Margin debt fully cooperated with a 6.9-percent June rally in the S&P 500. Bulls obviously hope this continues this month. They would also want to see the recent increase in bullish investor sentiment pick up steam.

After dropping 6.6 percent in May, the S&P 500 large cap index (3005.47) recouped the loss, and then some, in June and July. June was up 6.9 percent. July-to-date, it is up another 2.2 percent.

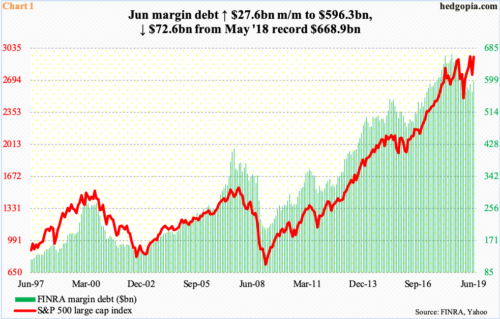

The June rebound was accompanied by an increase in leverage, with FINRA margin debt up $27.6 billion to $596.3 billion. This is still 10.9 percent from the record high of $668.9 billion set in May last year. At the same time, since December, margin debt has gone up by $42 billion.

The willingness to add to leverage since the December lows in US stocks, and in June in particular, suggests the willingness to selectively take on risk is still present. Given how small-caps have been lagging of late, these funds – at least a good majority – likely found a home in large-caps, not so much mid- and small-caps. Either way, equity bulls should welcome this.

As Chart 1 shows, stocks and margin debt very much move in tandem. The risk longer-term, of course, is when leverage gets taken off. The more the buildup, the higher the risk of a pullback – in both margin debt and stocks. For now, bulls are enjoying the buildup. As a matter of fact, they would like the momentum to pick up. The S&P 500 just scored a new high, but not margin debt. It is possible the latter went up again this month.

Bulls would also like investor sentiment to take it up a notch. In the right circumstances, there is room for that to happen. The last time the percent of Investors Intelligence bulls hit 60 was last October, peaking at 61.8 percent in the same week as stocks began a nasty correction.

This week, bulls fell 3.8 percentage points to 54.2 percent, even as bears remained unchanged at 16.8 percent. Bulls’ count last week was the highest since that October high, while bears have not been this low since March last year. The current readings are still not sufficient to push the bulls-to-bears ratio into four and above. With that said, the past four weeks have produced readings of three (Chart 2).

Bulls obviously would like the recent momentum to continue, culminating in readings of four and five, when it is all said and done. Of course, that would also mean an end to the uptrend, as at that point there would be few to no one left for bear-to-bull conversion. Rather, that is when reversal risks are at their highest. Until then, it is bulls’ ball to lose.

Thanks for reading!