Job openings – both non-farm and NFIB – are at new highs. But this optimism is not getting translated into other aspects, such as capex plans.

Last Friday’s jobs report was a huge letdown. Versus expectations of a million new jobs, the US economy created 266,000 non-farm jobs in April.

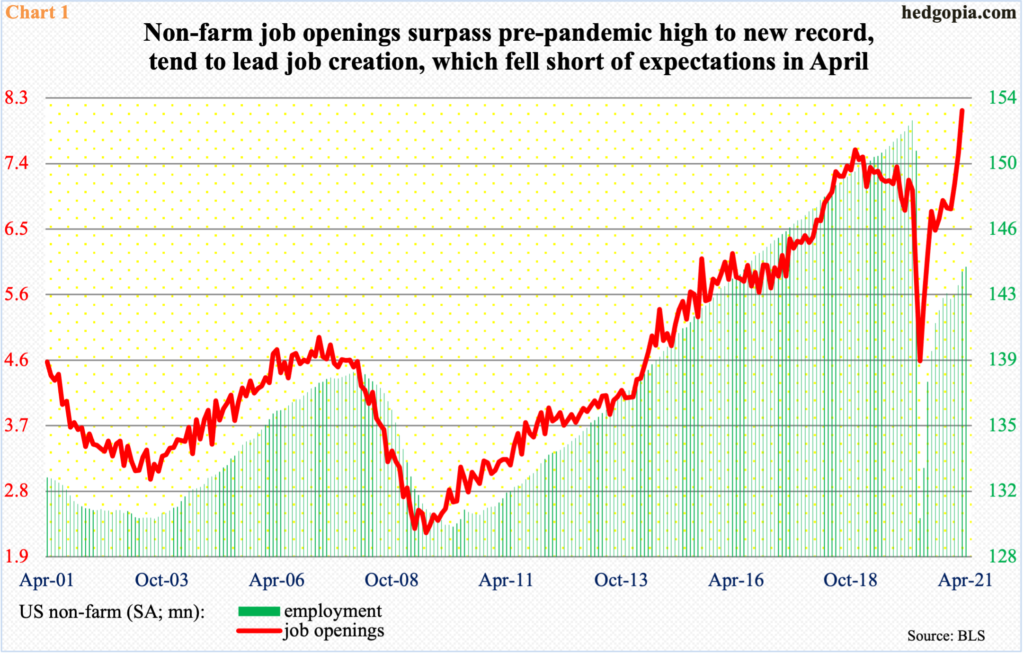

Just before the pandemic began to seriously impact people’s livelihoods last year, non-farm jobs hit a record 152.5 million in February, before rapidly dropping to 130.2 million by April. From that low, the economy produced 14.1 million jobs, but April’s (this year) tally of 144.3 million is still 8.2 million short. The unemployment rate similarly came in at 6.1 percent in April versus 3.5 percent in February last year.

If job openings are any indication, April’s disappointment is more of an aberration, not the beginning of a trend.

In March, non-farm openings jumped 597,000 month-over-month to 8.1 million – a new high (Chart 1). Post-pandemic, openings slumped to 4.6 million in April last year. Since that low, they have gone up by 3.5 million.

Historically, openings have tended to lead actual job creation.

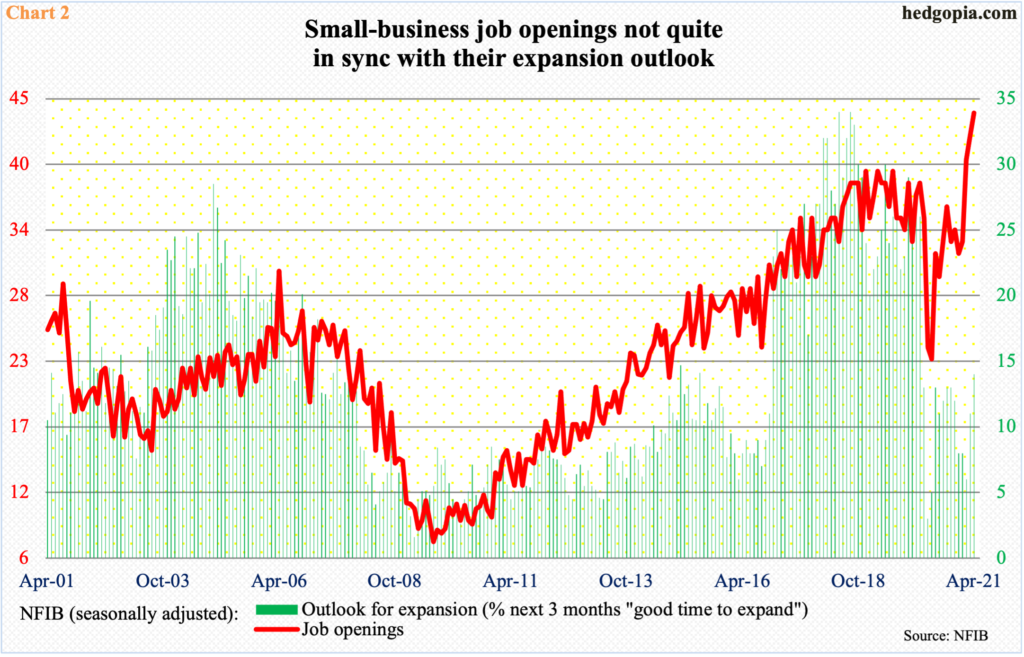

A similar message is coming out of small businesses. The NFIB job openings sub-index in April rose a couple of points m/m to 44 – a new record (Chart 2). It has gone up 21 points since dropping to 23 last May. Ordinarily, this metric moves hand in hand with non-farm job openings, although the latter comes out with one month lag.

The problem with small-business optimism is that job openings are at a new high but these businesses are not as gung-ho about their expansion outlook.

In April, the outlook for expansion sub-index increased three points m/m to 14 but this is substantially below the record high of 34 hit in May and August of 2018. Right before the pandemic hit, it touched 28 in January last year.

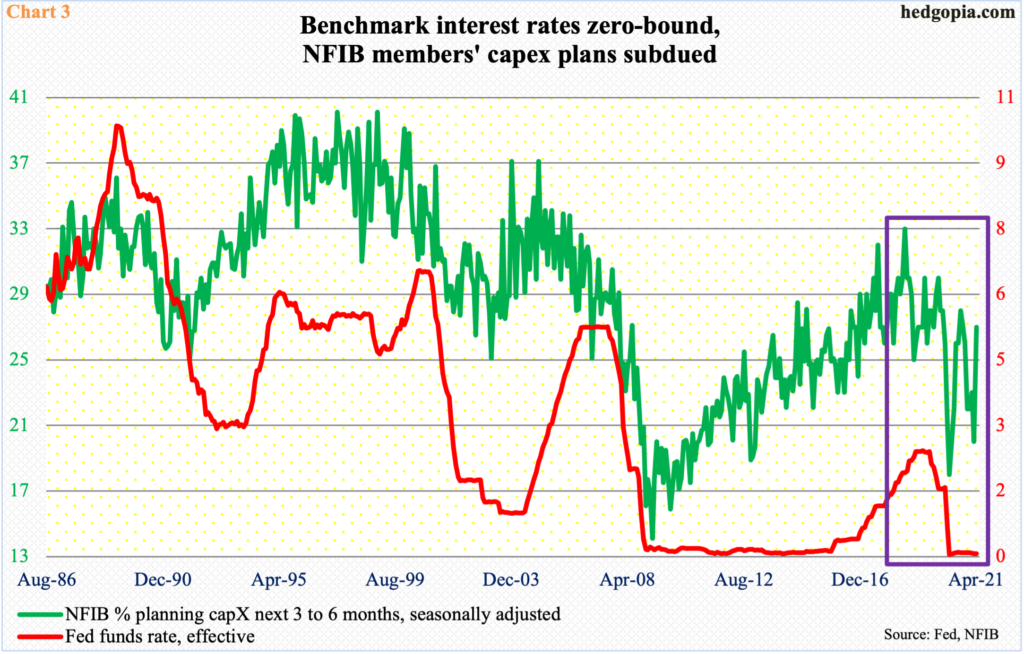

Several other sub-indexes within the monthly NFIB survey reveal that small businesses are treading with caution, not the least of which are their capital expenditure plans.

Because of their domestic focus, small businesses tend to benefit when the US economy flourishes. Real GDP shot up 6.4 percent in the first quarter, but this is also primarily due to massive stimulus – both monetary and fiscal. Besides the billions in stimulus checks, the Biden administration is trying to forge an infrastructure package, even as the Fed continues with its stimulus measures. The fed funds rate is zero-bound, and it continues to amass assets, with the balance sheet up $3.6 trillion over 14 months to $7.8 trillion.

Yet, small businesses are hesitant to commit to capital projects. At the latest 27, the capex plans sub-index is up nicely from the low of 18 in April last year but remains under the November 2019 high of 30, not to mention its prior record high – more or less tracking the fed funds rate, which is stuck in a range of zero to 25 basis points (Chart 3).

The bottom line is that the signal coming from job openings is not being reciprocated elsewhere. Businesses – small ones in particular – are not yet convinced the stimulus-juiced strength is deserving of long-term expansion plans.

Thanks for reading!