Investors Intelligence bulls this week hit the lowest since February 2016. Back then, the S&P 500 soon launched into a sustained move higher.

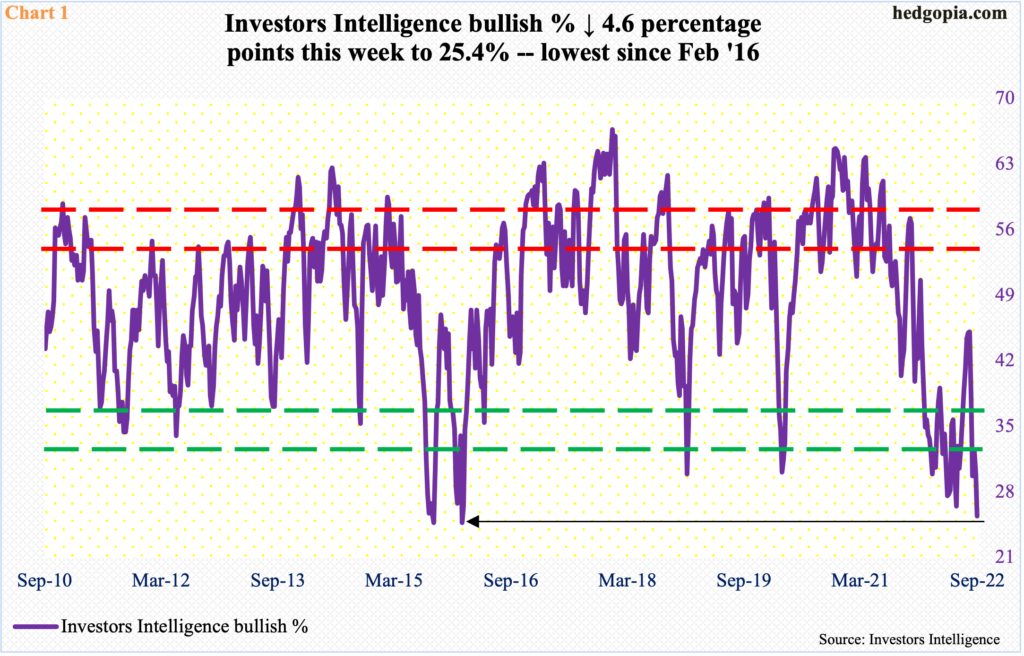

As of Tuesday this week, Investors Intelligence bullish percent dropped 4.6 percentage points week-over-week to 25.4 percent. This was the lowest reading since registering 24.7 percent in February 2016 (Chart 1).

Investor sentiment has remained subdued for a while now. Since dropping to 39.8 percent in the week to January 18 (this year), the metric managed to rally back into the 40s only four weeks – that is in 37 weeks. In eight of those, it dropped into the 20s, including this week, with the remaining 25 in the 30s.

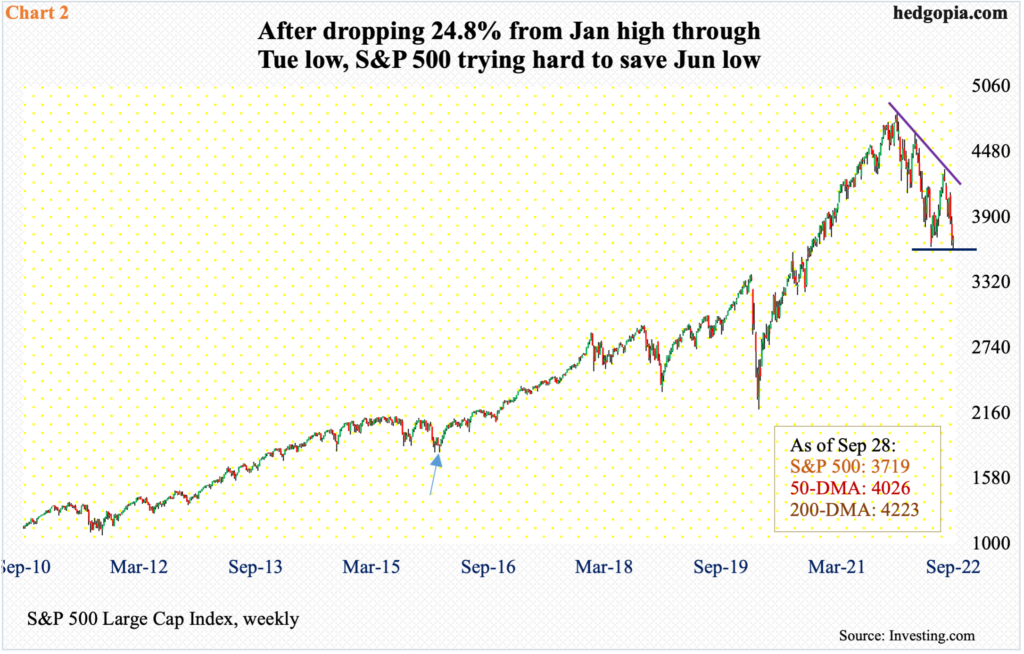

As suppressed as sentiment is, this could end up acting as a big tailwind for stocks – in the right circumstances, that is. Back in 2016, the S&P 500 bottomed in January-February before sustaining higher (arrow in Chart 2).

We are talking two different time periods, with different variables impacting investor sentiment, of course. Nevertheless, bulls do have a decent opportunity here.

From its January high through Tuesday’s low, the large cap index (3719) tumbled 24.8 percent. Yesterday’s low slightly undercut June’s low before drawing bids.

Several indicators are oversold enough, with some at washout levels, a reflex rally can happen anytime. In this scenario, 3900 is the nearest resistance, followed by 4200 where a falling trendline from January lies.

Thanks for reading!