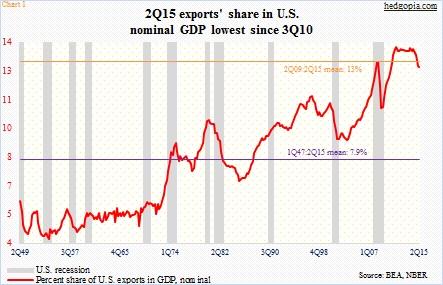

U.S. exports have been under pressure since they peaked at a seasonally adjusted annual rate of $2.36 trillion in 3Q14; 2Q15 was $2.28 trillion. As a percent of nominal GDP, exports’ share in 2Q15 was a full percentage point lower than 13.7 percent in 4Q13 (Chart 1).

If we focus on the long-term average, exports currently make up a much bigger share of the GDP versus 7.9 percent going back to 1Q47. In the current recovery, however, the share is 13 percent. Both the first and second quarters this year have been below that – 12.8 percent and 12.7 percent, respectively.

It is a weakening trend, and it can be seen in Chart 1. The drop in the red line does not have a good look to it. In the past, severe pressure on exports has been accompanied by contraction in the economy. So far, that has not been the case.

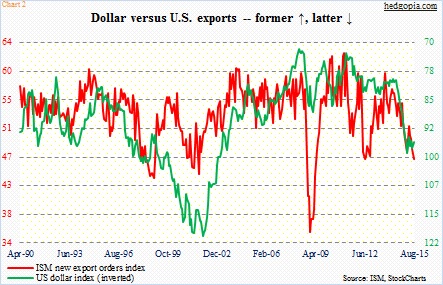

The dollar is the main culprit. The correlation between the U.S. dollar index and the ISM new exports index can be seen in Chart 2. The dollar index bottomed in April 2008, but a major spike began in July last year, rallying 26 percent in the next nine months. The ISM exports index dropped from 57 in March last year to 46.5 this August.

Of course, it is not fair to blame it all on the dollar. The global economy is fragile – reflected on weak PMI readings. In August, China (official) came in at 49.7, South Korea at 47.9, Japan at 51.7, and Taiwan at 46.1. These are all economies heavily reliant on exports. Germany, the European exports power house, was 53.3.

Hence the risk. As each country/region tries to indulge in competitive devaluation and use the currency as a tool, the greenback runs a risk of coming under upward pressure. Yesterday, Mario Draghi, ECB president, downgraded growth and inflation forecasts for the Eurozone and promised more QE if necessary. This probably forces Japan to do more. And China just recently devalued its yuan.

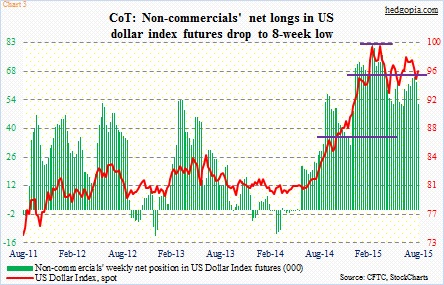

At least until Tuesday last week, non-commercials were not buying into this scenario, as net longs in US dollar index futures were at an eight-week low (Chart 3). Next week’s holdings will give us some clues. This week’s will be reported later today, but will contain holdings as of Tuesday. So we will have to wait until next week to learn these traders’ reaction to Mr. Draghi’s dovish comments yesterday.

The immediate reaction in the currency market yesterday was predictable. The euro was slammed hard, down 0.9 percent; the dollar index was bid up 0.6 percent. Since it peaked in the middle of March, the dollar index has been making lower highs. At the same time, dollar bulls have consistently defended the 93 level (Chart 4). It is also between the 50- and 200-day moving averages. A break – either direction – can be a big tell. U.S. exporters sure hope it is to the downside.

Thanks for reading!