The mid-May short interest was out yesterday, and some subtle shift in sentiment was noticeable.

First off, in the aggregate, short interest rose.

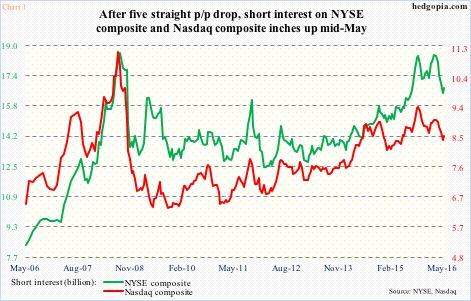

In fact, on both the NYSE composite and the Nasdaq composite, this was the first period-over-period increase since the February 12th period. That was three months ago. Short interest stood at 18.5 billion and 9.1 billion back then, and declined 11.2 percent and seven percent respectively in the next five periods (Chart 1). That was a big tailwind for stocks. (Stocks in general bottomed on February 11th back then.)

Second, mid-May short interest stood at 16.7 billion on the NYSE and 8.6 billion on the Nasdaq, nowhere near when stocks bottomed in February. Stocks on Tuesday staged a mini-breakout after nearly three weeks of sideways move. Both the Nasdaq composite and the Russell 2000 retook both 50- and 200-day moving averages, and the S&P 500 its 50-day. That said, given where short interest stands, it is hard to imagine a similar squeeze unfolding as was witnessed three months ago.

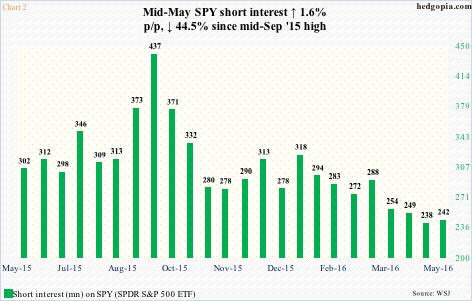

Take SPY, the SPDR S&P 500 ETF, for example. Short interest inched up in the latest period, but the prior period was the lowest since the end of March last year (Chart 2).

Incidentally, SPY was down 0.8 percent during the April 29-May 13 period. At the time, technically, it looked like it was looking to go down more, and it did, bottoming on May 19th. In this respect, shorts read the tea leaves right as they increased short interest by 1.6 percent. Since that low through yesterday, the ETF has rallied 2.5 percent. This has probably caused a squeeze, particularly yesterday. And once again, this further reduces the potential pool of fuel for squeeze.

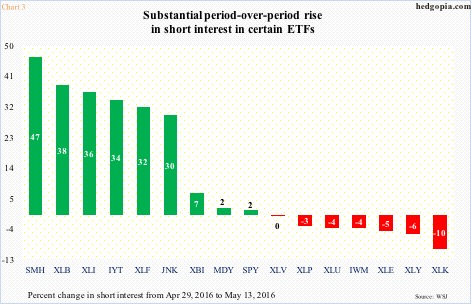

Third, on some ETFs, this fuel has had massive surge right before the underlying began to rally (Chart 3).

SMH, the VanEck Vectors semiconductor ETF, saw a 47-percent p/p jump in short interest to 14.8 million – the highest since 15.8 million in the February 12th period. Back then, it went on to rally north of 23 percent in the next couple of months. This time around, off the May 12th low the ETF has already rallied nearly 10 percent, and has approached a crucial level technically (Chart 4). A breakout here has potential to squeeze more shorts.

Hindsight is always 20/20, but SMH shorts probably got too aggressive at just the wrong time. This, however, is more of an exception than a rule. On IWM, the iShares Russell 2000 ETF, for instance, short interest fell four percent in the latest period (Chart 3).

The bottom line: in the aggregate, the odds of a major squeeze are much less potent than during the February 11th lows in stocks.

Thanks for reading!