Here is a brief review of period-over-period change in short interest in the May 1-15 period in nine S&P 500 sectors.

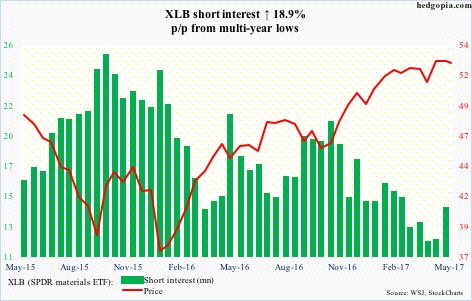

Support at 51-plus was defended yet again on May 18. At the same time, bulls are having trouble in genuinely rallying XLB (52.89) past 53-plus. Range-bound action continues.

Shorts, who got burned earlier and who had been cutting back post-election, added some this time around.

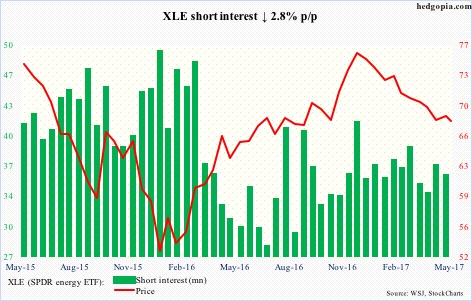

XLE (67.73) poked its head out of the December 2016 declining channel, but is struggling to build on it.

The ETF has not really taken part in the rally the past three weeks in crude oil. The 50-day moving average – now flattish – is not letting it.

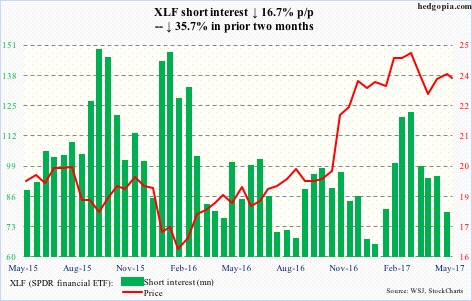

For over five months now, except for a false breakout in February, XLF (23.58) is caught between 22.80 and 23.70. A neckline break ensures completion of a head-and-shoulders formation. There is also the possibility of a double top – 25.31 in May 2007 versus 25.21 this March.

Medium-term, shorts likely have the edge, although they cut back big the past couple of months.

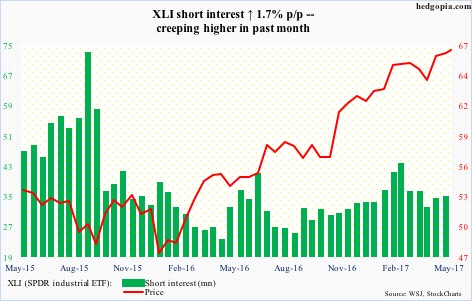

During the May 1-15 reporting period, XLI (66.89) once again went after resistance at 67. And once again, it met with failure. Ditto this week – Wednesday produced a long-legged doji.

Shorts have been adding but nothing too aggressive.

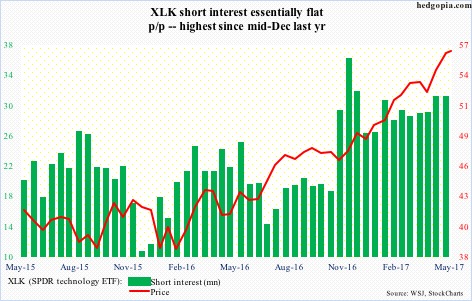

Yet another high of 56.13 on May 16. XLK (56.01) has rallied north of 19 percent post-election. Amazing!

Equally amazing is the fact that shorts are not buying this and staying with post-election buildup in short interest.

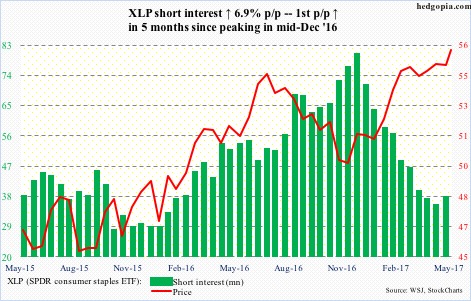

XLP (SPDR consumer stables ETF)

XLP (55.94) bulls defended 54.40 – again. This was preceded by a persistent rally beginning early December last year, during which shorts got hammered. The latter would not get traction until 54.40 is lost.

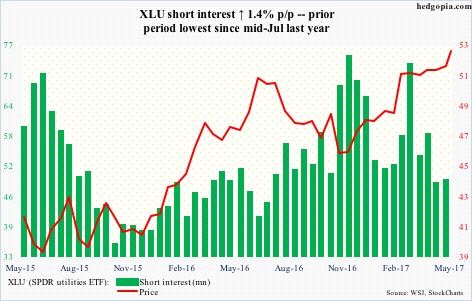

XLU’s (52.97) chart looks similar to XLP’s. In the past three sessions, it closed outside the daily upper Bollinger band. Way overbought near term.

That said, bears do not stand a chance until they push the ETF under 51 and change.

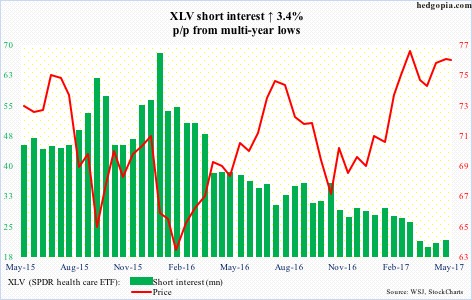

XLV (75.67) keeps hammering at nearly two-year resistance at 75-plus. Since mid-March, there have been two false breakouts. Shorts are behaving as if they expect a genuine one. Short interest remains tiny.

Nonetheless, bulls need to hurry up. The 50-day is gradually rolling over.

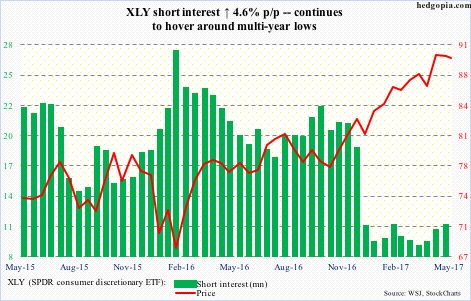

XLY (SPDR consumer discretionary ETF)

XLY (89.68) rallied to yet another high – 90.93 – on May 9. The subsequent drop found support at the 50-day.

Shorts were right to massively cut back during December 16-30 last year. Beginning April, they have been adding a tad, but not much to cause a big squeeze.

Thanks for reading!