The Nasdaq 100 index rallied to a new high, although the number of stocks above the 50-day moving average is nowhere near. Bears see this as divergence, bulls as room to push still higher.

Since it broke out of a three-week rectangle four sessions ago, the Nasdaq 100 (7210.08) proceeded to rally to a new record (Chart 1). It has now joined the Russell 2000 small cap index in that feat. Both these indices reflect the current risk-on sentiment among traders.

Large-caps are lagging. The S&P 500 large cap index as well as the Dow Industrials are still below their late-January highs.

Near-term momentum is intact in both tech and small-caps, although it is beginning to look way extended on the daily chart. In the last four sessions, the Nasdaq 100 closed above the sharply rising daily upper Bollinger band.

Amidst this, Wednesday produced a hanging man. This was preceded by a doji on Tuesday. Too soon to say if bears can make something out of these candles in the subsequent sessions. Leadership is narrow, but momentum is yet to break.

Medium-term, if bulls have to worry about anything, it is precisely that – narrow leadership.

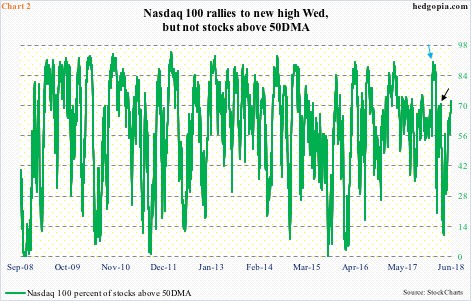

Wednesday, 72 percent of Nasdaq 100 stocks were above their 50-day. Historically, this metric has tended to peak at high-80s/low-90s. Back on January 26 when the index peaked at 7022.97, right before collapsing in the next 10 sessions, the share of stocks above that average consistently remained in high-80s for several sessions (blue arrow in Chart 2).

Later on March 13, the index rose to a new high, but one day earlier only 71 percent of stocks were above their 50-day (black arrow). The soldiers were falling behind the generals. This is occurring again.

As stated earlier, the index rose to a new all-time high of 7212.45 Wednesday, but only 72 percent were above the 50-day. This is one of those data points that currently can be spun both ways. For the bears, this of course means divergence. The bulls, on the other hand, can argue that there is room for this metric to push higher, before it enters a sell zone, hence more upside potential.

Continued divergence means only a select few are doing the heavy lifting, which in the larger scheme of things is not sustainable. Near term, in the face of the prevailing momentum, this may or may not amount to anything, but worth keeping in mind from the perspective of medium- to long-term.

Thanks for reading!