After a ferocious rally from last October’s low, US equities gave back some of the gains this month. This has impacted bullish sentiment, but not enough to make a durable bottom in stocks.

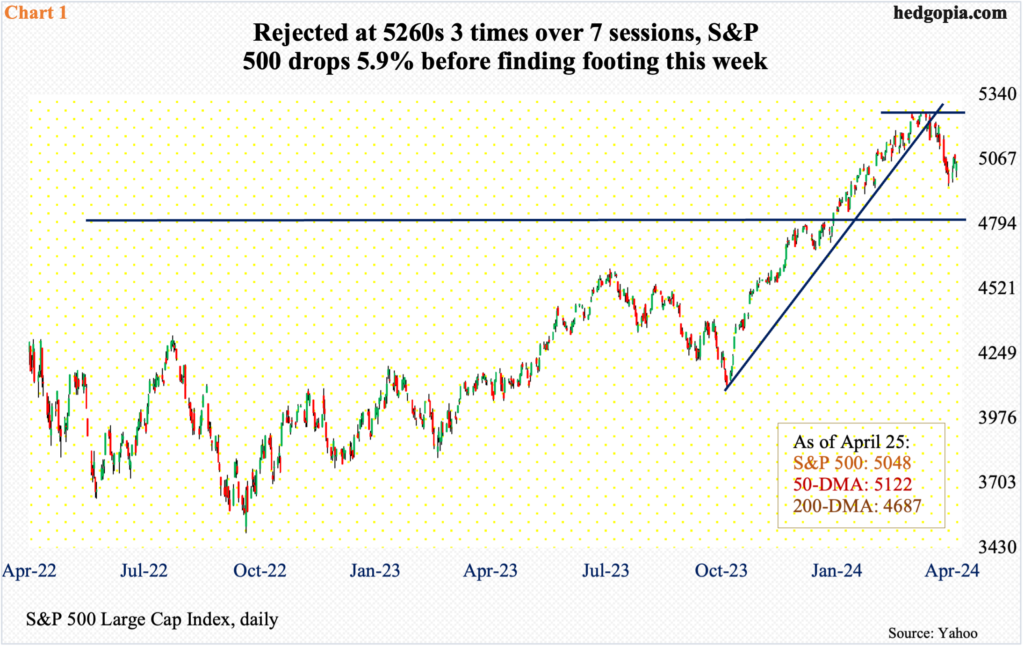

The S&P 500 shed 5.9 percent from its March 28th peak before finding a footing this week. Earlier, from the October 27th low of last year, the large cap index shot up 28.3 percent. Big picture, April’s giveback is nothing given the five-month scorching rally.

Between late-March and early-April, bulls began to face difficulty at 5260s, hitting the level three times over seven sessions, including the March 28th all-time high of 5265 (Chart 1). Bears took control right from the beginning this month. The index suffered three weekly declines before recovering. This week, with a session to go, the S&P 500 is up 1.6 percent.

The recent selloff has impacted bullish sentiment.

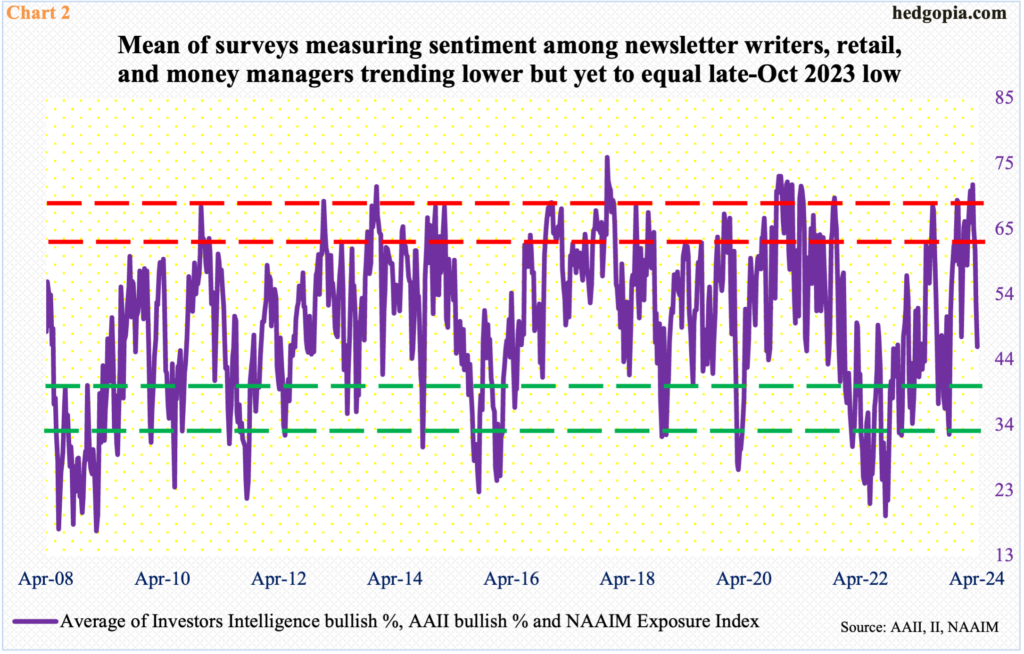

In the week to Tuesday, Investors Intelligence bulls tumbled 10.3 percentage points week-over-week to 46.2 percent. In the week to Wednesday, the NAAIM Exposure Index dropped 3.5 points w/w to 59.5, while American Association of Individual Investors bulls in the week to Thursday declined 6.2 percentage points w/w to 32.1 percent. The three surveys respectively measure sentiment among newsletter writers, money managers, and retail investors. This week’s readings represent a decent drop from the recent highs.

Investors Intelligence bulls hit 62.5 percent in the week to April 2nd. This was the highest reading since April 2021 and the fourth consecutive weekly reading of 60-plus. The NAAIM Exposure Index printed 103.9 in the week to March 27th; two weeks before that, it hit 104.8, which was the highest since November 2021. And AAII bulls hit 50 percent in the week to March 28th; three weeks prior, bulls reached 51.7 percent, which was an 11-week high.

Chart 2 combines the three surveys and takes out an average. A reading of 71.5 in the last week of March was the highest since January 2021. This week, the average dropped to 45.9, which is low but not low enough to even match last October’s low, when it dropped to 32.1, let alone the late-September 2022 trough of 19.3. Equities reached a major low in October 2022.

The bottom line is that investor sentiment has taken a hit but not enough to signal a durable bottom in equities.

Thanks for reading!